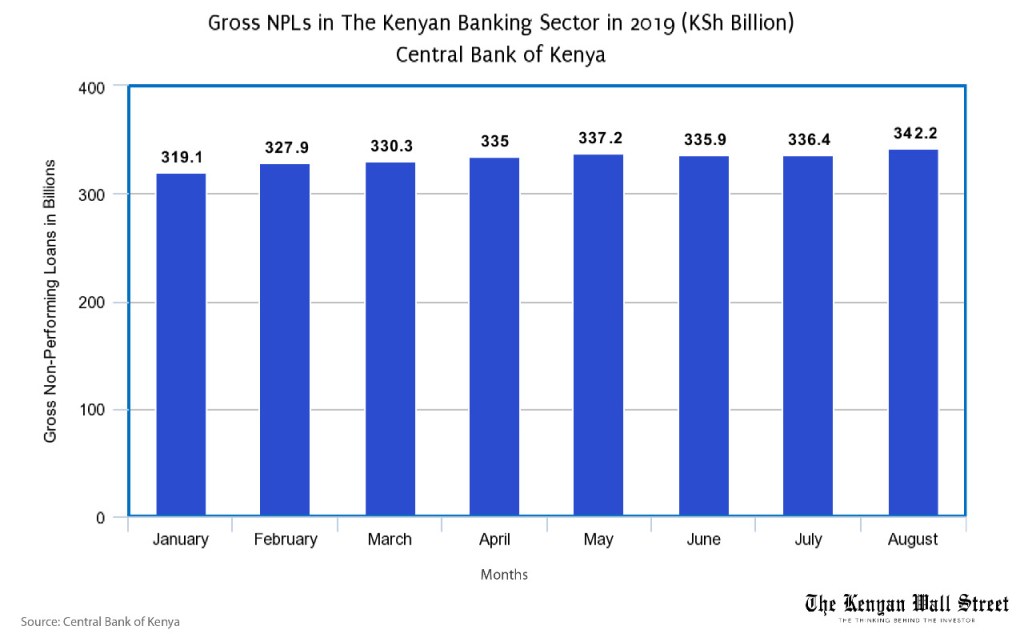

Kenyan banks continue to record rising nonperforming loans (NPLs). A report from the Central bank shows that NPLs rose from 12.4% to 12.6% between July and August 2019.

Moreover, third-quarter results from major banks show weak NPL performance in September.

For instance, Equity Bank, one of the biggest banks in Kenya, increased its NPLs from KSh 26.5 billion to KSh 30.6 billion by the end of September. According to Moody’s Investors Service, the rising NPL ratios indicate overarching pressure on the banks’ solvency, despite a growing economy, which is a credit negative.

Year on year data shows that NPLs in Kenya’s commercial banks have more than double in the past three years. Central bank cites that nonperforming loans grew from 5.6% in August 2015 to 12.6% in August 2019. The NPLs increased despite a growing economy.

Moody’s forecasts economic growth of approximately 6% this year, owing to public sector development and infrastructure spending.

High Taxes, Delayed Payments, Pushing up nonperforming loans

Kenya’s relationship between economic growth and credit repayment indicates a disconnect between infrastructure spending and impact in citizens’ lives.

First, delay in payments for contractors leaves SMEs struggling to stay afloat and at the risk of running out of business. According to The Star National government, counties and large corporations owed SMEs over KSh 310 billion by April 2019.

Second, high tax charges and other operating expenses have led corporates to cut down operations hence fewer job opportunities and reduced income.

Therefore, Kenyans in business and employment face shrinking incomes, which reduces their capacity to pay loans.

Regulatory changes in the banking sector might reverse the NLP trend. A prior report posits that the interest rate cap repeal will improve the pricing of loans and therefore grow the SME loan book.