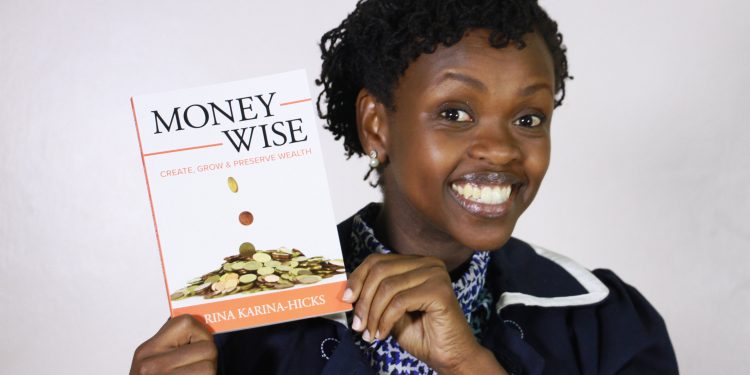

Drawing from her extensive experience as an investment banker, Rina Karina-Hicks is on a mission to equip the youth with basic skills and tools enabling them to make smart sound financial decisions. The book is simple and minimalistic in terms of language used. It’s a handbook offering wholesome reference point for creating, growing and preserving wealth.

The author, Rina Karina-Hicks takes us through a how to develop a plan for wealth creation and management while linked to your values and purpose in life. She carefully and intentionally places real life practical stories, narrations and tables for her audience so as to marinate in lessons for each and every chapter.

The book addresses and allows the reader to decide what kind of life they want to live, investment opportunities available in order to create wealth, how to protect your assets while learning the art of giving.

Both young and older adults will find the book use full as it details the investment opportunities available for you as well as outlines pre requisites to investing.

“The earlier you begin saving and investing you earn more. It’s never too late to start investing but resolve to start now. Invest regularly, remain discipline and be patient, the results may seem slow at first but as the interest compounds and you carry on with the discipline of investing, they begin to come faster.” she says.

Rina provides guidelines where one should look at the bigger picture, before you get to decide the amount of money you would like to have in future.

“Money is good, God want us to have it in abundance but for a purpose greater than our self-image and individual means.”

The book brings us to our attention that financial goals and desires will be largely driven by values which is unique to you, upbringing, experience, exposure to media, culture and expectations of the future influence values.

Your choice of investment must be made by assessing your situation, goals and different investment options. Setting tangible realistic goals, reviewing the and tracking progress are keys to achieving your financial goals. Determine short term, medium term and long-term goals while arranging them in order of importance.

Review them frequently.

The author asserts that knowing your financial conditions at all times is vital. She suggests that one should take a reality check to assess the areas you need to improve and identify blind spots that hinder you from reaching your goals.

Before you invest, you need to pay off your debt, she adds while preparing a summary of assets and list liabilities while noting negative worth and inflations. Calculate future costs and keep learning.

She warns about being entitled which blinds us from the bigger picture hence making financial decisions from an emotional standpoint. This renders following a financial plan almost impossible.

Do not be discouraged she says, with determination, the right resolve and consistency you can do it!

The Book is available on Amazon through: http://amzn.to/2nnpQ3l