Appeared on Frontera

(DaMina Advisors) In a major pyrrhic victory for Tanzania’s resource nationalist President John Magufuli, and in a key positive signal to other large mining economies in Sub-Saharan who are looking to nationalize foreign mining assets, Barrick Gold’s unprecedented capitulation today to share future gold profits from Acacia Tanzania operations on a 50:50 basis with the government, re-domicile in Tanzania, appoint a majority of local directors and senior staff, despite the state owning just 16% of equity of the new company, in addition to providing $300million to stave off a monstrous tax bill – will simply embolden Magufuli to push his nationalization agenda forward into other sectors. The country’s mining sector crisis is not over, despite today’s positive announcement.

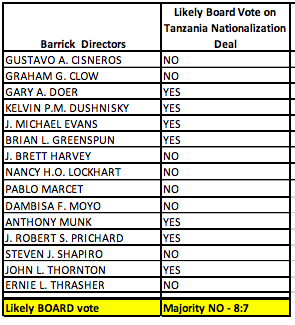

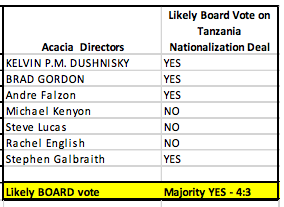

The sigh of momentary relief and excessive market euphoria notwithstanding, a clear majority of Acacia and Barrick’s Independent board directors – are NOT – likely to endorse this deal, fearing ruinous shareholder lawsuits. Barrick’s chairman in his statement in Tanzania’s capital signaled that board approval may be hard to get. Magufuli also aware that the boards of both companies are likely to reject the deal urged Barrick’s chairman to ‘ignore uncooperative shareholders’ and force thru the deal.

The deal waives all legitimate international legal claims by both companies on Tanzania and accepts and incorporates retroactively the Tanzania’s new mining laws into the currently existing gold mining agreements. In short – Barrick has thrown Acacia to the wolves in hopes of peace. This market euphoria will be short-lived.

Split Board Votes on deal will doom agreement

DaMina Advisors is an Africa-focused independent frontier markets risk research, due diligence and Africa M&A transactions consulting and strategic advisory firm.