On Monday 25th September 2017, Barclays Bank of Kenya held a workshop in Nairobi to introduce and discuss the implementation and challenges of the new accounting rules; IFRS 9.

A number of executives and analysts attended the briefing whose primary goal was to introduce and educate stakeholders in the financial services industry regarding the new procedures, their effect on the financial statements and the expected challenges for the standard’s upcoming implementation on 1st January 2018.

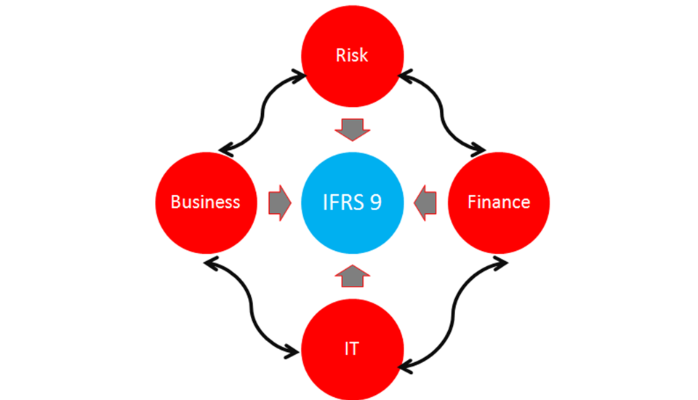

The new regulations are geared towards enhancing the resilience of financial markets and financial institutions by adopting more prudent governance rules in accounting for financial instruments

In addition, the forum discussed how the changes may impact banks, insurance and asset management companies due to their heavy exposure to financial instruments.

The new rules will require these organizations to increase their provisions for stock of credit impairment. This will lead to significant changes to the accounting of credit losses on financial assets and commitments to extend credit.

The development of these standards began in 2004 and accelerated following the global financial crisis in 2008. The most significant change is in the classification where it reduces categorization for financial instruments from 4 to 3. The new categories include amortized cost, fair value (for profit and loss) and fair value for other comprehensive income.

Kenya’s Central Bank has set a January 1st 2018 deadline for all financial institutions it regulates to move to these standards. As a result players including CBK, ICPAK among other stakeholders are working to fine tune guidelines which will be used by these institutions in their reporting. ICPAK reports that these standards will be ready by end of October.

What is the biggest impact?

The move to IFRS 9 from IAS 39 standards will have a significant impact on retained earnings and by extension reduce the available Tier 1 capital. These institutions are expected to tap into their retained earnings to make these provisions. Panelists at the Barclays Bank IFRS 9 workshop predicted a 25 -100 basis points reduction on Capital following implementation of these standards. At the same time provisions are expected to increase by between 20-30%.

Other changes will include income tax changes and external audit changes owing to transition to the new regime . An interesting point to note is that the new changes will also require banks to provision for lending to government institutions. Government securities is largely viewed as risk free.

Barclays Bank of Kenya also outlined how it plans to operate in the new environment. According to the bank’s CFO Yusuf Omari, the bank is looking to improve its debt collection strategies while at the same time adopting technology such as big data and predictive analytics to get an accurate risk profile of the borrower.

Also speaking at the workshop, Kenya Bankers Association’s CEO Habil Olaka stated that Banks are ready for the imminent changes but will push for the repealing of the banking amendment act owing to the likely impact the IFRS 9 standards will have on bank earnings. He also stated that areas such as mobile lending which banks have aggressively pushed will also be impacted by the new standards.

RELATED; IFRS 16: A New Life for Leases