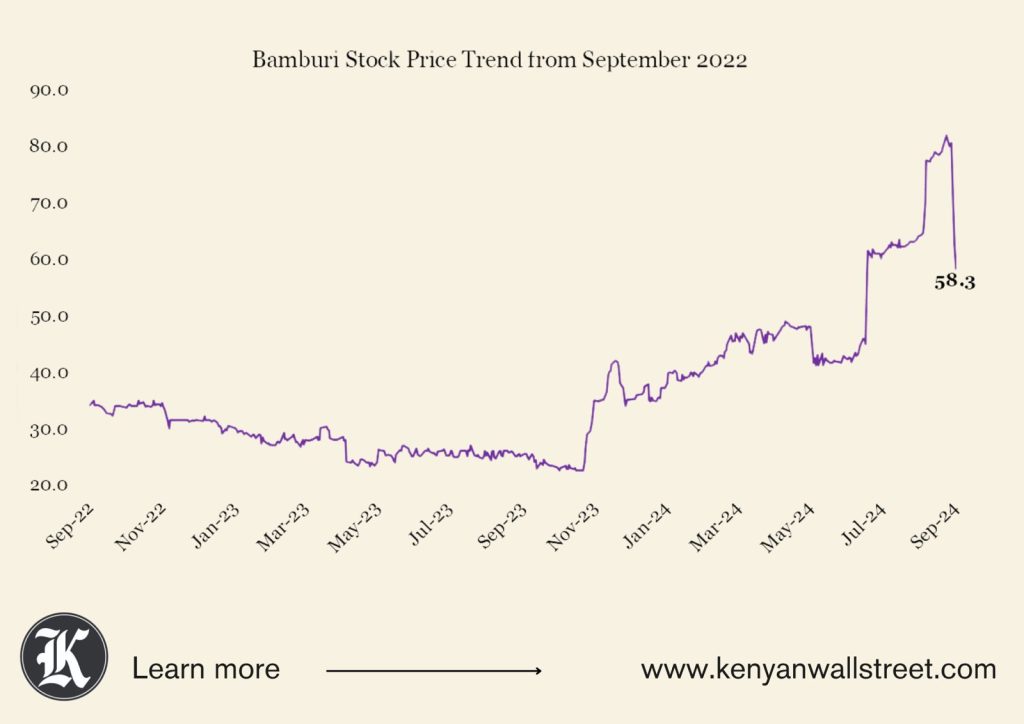

Bamburi Cement’s (Ticker: BAMB) share price has dipped 28.6% in just two days at the Nairobi Securities Exchange (Ticker: NSE), shedding KSh22.3.

- •The dip comes days after the closure of the company’s register on 20th Friday last week for the KSh18.35 special dividend to be paid on 27th September.

- •The easing is an aftermath of the book closure on Friday, with investors already locked in the anticipated dividend payout.

- •Bamburi has had a price rally in the past few weeks stemming from two acquisition offers from Savannah Clinker and Amson’s Group currently on the table at KSh 70 and KSh 65 respectively.

Book closure date is the day by which an investor must have bought the shares of a company to qualify for dividends for the period. It determines shareholders eligibility for dividend payments or bonuses for the period since the shareholder register is usually frozen after the dates.

The sell-off pushed the price lower to close at KSh57.50 per share on Wednesday, trading below the 52-week high of KSh84.00. Market participants in the Bamburi Stock are seemingly taking profits, closing out their long positions with the trading volumes near normal.

Holcim’s Retreat

The special dividend, which totals KSh6.6 billion, is being paid from the proceeds of Bamburi’s $84 million sale of its 70 percent stake in its Ugandan subsidiary Hima Cement in March to a consortium of Sarrai Group and Rwimi Holdings.

On the special dividend announcement date alone, the stock price shot up 11% to close at KSh77.50, extending gains until the book closure date. Other than the special dividend, the NSE listed cement company paid a final dividend of KSh5.47 per share for the year ended December 2023.

The offers were prompted by Holcim’s – Bamburi’s largest shareholder (58.6%)- decision to exit African markets in line with their portfolio optimization strategy.

Investors at Bamburi have had a smooth ride since July 2024, securing capital gains of more than 29 percent in 3 months and more than 100% year-to-date gain.