Branch International, a mobile-based money lender in Nairobi, has raised Sh7 billion in the second phase of funding to enable expansion to other countries.

Matthew Flannery, the CEO of Branch, said part of the money will be used to introduce operations in India and to expand the product to include a savings and payments platform in markets with one million customers.

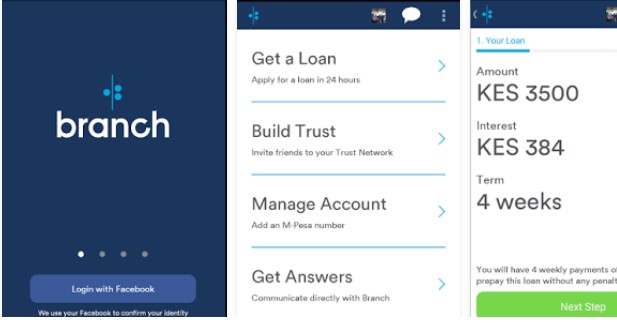

“Branch processes tens of thousands of loans every day, in amounts ranging from Sh250 to Sh5,000. The company’s growth rate is 20 percent on a month-over-month basis and expects to disburse over Sh25 billion in 2018,” he said.

Silicon-based Trinity Ventures, Victory Park Capital, International Finance Corporation (IFC), Andreessen Horowitz, and CreditEase Fintech Investment Fund participated in this Series B investment where debt and equity were combined.

Victory Park Capital and the International Finance Corporation (IFC) have created a new fund intended for financial technology companies in the country. Branch International’s announcement is one of the latest huge investments in the financial tech sector in emerging markets particularly in Kenya.

Branch depends on a user’s calling and social media habits to establish their eligibility for receiving credit. Schwark Satyavolu, Trinity Ventures general partner, said the increased use of smartphones in Kenya and other emerging markets and the limited access to credit has been a suitable opportunity to invest in.

“Because of the confluence of these two megatrends and because of the team’s incredible bench of talent, I am excited to invest in Branch and am bullish on its future,” he said.

A study by FSD Kenya indicates that most banks and fintechs gave out more than 80 percent of loans to 6.5 million Kenyans through mobile phones. Additionally, the study showed that 35 percent of Kenyans with phones have tried at least one digital lender.

RELATED; 35% of Adult Kenyan Phone owners Borrow Digitally – FSD Survey