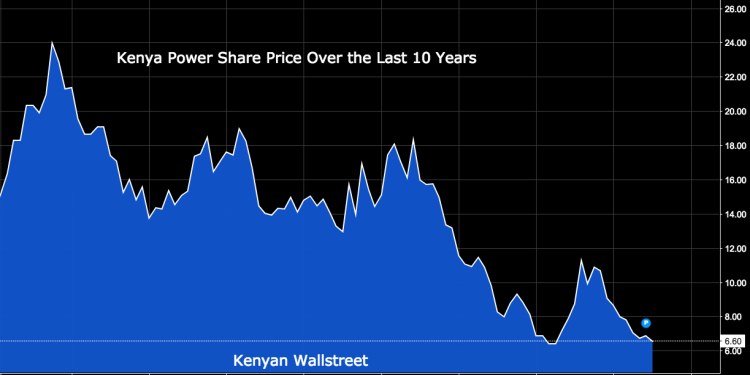

Kenya Power Share share price has recently nose-dived to Sh 6.65 as of Thursday 12th July 2018. The fall in share price is largely attributed to market overreaction on concerns such as overcharging of some of it clients, third party token vendors and fraud around prequalified contractors.

On the back of this plunge, local stockbroker, Apex Capital reiterates a BUY recommendation informed by a fair value of Ksh 7.70.

“We continue seeing value in Kenya Power despite the recent race to the bottom in its share price. The price seems to have bottomed out at current levels but could come under further pressure and slide below the current levels. Investment into the counter is ideal for the long-term value investor given the alluring dividend yield coupled with potential capital appreciation.” noted Harrison Gitau, a senior research analyst at Apex.

The firm projects a 4-year CAGR of 6.0% in electricity demand to hit 10.5 MWh in FY21. This will be supported by increased electricity connectivity (currently at 73.4%) and increased consumption from both the domestic and commercial customers. Government’s plans to lower the cost of power to industrial consumers to c.9.0 US cents per unit is anticipated to drive power consumption.

The recently commissioned Nairobi City Centre 220/66kV Gas Insulated station (GIS) substation is anticipated to boost the City’s Bulk power supply system.

High electricity access points to a slowdown in capex.

This is anticipated to ease debt requirements and reduce the debt appetite for the firm, projected decline in system losses in the long-run to raise gross profit margins and cash balances anticipated to close in the green in the long-run driven by rising cashflow from operations and lower cash used in investing activities.

However, Apex says full year 2018 is anticipated to be challenging as suggested by an estimated 21% decline in net earnings to Ksh 5.7 Billion. Possible review of tariffs may lower profit margins with possible change from foreign currency to local currency in pricing power may see Kenya Power lose forex hedge. Previous high capex leads to high future depreciation projected to slow down the recovery in EBIT going forward.