First Published on July 29th, 2022 by Quinn Mohammed for SureDividend

There is no exact definition for blue chip stocks. We define it as a stock with at least 10 consecutive years of dividend increases. We believe an established track record of annual dividend increases going back at least a decade, shows a company’s ability to generate steady growth and raise its dividend, even in a recession.

As a result, we feel that blue chip stocks are among the safest dividend stocks that investors can buy.

With all this in mind, we created a list of 350+ blue-chip stocks which you can download by clicking below:

In addition to the Excel spreadsheet above, we will individually review the top 50 blue chip stocks today as ranked using expected total returns from the Sure Analysis Research Database.

This installment of the 2022 Blue Chip Stocks in Focus series will analyze the manufacturing behemoth 3M Company (MMM) in greater detail.

Business Overview

3M is a leading global manufacturer, with operations in more than 70 countries. The company has a product portfolio comprised of over 60,000 items, which are sold to customers in more than 200 countries. These products are used every day in homes, office buildings, schools, hospitals, and others.

The company’s history can be traced back to 1902, when it was known as Minnesota Mining and Manufacturing. Today, 3M dominates in four significant business segments.

The Safety & Industrial segment produce personal safety gear, industrial adhesives & tapes, abrasives, and supply chain management software.

The Transportation & Electronics segment serves automotive and electronic EOM customers, by producing items such as fibres and circuits.

The Healthcare segment develops medical and surgical products, health information systems, and oral care technology.

The Consumer division sells stationary & office supplies, home improvement and home care products, and protective materials.

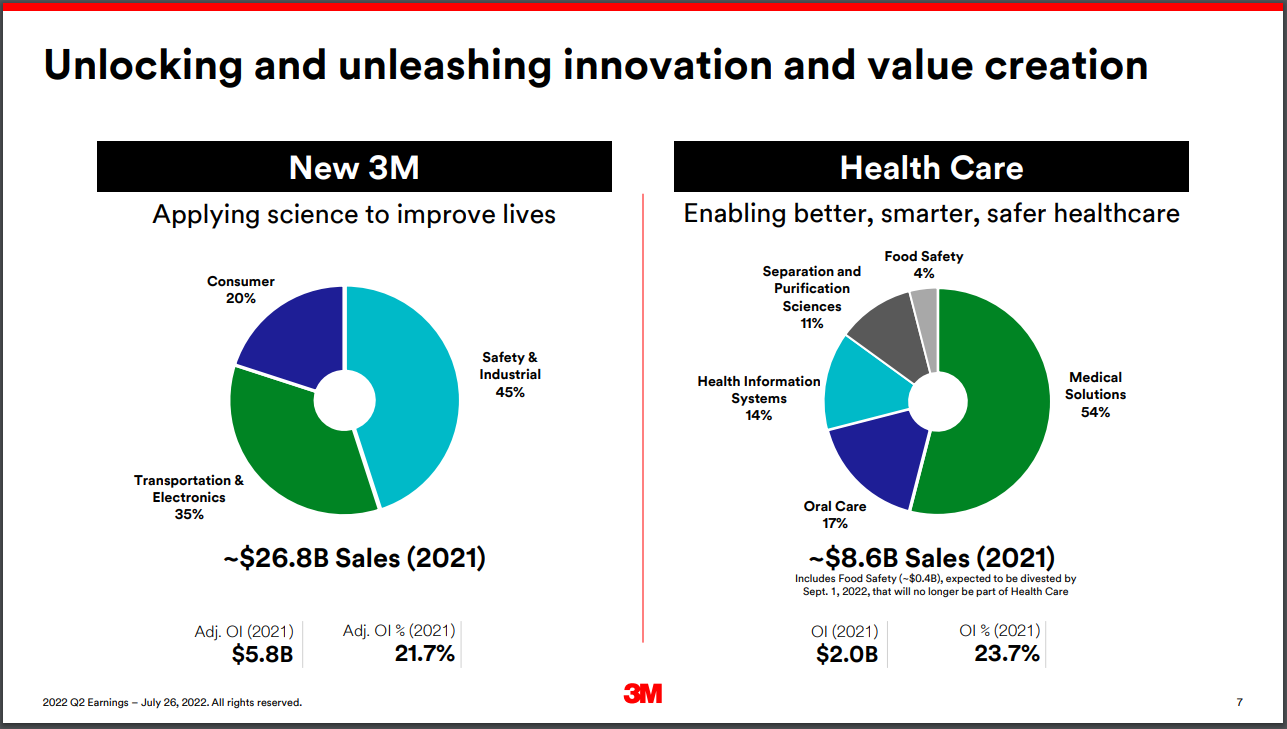

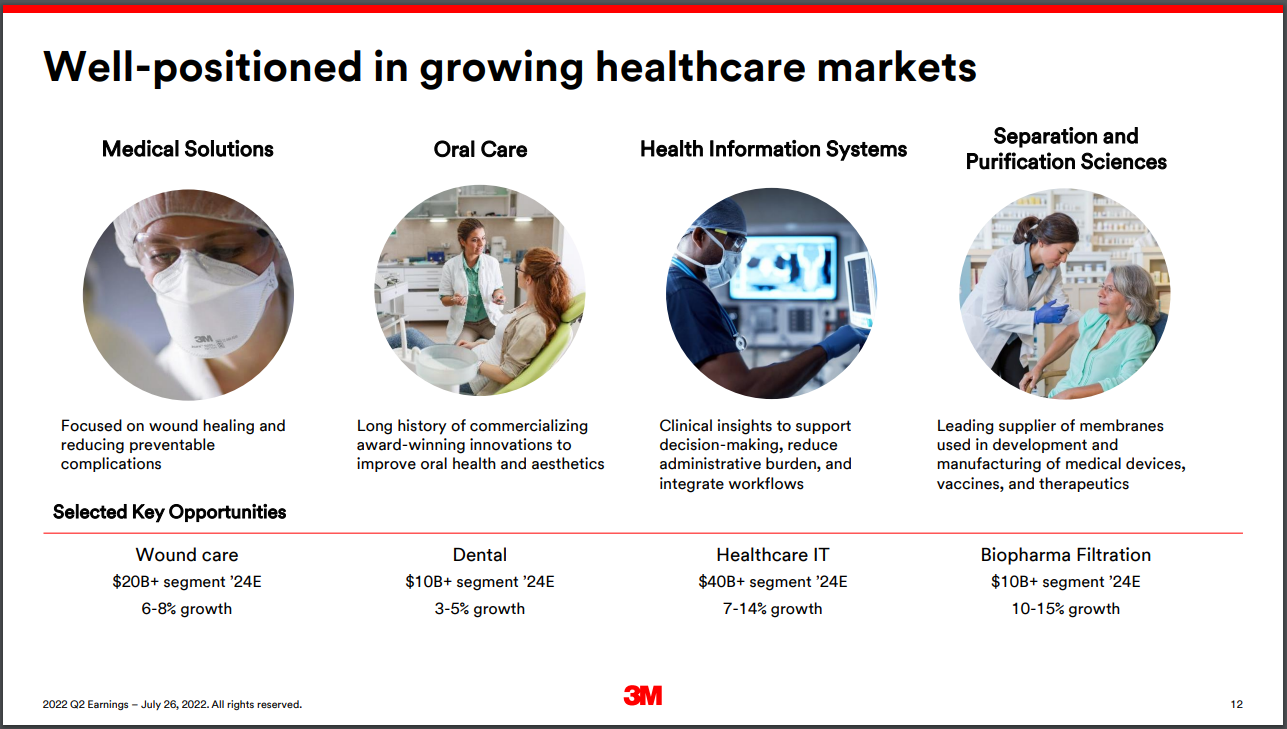

3M announced on July 26th, 2022, that they will be spinning off their health care business. The stand-alone healthcare technology business will focus on wound care, oral care, healthcare IT, and biopharma filtration. The spin-off is expected to be complete by the end of 2023.

The new 3M will consist of the segments which generated $26.8 billion of sales in 2021, while the healthcare spin-off will retain the product portfolio which generated $8.6 billion of sales in 2021.

3M reported second quarter 2022 results on July 26th. For the quarter, revenue fell 3% to $8.7 billion. Earnings-per-share of $0.14 was a massive decrease from the prior year, primarily due to costs related to the combat arms earplugs litigation, which amounted to a pre-tax charge of $1.2 billion. Adjusted EPS also fell, from $2.75 in Q2 2021 to $2.48 in 2022.

The company generated adjusted free cash flow of $1.0 billion, down 41% from the prior year period. 3M also returned $0.8 billion to shareholders by way of dividends in the quarter.

Leadership downgraded its 2022 guidance and sees total sales growth of -2.5% to -0.5% (down from 1% to 4% previously), organic sales growth of 1.5% to 3.5% (down from 2% to 5%), and earnings-per-share of $10.30 to $10.80 (down from $10.75 to $11.25). Thus, the 2022 EPS is forecasted to come in around $10.55 at the mid-point.

Growth Prospects

With such a vast array of products in a multitude of different sectors, 3M has the ability to focus on the most profitable growth avenues when it is most lucrative. The company is currently focusing investments in large, fast-growing sectors which have favorable factors worldwide. Some examples are automotive technology/mobility solutions, home improvement, electronics, personal safety, and healthcare.

3M also expects that its business and product improvements will drive further margin growth. Still, for the time being, global supply chain challenges and geopolitical impacts, as well as raw material and logistics costs weigh on margins in the current environment.

The consumer business was the only segment which saw organic growth declines in the second quarter. The healthcare business grew the most at 4.4%, followed by safety & industrial and transportation & electronics at 0.7% and 0.5%, respectively. All segments faced operating margin pressures and saw it lower year-over-year. Still, we believe that all segments should grow meaningfully over the long-term.

3M is likely to continue making strategic acquisitions, such as with the nearly $7-billion acquisition of Acelity, a leading global medical technology company that manufactures wound care and specialty surgical products. Interestingly enough, this acquisition will now be spun off with the 3M’s new healthcare company.

We expect 3M will grow earnings-per-share at a rate of 5% annually in the intermediate term.

Competitive Advantages & Recession Performance

3M’s technology and intellectual property are its most significant competitive advantages. These unique advantages have enabled 3M to raise its annual dividend for 64 years and counting.

3M has over 50 technology platforms and a team of scientists dedicated to generating innovation. Innovation has enabled 3M to obtain over 100,000 patents throughout its history, which lowers the chances that the company will have meaningful competition.

3M invests heavily in research and development year after year. The company aims to spend around 6% of annual sales on R&D. In 2021, the company spent $2.0 billion on R&D. For the second quarter of 2022, 3M invested $476 million in R&D & related costs.

The company has done so well in creating new products that roughly 30% of annual sales came from products which didn’t exist five years ago. 3M has established itself as an industry leader across its product segments. The company has remained profitable, even throughout recessions, which can, in part, be credited to their competitive advantages.

Listed below are 3M’s adjusted earnings-per-share results before, during and after the Great Recession:

- •2006 adjusted earnings-per-share: $5.06

- •2007 adjusted earnings-per-share: $5.60 (10.7% increase)

- •2008 adjusted earnings-per-share: $4.89 (12.7% decrease)

- •2009 adjusted earnings-per-share: $4.52 (7.6% decrease)

- •2010 adjusted earnings-per-share: $5.75 (27.2% increase)

- •2011 adjusted earnings-per-share: $5.96 (3.7% increase)

Just because the company remained profitable, does not mean it is immune from recessions, and its earnings-per-share fell in 2008 and 2009. However, the consistent profitability afforded the company the ability to continue increasing the dividend. And EPS bounced back as early as 2010 and continued growing.

Valuation & Expected Returns

Shares of 3M Company have traded for an average price-to-earnings multiple of around 19.1. Shares are now trading far below this average, which indicates that shares could be undervalued at the current 13.2 times earnings.

Our fair value estimate for 3M Company stock is 19.0 times earnings. If this proves correct, the stock will benefit from a 7.6% annualized gain in its returns through 2027.

Shares of 3M Company currently yield 4.3%, which is above its average yield of 2.8%. On a dividend yield basis, MMM shares seem to be trading below fair value.

The current dividend payout is adequately covered by earnings, with room to grow. Based on expected fiscal 2022 earnings, MMM has a payout ratio of 57%. We anticipate continued low single-digit dividend increases in the years to come.

Putting it all together, the combination of valuation changes, EPS growth, and dividends produces total expected returns of 15.6% per year over the next five years. This makes 3M Company a buy.

Final Thoughts

3M Company is a manufacturing behemoth, which is heavily diversified across product segments, and has a strong global presence. The company is a Dividend King, as it has increased its dividend for 64 consecutive years.

While the company can feel the impacts of recessions and economic weakness, its durable competitive advantages afford it the ability to remain highly profitable.

With strong total return expectations of 15.6% per year over the next five years, 3M Company stock is a buy for long-term dividend growth investors.

This article was first published by Quinn Mohammed for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

3 Undervalued Blue Chip Stocks For Safe Dividends

6 Blue Chip Stock With High 4%+ Yields For Safe Income

2022 Blue-Chip Dividend Stocks | See All 357 | Yields Up To 8.3%

2022 Dividend Achievers List | See All 347 Now | Updated Daily