Kenya’s banking sector, through the Kenya Bankers Association (KBA), has pledged KES 450 billion (KES 150 Billion annually) over the next three years to support Micro, Small, and Medium-sized Enterprises (MSMEs).

- •This commitment, announced at KBA’s 2024 MSME Summit, is aimed at providing affordable credit to boost the growth and development of MSMEs.

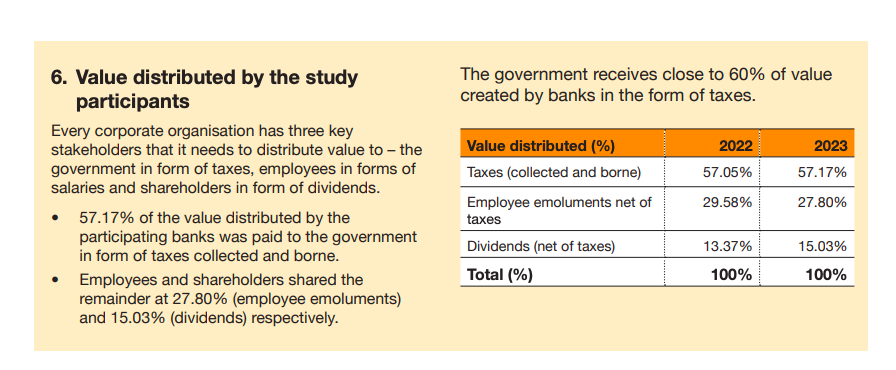

- •The banking industry’s total tax contribution over the last five years stood at KES 825 billion, with KSh 190.26 billion contributed in 2023 alone.

Speaking during the opening of KBA’s 2024 MSME Summit and the release of the Banking Industry Total Tax Contribution Report 2023, President William Ruto lauded the banking sector for committing to double its financial commitment to MSMEs, adding that the Government would lend its support to the sector through policy and institutional backing.

Speaking at the forum, National Treasury and Economic Planning Cabinet Secretary, John Mbadi, noted the importance of a predictable tax environment to foster continued growth and investment in the banking sector.

“The implementation of a national tax policy and clear tax laws will reduce litigation between taxpayers and revenue authorities, creating a more conducive environment for businesses to thrive,” Mbadi said.

According to Kenya Bankers Association (KBA) Chairman, John Gachora, the MSMEs sector contributes about a third to Kenya’s GDP and provides 8 to 9 of every 10 job opportunities in the country.

The Banking Industry Total Tax Contribution Report, which was launched today, revealed that for every KSh 100 generated by the sector, KSh 57.2 goes to taxes, KSh 27.8 to employees, and KSh 15 to shareholders.

READ; MSMEs Choke under Ksh 70 Billion Pending Bills, Overregulation – Kenya Bankers