Bamburi Cement, which is considering two acquisition offers, is set to pay a special dividend of KSh 18.25 per share despite posting a loss for H1 2024.

- •The special dividend amounts 61 percent of the $84 million that Bamburi received from the sale of its stake in the Ugandan subsidiary, Hima Cement to a consortium of Sarrai Group and Rwimi Holding in a deal.

- •The cement maker has posted a KSh 877 million loss in the first half of 2024 from KSh 88 million profit in the same period 2023.

- •The loss is primarily attributed to tax obligations and currency translation losses incurred during the sale of the Ugandan subsidiary.

On the upside, profit after tax from continuing operations grew by 131 percent to KSh 525 million from KSh 227 million in H1 2023. In the first 6 months of 2024, the profit before tax from continuing operations increased by 114 percent to KSh 695 million compared to prior year attributed to the several cost optimization measures and improved operational efficiency.

Turnover from continuing operations increased by 4 percent to KSh 10.9 billion compared to H1 2023 on the back of high quality premium products strategy. The unusually heavy rains in the first half of 2024 coupled with social disturbances linked to the rejection of the finance bill 2024 adversely impacted operations for the company.

Cash generated from operations increased by 51 percent to KSh 1.9 billion in H1 2024 compared to KSh 1.2 billion in the previous year resulting from improved operating profit and efficient working capital management.

“Despite the challenging operating environment and slowdown in the market, we remain committed to our strategy and confident in our ability to deliver strong performance in 2024,” Bamburi noted in the earnings release.

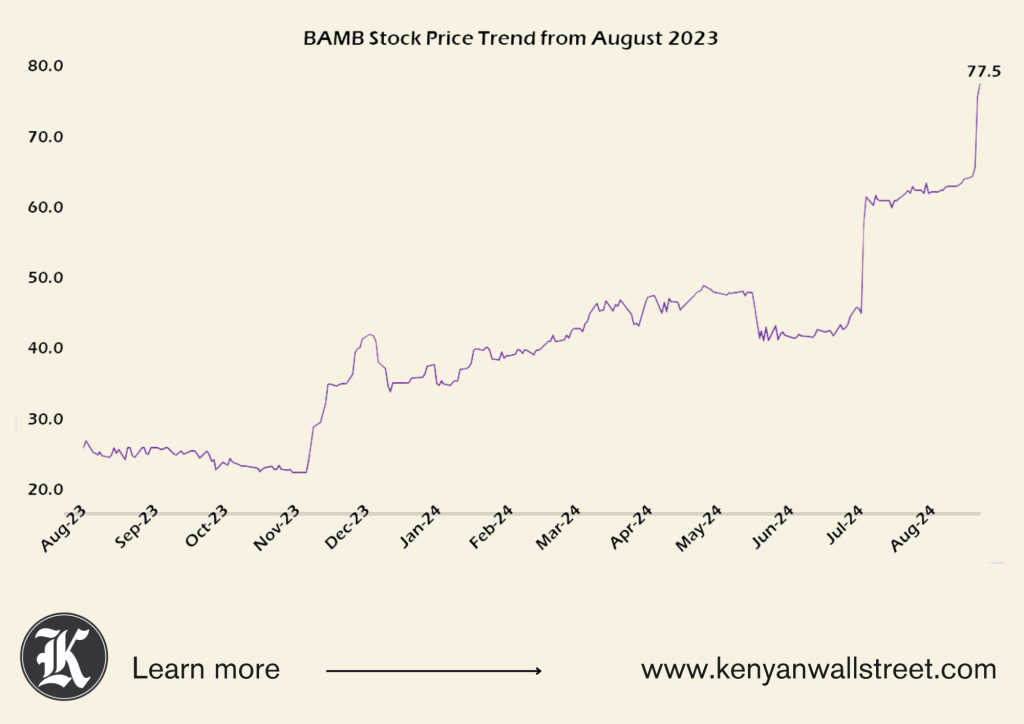

Following an exit plan by the majority shareholder – Holcim – Bamburi has received two acquisition offers in a span of two months from Amsons Group and Savannah Clinker at KSh 65 and KSh 70 respectively.

Amsons, a Tanzanian conglomerate, has received irrevocable commitment from Holcim, which owns a combined 58.6% through subsidiaries Fincem Holding Ltd and Kencem Holding Ltd. Holcim’s decision to exit African markets is in line with their portfolio optimization strategy rolled out in 2015 after merging with Lafarge.

Bamburi Cement is listed at the Nairobi Securities Exchange under the ticker symbol BAMB. The counter closed today’s trading session at KSh 77.52, an 116.2 percent year to date gain.