The pace of job creation in Kenya’s business sector was slowest in July since the start of the year primarily due to protests, the increase in fuel prices, and tighter financial conditions, the monthly Stanbic PMI report shows.

- •Business activity slowed across four of the five broad sectors covered, with the sharpest decline in agriculture and the only outlier being manufacturing.

- •Disruption from the protests impacted the ability of suppliers to deliver items to companies and the completion of projects.

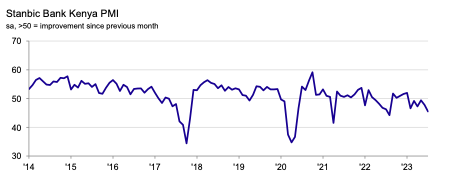

- •At 45.5, the index was down from 47.8 in June, registering below the 50.0 neutral mark for the sixth month in a row.

The Stanbic PMI report indicates that the business confidence dropped and was the second-lowest on record, only marginally above the series posted in February.

Those companies that remained optimistic about the outlook for business activity generally linked this to plans to open new branches.

“July’s PMI headline trajectory comes as no surprise given events during the past month. Political protests, an increase in pump prices by approximately KES12.61 in July, the further tightening of financial conditions as well as a further depreciation of the shilling — all of which saw the private sector deteriorating for a sixth straight month. Notably, the survey results show that the July contraction in output was the deepest since August 2022,” Christopher Legilisho, Economist at Standard Bank, said.

Meanwhile, input costs increased for the second month running, feeding through to a further rise in selling prices. That said, rates of inflation remained much softer than 2023.

“With overall sales falling rapidly, Kenyan businesses indicated a sharp drop in output over the course of July, which was the second-worst since 2017 when excluding lockdown-affected periods. Firms often noted that weak orders resulted in cash flow issues that limited activity,” the Index report for July indicates.

Purchase prices increased for the second month running in July, reflecting high living costs and taxation. Although the pace of inflation quickened from that seen in June, the latest rise was still much weaker than those recorded during 2023. Meanwhile, staff costs increased marginally. Output prices were also up modestly for the third successive month. While some firms increased charges in response to higher input costs, others lowered selling prices in a bid to boost sales.

“The agricultural sector rebounding has been supporting economic activity despite the construction, wholesale & retail and services sectors slowing. Export orders remain in expansionary territory, buoyed by the weaker shilling,” Legilisho added.