The total monetary value of cash in circulation in the economy increased by KSh 17.8 billion to KSh 333.8 billion in the year to June 2024 as withdrawals surpassed deposits, according to fresh data published by the Central Bank of Kenya (CBK).

- •The 5.64% increase points to Kenyans cashing out their savings and investments to cushion them against uncertainty amid an increase in demand for physical cash in the economy in a period marked by high interest rates coupled with stubborn inflation.

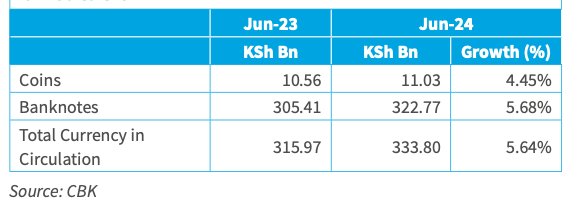

- •The increase was primarily driven by a 5.7% uptick in banknotes to KSh 322.77 billion from KSh 305.41 billion and a 4.5% increase in coins to KSh 11.03 billion from KSh 10.56 billion previously.

- •The increase coincided with a notable decline in private sector credit growth throughout the period to 4% from 12.2%, which the CBK attributes partly to exchange rate valuation effects on foreign currency denominated loans.

“The net increase of currency in circulation was attributed to higher currency outflows (withdrawals) compared to the net inflows (deposits),” CBK said in its annual report.

Withdrawals outpaced deposits in the 12 months to June 2024, which stood at KSh 534.71 and KSh 516.85 billion respectively. However, both deposits and withdrawals – mostly through commercial banks – were lower compared to the same period in 2023, by 5.1 percent and 3.7 percent respectively. Cash available for withdrawal in banks declined by KSh 50.3 billion to KSh 1.63 trillion from KSh 1.68 trillion in June 2023.

The growth in annual broad money supply declined to 6.8% from 13.4% in 2023 attributed to a slowdown in lending to the private sector and net lending to the government.

“On the liability side, the reduction in money supply was reflected in reduced growth in deposits, mainly attributed to valuation effects on foreign currency deposits following exchange rate appreciation,” CBK added.