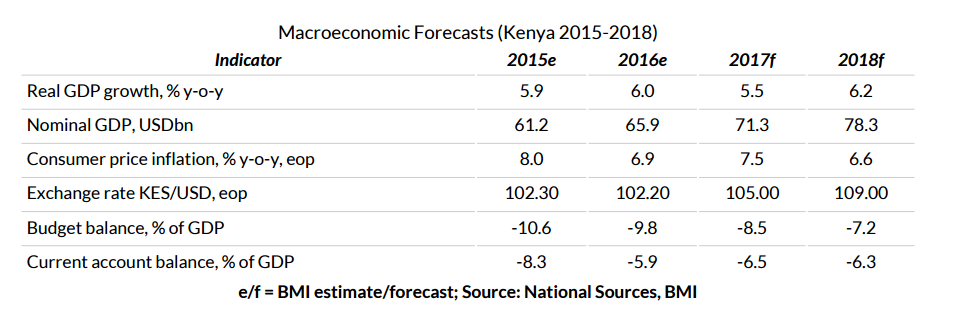

According to BMI Research, Kenya’s real GDP growth will decelerate in 2017 noting that credit growth remains weak following the government’s cap on lending rates.

“Concerns over real GDP and credit growth will keep Kenya’s central bank from hiking rates in 2017, despite a modest uptick in inflation. That being said, the likelihood of higher inflation as commodity prices increase and Governor Patrick Njoroge’s largely hawkish bias would also suggest the bank will not look to resume cuts until 2018.” the firm noted in a report.

However, its outlook for the country’s economic activity remains largely positive, and an election in August and relatively low short-term borrowing costs open the door to some fiscal stimulus to offset slower credit growth

The firm raised concerns over Kenya’s rapidly increasing debt burden even though it remains in a largely sustainable position.

On Kenya Shilling.

While the Kenyan shilling is structurally inclined to depreciate (albeit gradually) in nominal terms, it will remain a strong performer in terms of total returns thanks to high interest rates. While a large fiscal deficit will continue to drain the country’s savings, productive public and private investment will support growth and keep the shilling relatively stable over the next two years

On Elections & Global Events

Partisan tensions are set to continue over the coming months in Kenya as the August general election approaches, posing headwinds to policy-formation and social stability. Even so, this will be insufficient to derail the country’s largely positive growth story.

The Kenyan economy remains vulnerable to volatility in external financial markets. A substantial downturn in China, which is a major financier of Kenyan infrastructure projects, could weigh on investment into the country. Additionally, rising political tensions surrounding the 2017 general elections could result in delayed investment decisions.