In May 1984 while giving a speech at Columbia Business School, later adapted into an essay, Buffett introduced what he called, “The Superinvestors of Graham-and-Doddsville.”

Its a lengthy article explaining Graham’s principles are everlasting, and how Graham’s record of creating exceptional investors (such as Buffett himself) is unquestionable.

Also Read; Largest Sovereign Wealth Fund’s Investment Journey in Kenya

Buffett describes Graham’s book – The Intelligent Investor – as “by far the best book about investing ever written” (in its preface, which Buffett wrote). In The Intelligent Investor, Graham recommended various categories of stocks and specified precise qualitative and quantitative rules for each category. Benjamin Graham is rightly considered the father of value investing. But the term “Value” is often misunderstood to refer to only quantity, and not quality.

“The common intellectual theme of the investors from Graham-and-Doddsville is this: they search for discrepancies between the value of a business and the price of small pieces of that business in that market.” Buffet Writes

And that’s pretty much it. Buffett doesn’t think about buying a stock; he thinks about buying a business.

The name “Graham-and-Doddsville” comes from Benjamin Graham — whom Buffett studied under at Columbia — and Dave Dodd, with whom Graham literally wrote the book on security analysis.

Buffett explains that the investors of Graham-and-Doddsville don’t care when they buy stocks, or worry about a stock’s beta or the “covariance in returns among securities.” He says these investors are businessmen buying pieces of businesses, not traders buying stocks.

Many think Buffett was a simple “buy and hold” stock investor, but his investing is about way more than that — or way less, depending on how you look at it.

Buffett Concludes;

“The Superinvestors of Graham-and-Doddsville” writing: “Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace, and those who read their Graham & Dodd will continue to prosper.”

Source; Kenyan Wall Street, Columbia Business School

The whole essay is embedded below.

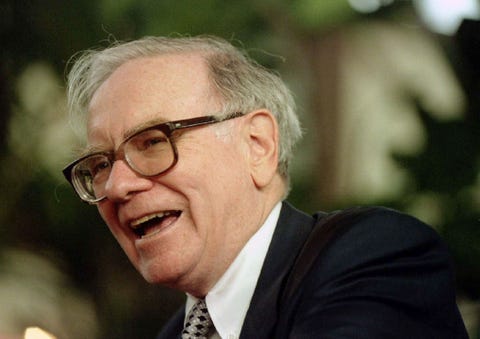

The Superinvestors Of Graham-and-Doddsville by Warren Buffett