Cigarettes and Tobacco manufacturing company British American Tobacco Kenya Ltd declared its full year results for the period ending December 31 2016.

Gross revenues increased by 2% from Ksh 35.8 billion in 2015 to Ksh 36.7 billion in 2016. The company mentions that its market share increased in 2016 despite challenges in an increase in excise duties.

Operational costs reduced by 9% from Ksh 14.5 billion in 2015 to Ksh 13.3 billion. The cost reduction is attributed towards stringent cost management, productivity and overheads savings. The company also undertook a reorganization exercise which cost them Ksh 338 million.

Related; East African Portland Cement records HY Loss Before Tax of Ksh. 533Mn

Finance costs decreased by 45% to Ksh 295 million in 2016 compared to Ksh 534 million in 2016.

Profit after taxes stood at Ksh 4.2 billion in 2016 compared to Ksh 4.9 billion in 2015. The 15% decline in profits is largely attributed to the significant 24% increase in excise duty and VAT to Ksh 16.8 billion which brings the total amount remitted to the government to a total of Ksh 19.2 billion factoring in PAYE and corporate tax.

The board of directors declared a final dividend of Ksh 39.50 per share which brings the total dividend for FY 2016 at Ksh 43.00 per share.

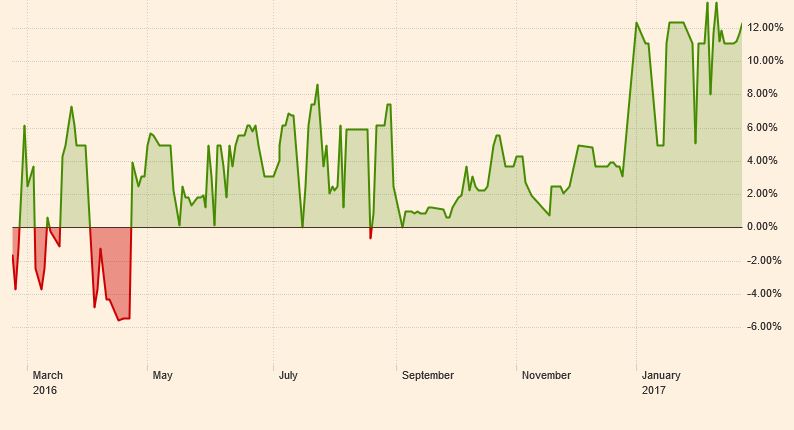

In the markets BAT Kenya was last spotted trading at Ksh 909 per share. In the last one year the share price has been up by roughly 12% as shown in the chart below.

Some of the Top Institutional holders of BAT are:

- LGM Investments Ltd

- Aberdeen Asset Managers

- JP Morgan Asset Management

- Coronation Asset Management

- Imara Asset Management

- Coeli Asset Management SA

- Danske Bank A/S

- Russell Investments Ltd

- Parametric Portfolio Associates

- Absa Asset Management

Note that BAT plc owns 60% of BAT Kenya through its holding company Molensteegh Invest BV.

Download: BAT (K) Ltd- Full Year Results for the Year Ended 31st Dec 2016

Source: (BAT, FT, Kenyan Wall Street)