Car & General Kenya Plc has posted a 920% increase in profit after tax from KSh 62 million in H1 2024, to KSh 637 million for the six months ended 30 June 2025.

- •Gross profit jumped 33% to KSh 2.12 billion, while EBITDA more than doubled to KSh 1.54 billion.

- •Cash generated from operating activities reached KSh 899.67 million, with closing cash at KSh 190.51 million versus a deficit last year.

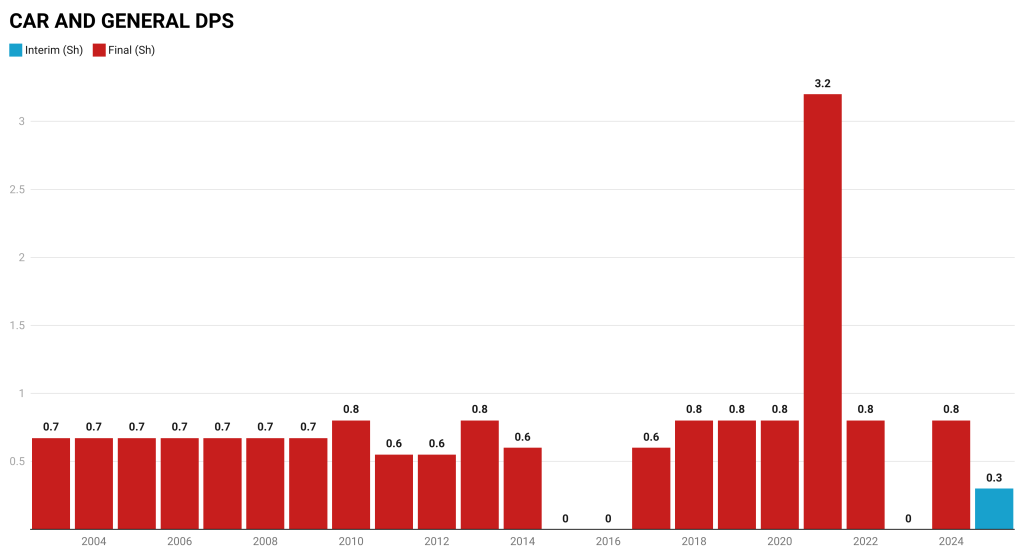

- •The board approved an interim dividend of 0.30 per share, the company’s first in at least 22 years.

Car & General’s revenues rose 9.6% to KSh 12.03 billion from KSh 10.97 billion in the same period last year.

| Metric | H1 2025 | H1 2024 | YoY % |

|---|---|---|---|

| Revenue | 12.03 Bn | 10.97 Bn | 9.61% |

| Gross Profit | 2.12 Bn | 1.60 Bn | 32.91% |

| Operating Expenses | -1.32 Bn | -1.25 Bn | -5.77% |

| Share of Profit in Associate | 422.70 Mn | 113.76 Mn | 271.56% |

| EBITDA | 1.54 Bn | 752.14 Mn | 104.23% |

| Finance Costs | -732.76 Mn | -614.17 Mn | -19.31% |

| Profit Before Tax | 753.83 Mn | 106.49 Mn | 607.86% |

| Profit After Tax | 637.06 Mn | 62.48 Mn | 919.66% |

| EPS | 7.93 | 0.78 | 916.67% |

| Total Assets | 18.62 Bn | 18.46 Bn | 0.86% |

| Total Equity | 6.26 Bn | 5.35 Bn | 16.98% |

| Net Cash from Operating Activities | 899.67 Mn | 1.03 Bn | -12.54% |

| Cash & Cash Equivalents at End of Period | 190.51 Mn | -139.02 Mn | 237.04% |

Regional and Product Performance

The results were driven by robust sales growth in Kenya, where turnover rose 17%, supported by an increase in motorcycle sales from an average of 4,600 units per month in 2024 to 7,000 units in 2025.

Profits from subsidiary Watu grew 272%, boosted by phone financing and strong performance across Kenya and Tanzania. Tanzania posted 5% growth in 2- and 3-wheeler sales, while poultry sales doubled following operational stabilisation. Uganda recorded a 24% sales decline.

Finance costs rose 19% to 733 million, and total assets edged up to 18.62 billion. Equity grew 17% to 6.26 billion.

The company also reported that its helmet manufacturing subsidiary, Boda Plus, is now EBITDA positive and exporting to multiple African markets.

According to the company, the Nairobi Mega Mall on Uhuru Highway is seeing higher foot traffic, Shanzu land disposal is targeted before the financial year-end, and investments in electric 2-wheelers in Kenya and CNG 3-wheelers in Tanzania are gaining market traction.

First Interim Dividend in Decades

Historical data from 2003 to 2024 shows no interim payouts, with dividends during that period exclusively final. The last two decades have seen final DPS range from 0.55 to 1.60 shillings, with notable consistency in payouts despite market fluctuations.

The company expressed confidence in sustaining growth across all product lines, supported by stable macroeconomic conditions in East Africa, and plans to leverage its market leadership to expand share in all segments while optimising the balance sheet.