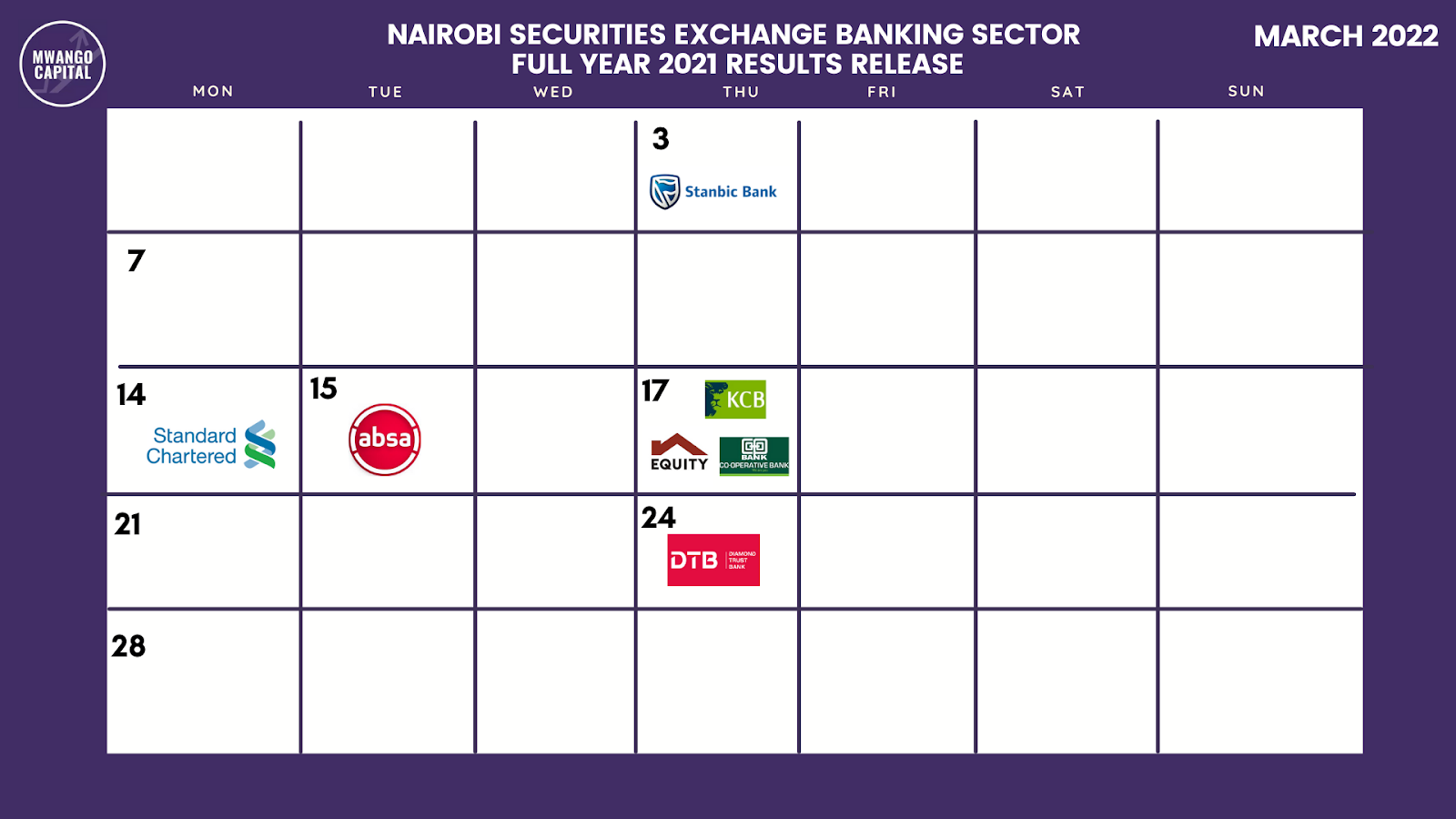

Stanbic was first: Stanbic was the first listed bank to release its results in what is a month of a flurry of releases of 2020 Full Year results.

Next week: In the coming week, Standard Chartered will release results on the first trading day of the week, and other tier 1 banks including Absa, Equity, KCB, and Cooperative are also slated to release their annual results mid-week.

Keep it here: We will be here to give you the full analysis throughout the week and in the newsletter next week. We are keenly following the growth in total assets, the issuance of dividends, and the approvals for risk-based lending.

Equity Bank Gets Risk-based Lending Approval

First Approval: CBK this week granted approval to Equity Bank to price their loans according to customer risk; becoming the first Tier 1 bank to get risk-based lending approval.

Impact: For Equity Bank, Net Interest Margins are expected to increase and the bank projects yields on loans to come in at 12% in FY 2022 from 11.8% in Q3 2021. More approvals by the CBK to banks will upend the current lending configuration where banks are heavily invested in government securities – as higher and attractive interest rates in the private sector will lead banks to offer more loans towards this customer group. As a result, banks will also be in for higher interest income. There will be implications for the wider economy as risk-based lending is likely to increase private sector credit hence availing more capital for businesses.

Mwango Explainer: Risk-based lending is where a financial institution adopts a tiered pricing structure that assigns loan rates that takes into account an individual or company’s credit risk. Financial institutions like banks are able to make loans to higher-risk borrowers and charge them more and offer lower rates for more credit-worthy members.

Take-away: Risk-based lending gives Equity Bank the capacity to charge loans depending on customer risk. This regime is set to increase the cost of loans and boost interest income as borrowers high up in the risk curve will be priced higher. Reinstatement of charges has the impact of boosting non-funded income.

Other things that happened this week:

?Jubilee Holdings Increases SEACOM stake: Jubilee Holdings raised its stake in SEACOM – a Cable Systems and Communications company with operations based in Africa. Jubilee added to its 8.8% holding, 10%, to bring the total current shareholding to 18.8%. The acquisition comes barely a year after Allianz acquired a stake in Jubilee Holdings that granted the German financial services company a 66% stake in Jubilee Insurance Company of Uganda – a Jubilee Holdings subsidiary. Jubilee Holdings closed +0.36% on the week.

?M-PESA Milestone: M-PESA reached 30 Million Customers this week in its 15-year existence as businesses accepting payments on Lipa Na M-PESA grew 124% from April 2020 to reach 387,000 this week. Africa-wide, M-PESA has 51M users across Kenya, Tanzania, the DRC, Mozambique, Lesotho, Ghana, and Egypt.

?Kenya Eases Covid Response Measures: The Ministry of Health reviewed guidelines set at least two years ago to reflect the current subsiding pandemic situation. MoH lifted mask and temperature screening requirements in public spaces and offered new guidelines on public road transport and air travel.

?Rising Prices: Companies have been issuing price adjustment notifications as raw materials and logistics costs increase. Bamburi Cement is the latest – issuing notice for a 2 – 10% price hike for its Nguvu, Tembo, and Fundi brands as a result of rising costs of input raw materials.

?Off-peak Power for Nightly Charging?: Amidst this, Kenya Power has emerged to point out that it has the capacity to charge electric cars with its 1,200MW off-peak load – enough capacity to charge 50K buses and 2M motorcycles in an off-peak session. For context, Kenya Power gives an estimation of 120kWh consumption for an electric minibus with a 200KM daily range at a total cost of KES 2,400.