There are five main financial statements, the cash flow statement, income statement, the balance sheet, the statement of comprehensive income and the statement of changes in shareholder’s equity.

Most often, investors tend to focus on just two of the above, the cash flow and the income statement.

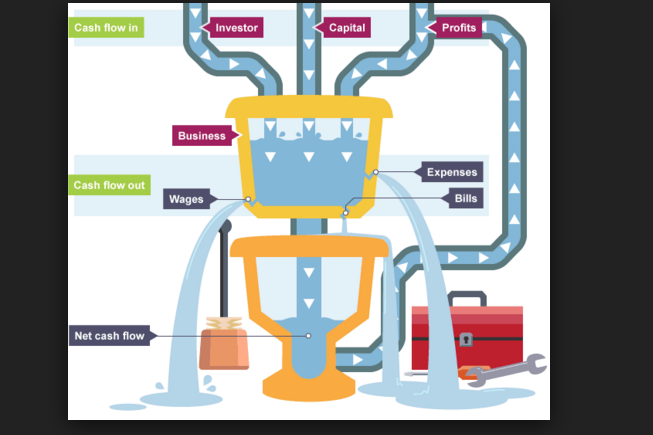

“Cash Flow” basically is the movement of money in and out of an organization. If the amount of cash increases, that’s a positive cash flow. If the amount of cash declines, its negative cash flow.

Related; IFRS 16: A New Life for Leases

Is the Cash Flow more Important than the Income Statement?

The Cash Flow Statement is always viewed as the most important statement when an investor is conducting due diligence and projections of a particular company.

When evaluating investments, the cash flow statement is a “must go to” document as it shows the changes in balance sheet, and income affect cash and cash equivalents, and analyzes the operating, investing and financing activities.

The cash flow statement tells the investor why cash is behaving the way it is unlike the profit and loss which can be misleading and can be easily manipulated.

The Cash flow statement helps in efficient management of the company’s cash. And one of the most important functions of a CFO and his team is to manage cash resources in a manner that is sufficient in order to meet the organization’s short term obligations. This will enable the management to properly plan and coordinate the company’s financial operations.

Cash flow from operating activities is a section of the cash flow statement that provides information regarding the cash-generating abilities of a company’s core activities.

Assuming the company has some long term debt obligations, the behavior of the cash flow statement will help the investor determine the possibility of repayment as this depends on the availability of cash. From the Cash flow statement, you can easily predict the amounts, timing and uncertainty of future cash flows.

As much it is important for finance managers to determine the increase or decrease in cash position, as it is to find the reasons thereof. The cash flow statement aids finance managers greatly in understanding and explaining how the company is short of cash despite the fact that it generates higher profits.

Making comparative financial statements is of great value and importance for a business entity for a number of reasons. It helps in assessing the performance over multiple periods. It also reveals information for more than one accounting period. The budgeted cash flow statement, when compared with the actual one, discloses the success or failure of the management in managing cash resources. Not just this, it also aids greatly in taking remedial measures in case there are deviations.

It is thus to be said that the cash flow statement is a better tool of analysis. It not only provides information regarding inflows and outflows of cash of a firm for a period of one year, but it also helps finance managers to ensure whether or not sufficient cash is being generated to maintain a healthy business.

Related; When To Exit Your Stock Investment – 10 Selling Strategies