“Popping in and out of sub-Saharan Africa is not a 20 basis-points trade or a 30 basis-points trade. You’re really thinking about building a position slowly… Ghana, Kenya and Zambia make sense to me in that space.”

— Jeff Gable, Head of research at Barclays Africa

In the recently held Barclays Africa Forum in Nairobi, Kenya, here are our key takeaways on their macro economic presentation:

Growth

It is noteworthy that the global economy remains uncertain with the IMF cutting its growth forecasts between 3 and 3.5% as a baseline assumption, monetary policy is still at its lowest and debt is piling up in many major economies and more capital is being allocated to riskier assets in a hunt for yield thus benefiting emerging markets but any reversal could be sharp. China also remains a Key economy but its debt level creates an unprecedented risk that cannot be ignored.

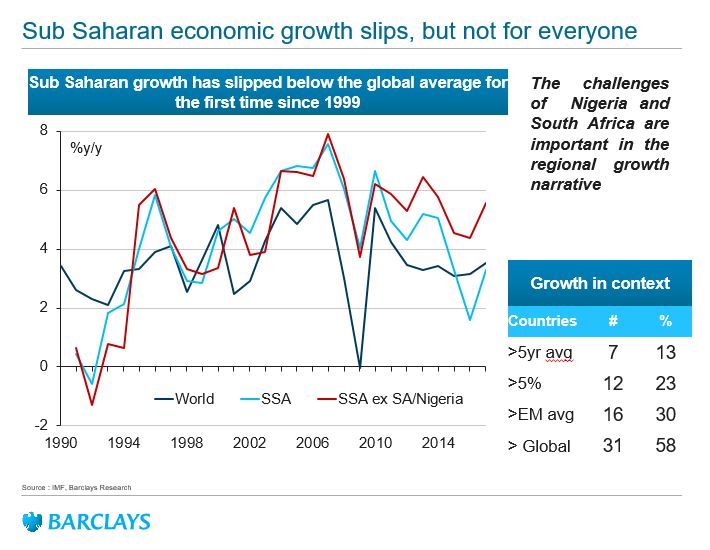

Sub Saharan growth slipped below the global averaged for the first time since 1999. Though the Challenges of Nigeria and South Africa are important in the regional growth narrative, their down turn caused Africa’s growth to dissipate below the global average to 4%, but if we were to eliminate the two economies, the rest of Africa had better than average global growth recording 5.7%.

Global Factors

According to Barclays, a number of global factors ranging from globalisation, stagnant middle class, lower interest rates, terrorism, distrust from governments and the current populist stance would have an impact on the growth of Africa’s economy.

The Bank also argued that Brexit may lead to reduced demand for African exports, less tourism, reduced remittance inflows into the continent, higher financing costs and reduced donor from UK and the European Union.

On Trump Presidency

Many African currencies will be greatly affected by the Trump Presidency even though the impact won’t be as cruel as elsewhere because the continent accounts for a small percentage of global markets. Barclays also argued that Trump Presidency might lead to more isolationist stance with less African engagement hence we might witness a heavier african states engagement with China and India.

Rate Cap

In Kenya the recent Interest Rate cap on lending will see slower credit growth, reduced economic growth as private loan uptake reduced to single digits and potential job cuts from the financial sector.

Related; Barclays’ initiative in supporting Emerging Supply Chains

Low Commodity Prices

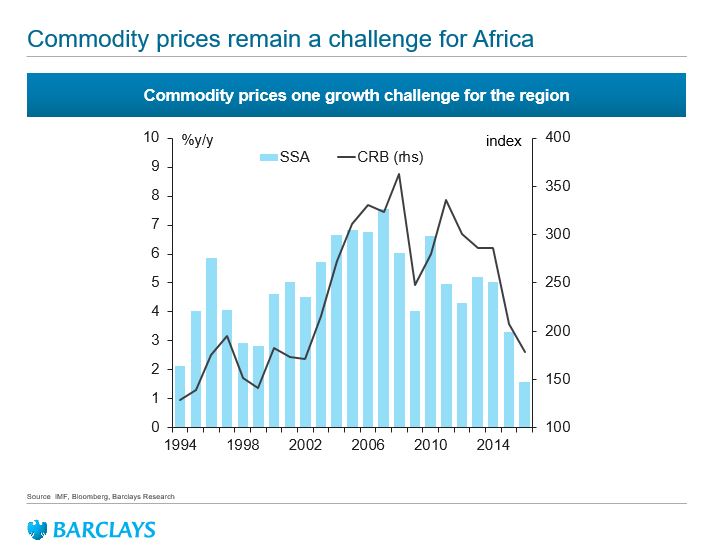

Commodity prices have tumbled since 2014 having a double edge sword effect to African nations. Countries heavily dependent on it have seen massive fiscal deficits and huge currency depreciation e.g. Nigeria, South Africa and Angola. On the flip-side other Sub-Saharan Economies that have low reliance on commodities like Kenya have seen a reduced oil import bill.

Macro imbalances

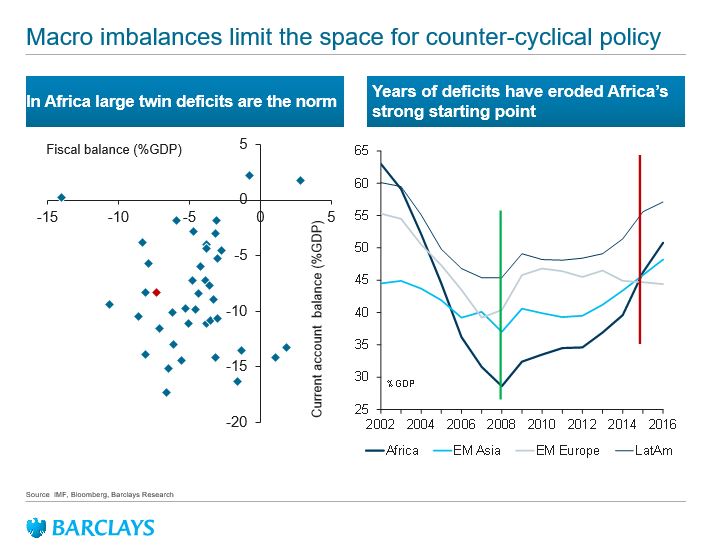

In Africa Current account deficits is the norm rather than the exception, which make them vulnerable in the case of a cyclical turn as they have very little space to maneuver. It also increases their dependence on debt and most have gone to the international debt markets and are now more than ever exposed to a strong dollar. Debt in Africa is increasing at a rapid rate, which is worrying. Years of deficits have eroded Africa’s strong starting point.

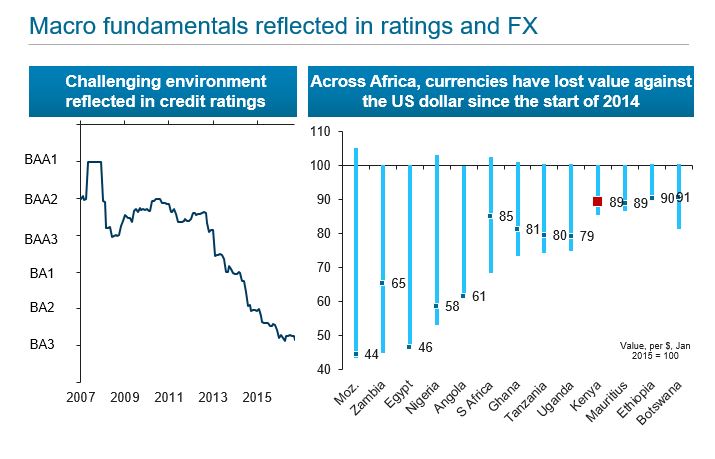

A challenging macro environment has seen most African countries downgraded as reflected in credit ratings since 2007. This means most will have difficulty meeting their budget and debt obligations. Also in tandem across Africa, currencies have lost value against the US dollar since the start of 2014 and most have averaged from 10% to as much as 60% value depreciation.

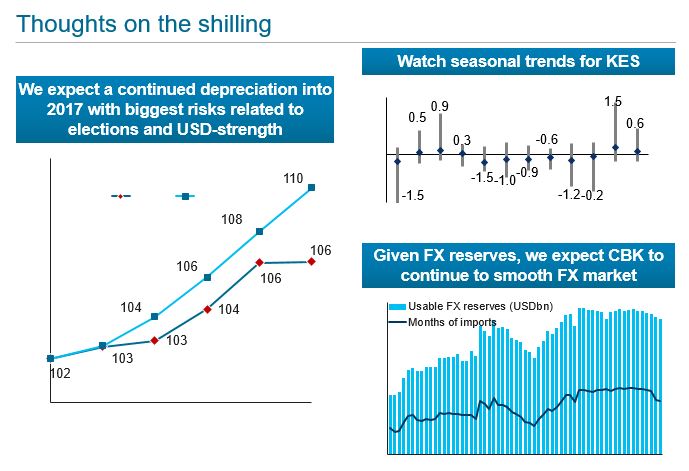

In regards to the Kenya Shilling Barclays sees more depreciation in 2017 but would likely be smoothed out by the Central Bank of Kenya’s war chest of forex reserves.

Kenyan Economy

Due to the diversity of the Kenyan economy and less dependence on one particular economic activity, the Kenyan economy has remained resilient in a very challenging environment. Its diversity into real estate, agriculture, tourism, finance, trade, manufacturing, information and communication, accommodation etc has helped it wither a tough environment and had a strong growth in GDP.

Favorable weather conditions have increased agricultural output, tourist arrivals are on an upswing though still below pre 2013 levels, investment in Infrastructure and is expected to be the key growth driver, GDP expected to remain strong over longer term though elections pose a risk, formal employment broadly rising, fiscal deficit to narrow as large projects are completed and discipline implications.

Kenya still remains the largest FDI receiver in East Africa and the 4th largest in Africa. This shows Kenya’s continued attractiveness to foreign investors and its economy.