Two very important events in history are relevant to this text: the first falls in March 3rd 1882, the very date fate appointed to be the birthdate of one Carlo Ponzi.

The second, falls in January 3rd 2009; on this day, Satoshi Nakamoto mined the first batch of Bitcoins(Genesis block). Needless to say, each of these events would change the world forever.

The two seemingly random events came together as soon as the genius in the technology behind Bitcoin came to the fore; the blockchain. Hailed as one of the greatest technological inventions of our time, blockchains(like many grand inventions before her) would soon fall into corrupt human hands. For what? She would be the master tool for a new age of Ponzi schemers.

For me to tackle the title matter of this text, one first needs to understand the basic working of Ponzi schemes and a rough understanding of blockchains.

Ponzi schemes, for this unacquainted with the “art” work under a rob-Peter-to-pay-Paul principle. An individual/company sells a fraudulent investment that generates revenue for old investors by acquiring funds from new investors. This business model is, of course, unsustainable as no actual value is generated from the process. It is a con that seeks to fill a hole by creating another hole, repeated until the flow of new investors runs out, leading to the ultimate collapse of the scheme.

A blockchain in layman, is a distributed ledger. Still floating huh? Take this for instance: any school classroom needs an attendance register. Conventionally, this register is maintained by the teacher in charge who marks the attendance FOR the students. The students never get possession of the register and can never access it unless through the teacher. That is a traditional ledger. For a blockchains-in the same instance- the register is owned and maintained by everyone. What does this mean? Through distribution, a single online register is created and copies made for every student’s individual computer/device. The network of attendance register copies are thus appended into one master register. If, say, student X marks himself present on his copy of the register, the same information is automatically marked in the master register, which in turn reflects in everyone’s copy. Thus, in the blockchain register, the teacher is not needed as an intermediary between the students and the register. Everyone plays his role in the maintenance of the register without depending on a centralized component of the system. As a matter of fact, there is no centralized component in the system. The teacher, in our scenario, is not the integral part anymore. This is what we call a peer-to-peer(P2P) network as it relies on each student to mark his individual register then appends them all through networking into one dynamic master register. The students form a BLOCK of individuals, the interdependence of their registers CHAINS each to one another. Hence the word BLOCKCHAIN; a block of system nodes chained together through a network of interdependence.

Note: Blockchain components are interdependent but the whole system is not dependent on any one component. Even if one node fails, the system still stands. Hence there is no single point of failure.

Like kingless subjects, the nodes are interdependent to operate their territory, while remaining independent of each other. Sounds unrealistic huh? Imagine this is the reality underlying the blockchain internet currencies; Bitcoin, Ether etc. No modest feat was achieved by their creators.

Now to the title subject; Nurucoin and blockchainPonzis

With the emergence of Bitcoin, many saw the future of finance and currency. For some, the new frontier in digital crime had been opened. The Bitcoin craze led to the emergence of copycats(called altcoins in crypto-geek lingo).

To establish these altcoins, many of their parent companies turned to crowdfunding(a new digital phenomenon you better Google). To raise the capital needed to establish blockchain coin projects, these companies established ICOs(Like an IPO except with a ‘C’). In less technical language, an Initial Public Offering(IPO) is an event where a company seeking initial capital for a startup stakes shares in their company’s value to be sold to investors as share certificates. With ICOs the concept is majorly the same except the company gives out digital tokens(coins) instead of share certificates. These digital coins may or may NOT be attached to the company’s share value. Coin buyers invest in the digital coin hoping the project will kick off and the coin’s value will appreciate, yielding returns on their holdings when they sell them at a later date. This process is referred to as speculative buying.

Needless to say, many of these ICOs were get-rich-quick schemes with baseless business models. All they sought was to pump their worthless coins, get money from it then disappear. If I was a lawman, I would call this fraud. But we’re here, so I’ll call it a digital Ponzi. The process of creation of these useless digital tokens yielded a new term; pump-and-dump. These digital tokens earned the name dumpcoins. Pump the coins, dump them on the populace.

As blockchains become a household term, we’re increasingly left in the crosshairs of neo-Ponzis. Some notable instance, I would say, is the phenomenon that was the Plexcoin ICO. In December 2017, Dominic Lacroix became famous in the digital world after it became apparent his Plexcoin project was a Ponzi. By the time authorities got to him, he had defrauded the public of nearly $15M in hard-earned currency. Another project, Benebit, put up $500,000 for marketing their digital Ponzi. By the time it was all over, the Benebit founders had walked away with a whooping $4M. There are more Opair, Ebitz, Recoin & DRC and even(ironically) Ponzicoin. As you see, it is something that happens all too often. Just check deadcoin.com to get an idea of all the coins that died before their birth.

It is for this reason that the emergence of a new ICO in Africa(based in Kenya, allegedly registered under Mauritian law) caught my fancy. Nurucoin (Link: https://token.nurucoin.com/presale) had hit mainstream media and hit it hard. Everywhere, individuals behind this project were touting it as the liberator of Africa’s economy and much more. Was this another Ponzi ICO ploy or a legitimate innovation here to revolutionize the face of African e-commerce? I had to find out for myself.

To do this, I started from the very conception of Nurucoin. From the brains behind it; one Isaac Muthui. This interesting character, a pastor in his own right, is the founder of Churchblaze Ltd. Churchblaze is a Christian social network site Mr. Muthui claims had garnered 20M visits even before its official launch (This is obviously a market bluff as Similarweb doesn’t place it anywhere near that range) This was, sadly, not the last lie I would catch Mr. Muthui in.

The fishyness behind this Nurucoin project would lead me to the base of it all: the Nurucoin whitepaper (The rough blueprints outlining an overview of the project’s architecture, purpose and operations).

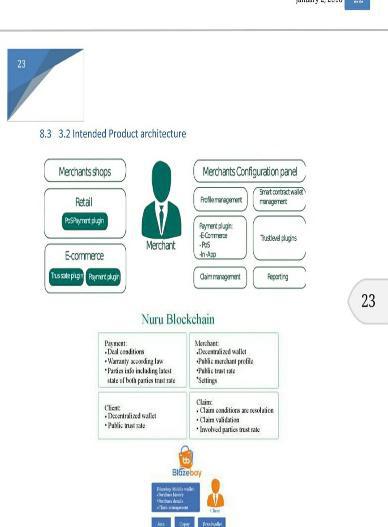

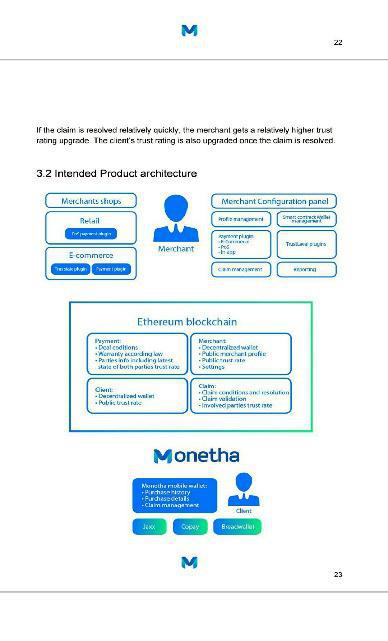

Now the Nurucoin whitepaper is a very controversial document. As I perused through it for the first time, I clearly saw it was unprofessional, rushed and at times incomprehensive. I quickly downloaded it from their Telegram forum (link: https://t.co/PCmAPpFBh3?amp=1 it still beats me why such a grand project would host their forum on Telegram instead of establishing one on their own site for proactive interaction with users). I then put it through the plagiarism test on Quetext.com and alas(no prizes for those who guessed it) it was heavily copied from another blockchain project, Monetha (link:https://monetha.io/ whitepaper included on site)

Downloading Monetha’s whitepaper, I then carefully went through both whitepapers just to make sure Nurucoin was a stolen project.

Then, I reached out to Mr. Muthui for an in-depth look into the project.

Here, upon posing my first question, I met my 2nd lie; Mr. Muthui calmly stated that the project was his idea even though this was hard to pass off to the keen eye. He had only a tolerable knowledge of blockchains and cryptocurrency. A quick background check on the Nurucoin team also returned null. None of the people rallying behind the project had any background in the field. If any of them were crypto-gurus, I’d have given them the benefit of doubt that maybe their striking similarity to Monetha was a coincidence. But my beliefs held true; Nurucoin was a cheap rip-off off Monetha, never even taking the time to eliminate some of the obvious giveaways. Nonetheless, the stolen idea wasn’t enough proof to make the project a Ponzi. I dug my claws deeper.

Nurucoin marketing schemes were full of half-baked lies and dream-marketing rhetoric. So, as you can imagine, catching them on their Ponzi wasn’t hard enough. I just had to prod the projects framework a little and the worms free-flowed from the can.

First things first, Nurucoin was proposing a universal trust-based payment system running on their own independent blockchain. If I’ve lost you, please refer to the introduction. If you’re following, let’s tread on. The timelines for the project were vague and varying. The white paper says it will all be implemented in just under two years. A Nurucoin representative said the independent blockchain would be ready in 6-8months. In contrast, Bitcoin’s blockchain took more than 2years from conception to development to launch. Ethereum, was well, much faster because Vitalik Buterin and other seasoned blockchain developers had gained invaluable insight from their role in Bitcoin’s development. Still they took more than a year. Mr. Muthui? Well our blockchain genius was dangerously tongue tied and confused on the timelines. Poor Ponzi planning I assume. Nurucoin’s Ponzi promise is that it can deliver a fully functional blockchain+several complex complementary systems in just under 8months. What’s more, they’re planning to use developers who’ve undergone mere weeks of blockchain training(my developer contact said a seasoned developer needs no less than 4months of INTENSIVE training). Where’s a reality-check when you need it?

Now trust is a very broad words by individual definition. My standards of trust aren’t compatible with yours. Everyone has unique standards of trust. The Nurucoin project aims to create a user trust rating mechanism that works for ALL. Implementing a universal trust-based payment system that fosters user privacy(as NuruInc aims to do) would be a mammoth undertaking. The only exercise comparable to this is trying to catch all the whales in the world with a single harpoon.

A universal trust-based system should foster free markets and provide the same tailor-made services for all. If, say, a gun-runner is as adept at handling market transactions as a clothes merchant they would get the same trust rating on the Nurucoin blockchain. Quite unethical, yes? With a universal service aimed at serving 7billion on the planet engaging in diverse commercial activities, it would be nearly impossible to tailor a blanket trust rating system capable of meeting all their needs. It is why Alibaba haven’t considered merging their trust rating system with Amazon. Or eBay with Silkroad. Fela would call it an “impossibility magicalization”. When I reached out to Isaac Muthui on the feasibility of this project, it became clear to me that they hadn’t bothered conducting a study to see if it was possible. In fact, I suspect I’m the one who introduced the word “feasibility” to him. Serious red flag: if they haven’t assessed the practicality of the project before conducting an ICO, I don’t think they’re looking forward to even remotely establishing the project.

Next on my hitlist was the ICO itself; the grand golden goose. When conducting a crowdfunding project, it is essential that you’re transparent with the finances as they are, after all, public finances. Nuru Inc sadly, believe otherwise.

With 1billion tokens for sale each at $0.1(the current market price) the Nurucoin is potentially aiming to raise $100M. Not monopoly Money; real cash. This intention hasn’t been clearly stated on the ICO website. Neither has the progress of the ICO been stated. In fact, their website is a hastily constructed, bug-infested and error prone page that shows no essential information. Their website is as secretive as the Cosa Nostra and their Omerta. I was surprised people were actually buying into such shadiness. Some irregularities in their whitepaper worsened the illegitimacy of the ICO.

First, they state that the minimum amount needed for their project is $3M. No breakdown of how they arrived at this figure is provided. They then go on to state that their soft cap is $3.6M(The soft cap is the provisional maximum amount to be raised, with the option that it can be exceeded). THEN they state their hard cap at $36M dollars(The hard cap is the maximum amount raised that the ICO cannot exceed).

Now you realize the very unconventional business practice here. There is a range of 1000% between the soft cap and the hard cap with no reasons stated for this gross abnormality. Clearly, the “owners” of this project don’t even know how they arrived at these figures meaning they haven’t adequately thought out about the actual running of the project. In fact, only a vague description of how the money (read “loot”) will be used is provided and even this is done in percentages.

Another glaring irregularity (the main giveaway that this is clearly a Ponzi) is that the funds are held in personal accounts instead of escrow. I’m not about to define escrow because Google is your friend. The danger of opting not to hold funds in escrow? In case the company fails to uphold their end of the deal by developing the project, there is no mechanism to ensure the funds are refunded to the rightful owners. If they had escrow, a smart contract (another innovation underlying ethereum) would make sure that if the project failed to kickstart, no money would be withdrawn by the company. Without escrow, NuruInc can do whatever they want with publicly raised funds (This is including melting into thin air with the loot, although I’d go to The Bahamas if it were me).

More irregularities to the ICO Of course. NuruInc is generating 1billion tokens and planning to sell them down to the last one(in contrast Bitcoin will only ever have a maximum of 21million units generated). Even the coins unsold in the ICO, instead of being destroyed, will be kept for “future company financing”. This opens the floodgates for currency inflation and a whole host of other financial malpractices. But I don’t think inflation is their main worry. This being a Ponzi, they’re more intent on disposing of all the coins instead of creating value out of them.

Another very crucial error, one Mr. Muthui brushed off as an innocent typo, was in the coin generation ratio. For the first batch of coins, the whitepaper states that for every Ethereum unit received, the system would dispense 800Nurucoin tokens. For the 2nd batch, the system would dispense 7000coins for every ethereum unit. To the innocent observer, that would be an innocent typing error. To the system, this error is detrimental as it results in an 87% drop in the coins value all in an instant. If Mr. Muthui is as smart as he thinks he is, this is a gaping loophole out of this Ponzi pickle he’s in. All you have to do is sell them the first batch then buy it all back at the price of the 2nd batch, making a neat and genuine profit off the process. Mr. Muthui ” hadn’t noticed” this error of sorts when I brought it up to him which says a lot about the father and the project he sired.

The last fishy detail about the ICO is that there are no wallets(accounts) for users to store their purchased coins. No hot wallets(online accounts). No cold wallets(offline accounts). Nurucoin users are buying the coins in the faith that Nuru Inc will be good enough to honor their end of the deal. This is clearly courting trouble.

By having no user wallets, the company retains responsibility for all the coins. This is disastrous(or handy depending on your position in this Ponzi) because in case of a hack on their website, all the coins would disappear into thin air. If Mr. Muthui is scheming as I think he is, then I just handed him another chute he could use to vanish with your monies.

The newest rat I’ve smelled in this ICO is attributed to the opacity of the ICO’s progress. When I talked to Mr. Muthui, he told me they had already reached their soft cap. If this holds true, he has raised $3.6M of looted African funds within his keep; enough for a more than modest home in Bel-Aire. If you ask me, he’s bluffing and isn’t anywhere close to it.

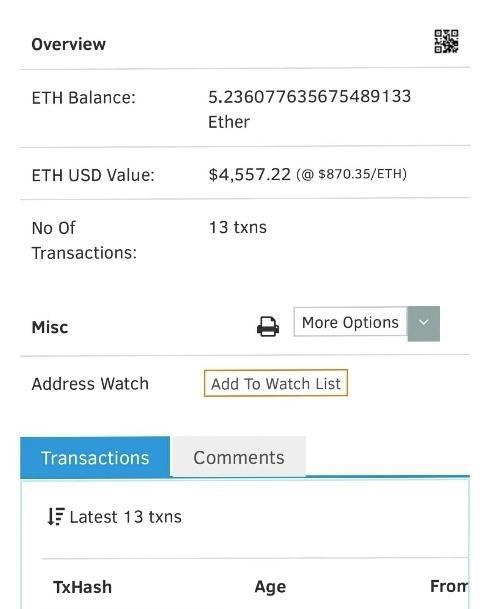

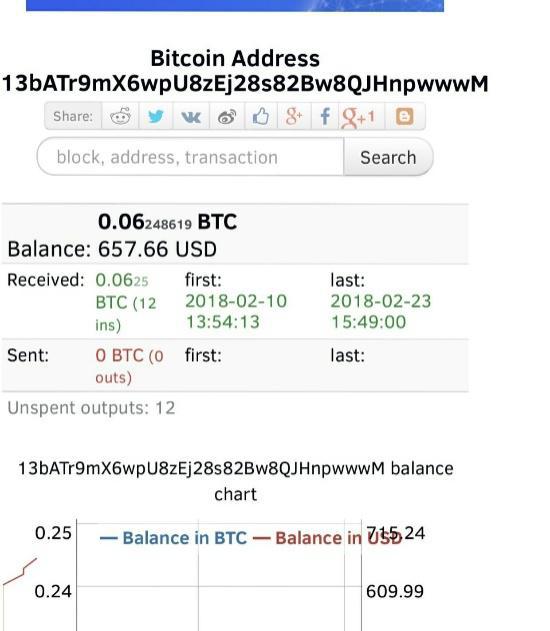

A spot-check on the Bitcoin and Ethereum addresses revealed total holdings of $5214.88. Don’t you just love the transparency of blockchain currencies? I just went online and there were their personal accounts for the whole world to see.

.

If the state of these Ethereum and Bitcoin addresses reflect the overall purchase of Nurucoin in their Equity(You guys should know better than facilitating fraudulent transactions) and Paypal accounts, then NuruInc is nowhere close to their target.

Talking of targets, Who is the target market for Nurucoin tokens? On the whitepaper, the legal section states that Nurucoin shouldn’t be used for speculative buying as the project may fail to materialize. Considering the assumption I formulated from their forum that most of their buyers are short term speculative buyers expecting yields in the near future; it is reckless and negligent that the Nurucoin team have failed to conspicuously highlight that their token shouldn’t be used for speculative trading. I brought this up to Isaac: in the next 6months he will be pickled by a horde of investors who saved their crucial monies in the project expecting short term yields. I figured he didn’t care enough as long as he could get all the money in.

In conclusion, I can say that I’ve learned alot from my research into Nurucoin. First, alot of people are dabbling in the cryptocurrency market but they remain largely unregulated. Governments have also been slow in adopting blockchain and passing required legislation. These unchartered waters harbour criminals who will make killings defrauding unsuspecting users in these spaces and walk away scot-free in the end. That is the reality. Even after I write this article, NuruInc can’t be touched by my government as the constitution hasn’t dynamically adapted to cover the new-age of cyber crime. Even in America, Lacroix and his Plexcoin plotters got away with less than 1M in damage fines.

This is a loophole that should make you cautious against investing in cryptocurrency and blockchain projects. Also, those in the legislation wing of government should do something to protect their citizenry from the ever evolving threat of Ponzis.

Now from this text, I hope you have caught a few pointers on how to catch a fraudulent ICO, otherwise this task would have been useless.

As for Nurucoin, I conclude that it is nothing more than a cheap Ponzi and no amount of shrouding itself in apparent legitimacy will make it anything else. To my native Kenyans, I’ve noticed a worrying trend that is the purchase of stolen babies; from the infamous Gilbert Deya to the recent Edna Kwamboka. I, as a self-proclaimed midwife declare this stolen Nurucoin baby a stillborn. It is thus useless value for your coin.

As the parting shot, I would like to employ the most volatile social mobilisers of all time; the feminists. Guys, just look at the gender representation in their developer team.

Right?

To Nuru Inc: Your graphic designer was the first giveaway. He just didn’t put enough finesse into the job.

Sources:

Nurucoin white paper: https://www.dropbox.com/s/1q4u64d7oiqpvio/nurucoin%20white-paper.pdf?dl=0

Monetha white paper: https://monetha.io/

Nurucoin Telegram group:https://t.co/PCmAPpFBh3?amp=1