Britam Asset Managers has received a license from the Capital Markets Authority to operate as a REITs (Real Estate Investment Trusts) Manager.

The asset management subsidiary of Britam Holdings Plc is now among the few companies in Kenya who have been licensed by the regulator to offer REITS as an alternative investment vehicle.

REITS are regulated investment vehicles that allow collective investment in real estate where both retail and corporate investors pool their funds and then engage in real estate projects. REITs may invest in the properties themselves, generating income through the collection of rent, or they may invest in mortgages or mortgage securities tied to the properties, helping to finance the properties and generating interest.

“We are pleased to advise that the authority has approved the grant of a REIT Manager licence to Britam Asset Managers Limited. This licence will remain in force unless otherwise suspended or revoked following the necessary due process,” said Mr Paul Muthaura, the CMA Chief Executive Officer.

Speaking after receiving the licence, Britam Asset Managers Chief Executive Officer Kenneth Kaniu said the company’s retail and institutional investors now have the opportunity to invest in real estate as a viable investment option as REITS allow anyone to invest in portfolios of large scale properties the same way they invest in other sectors.

Mr Kaniu said that going forward, the company will be looking to offer Real Estate Investment Trust Schemes that will be listed to trade at the Nairobi Securities Exchange.

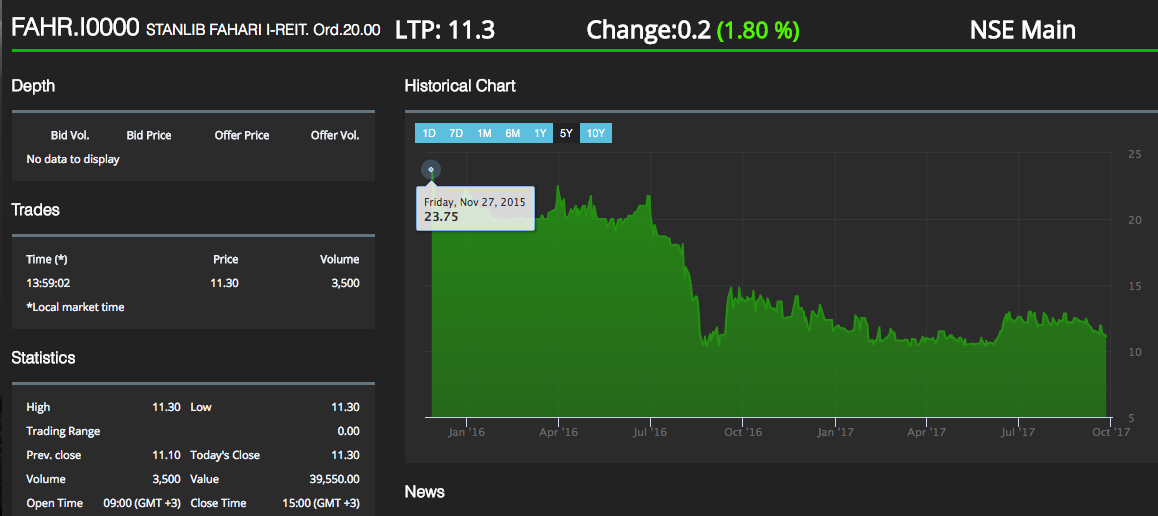

In November 2015, Stanlib Kenya launched Kenya’s first REIT (Fahari -Ireit) which targeted to raise Sh12.5 Billion but managed a third of the amount, Sh3.6 Billion. Since listing on the Nairobi Securities Exchange, the offer’s price per unit has fallen from a high of Sh 23.75 to Wednesday’s closing price of Sh 11.3.