Diversified financial services firm Britam holdings has issued a profit warning saying earnings for 2017 financial year are expected to be lower by more than 25 percent compared to the earnings reported in the same period in 2016.

The Nairobi Securities Exchange listed company attributes this to a change in the regulatory requirement in accounting for liabilities. The new law now requires insurance companies to change the basis of valuation of their long term liabilities from Net Premium Valuation (NPV) to Gross Premium Valuation (GPV).

According to industry experts, GPV methodology supports a market-based approach and reflects the best estimate of reserve for insurance policy obligation. Insurance companies will now deal with increased reserve cost and obligation for financial reporting purposes. This translates further to more volatile results of operations (fluctuation in profit or loss) given the market-driven reserve assumptions that are susceptible to changes in market conditions.

In 2016, the one off change positively impacted Britam’s earnings by Sh 5.2 Billion.

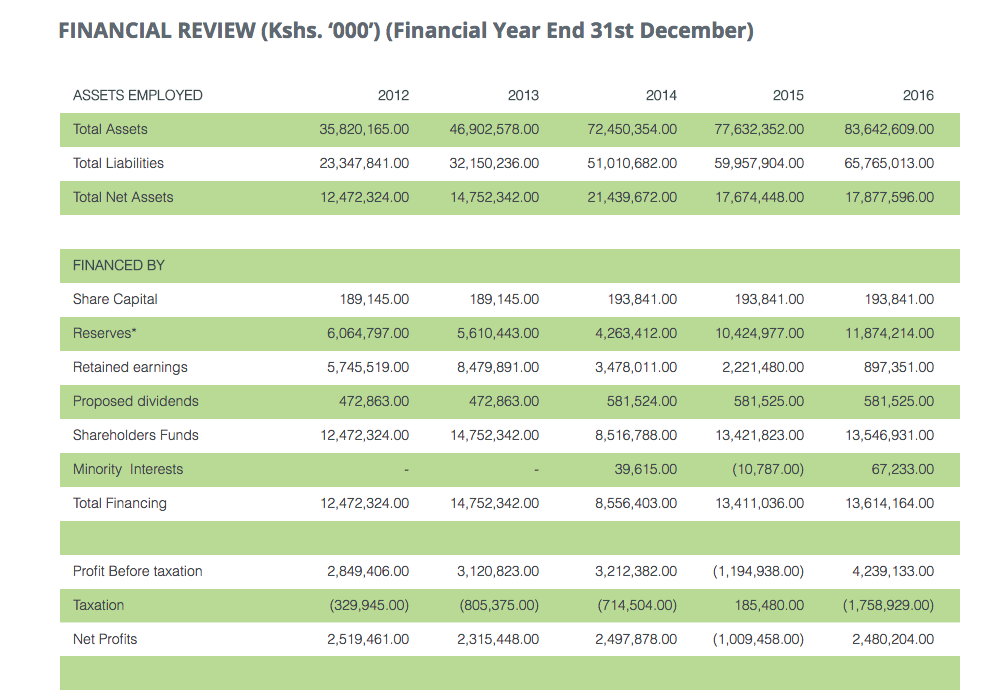

Britam’s Financial Performance over the last 5 years

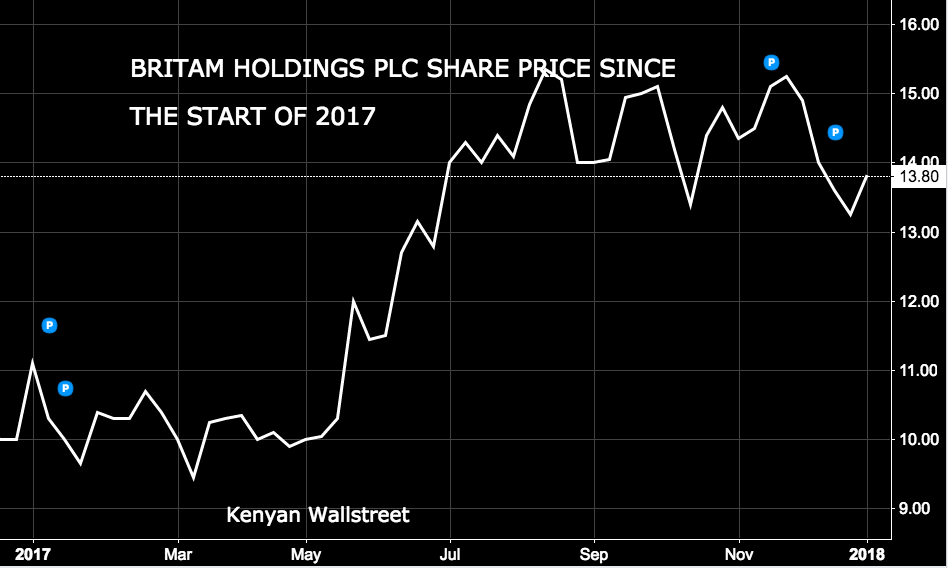

Britam Share Price