BOC Kenya Limited an NSE listed company engaged in the manufacture and sale of industrial gases, medical gases and welding products issued a profit warning expecting its full year 2017 net earnings to be at least 25% lower than the previous financial year.

The company’s have year 2017 results have also mirrored this profit warning as it saw the manufacturer make a net profit of KES 42.7 million which was 37.3% lower than the HY2016 which it made KES 68.1 million. The company saw the loss of a major public sector hospital tender in the first half of the year that weighed down on revenues by 4.5%.

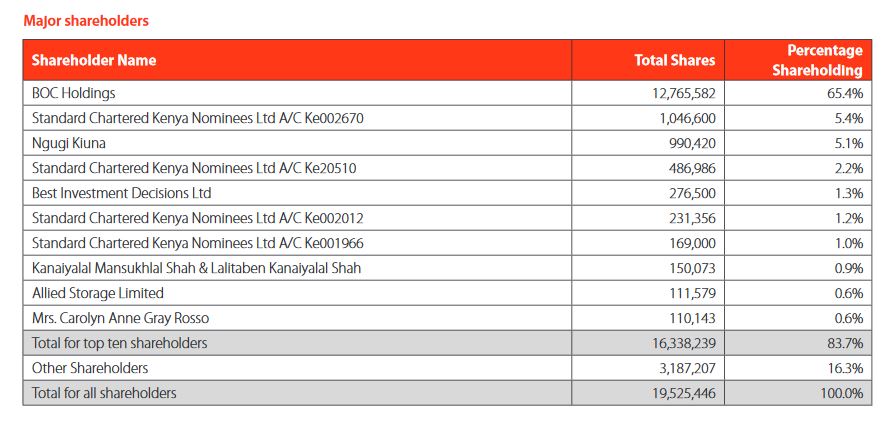

BOC’s largest shareholder is BOC Holdings that owns a 65.4% controlling stake of the company as at March 2017 which is related to the European company, Linde Group. The Chairman of the company Mr. Ngugi Kiuna owns a 5.1% stake.

On Wednesday (November 15, 2017) the counter was up by 6.8% touching a session high of KES 110.00 per share before closing at KES 108.00. It traded 6,200 shares. The counter is up by 31% on a year-to-date basis. The current 52 week trading range on the counter is KES 81.00 – 110.00.

Source: BOC Kenya, FT