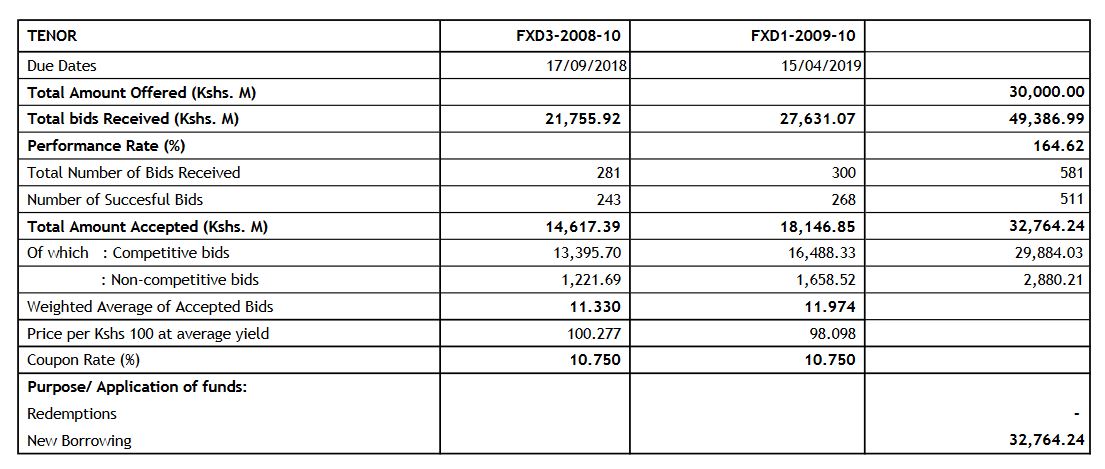

Kenya’s Central Bank in the month of April sought out Ksh 30 Billion from the market through two 10 Year Treasury Bonds FXD3-2008-10 and FXD1-2009-10. Total bids for the two bonds on offer came to Ksh 49.4 Billion. Total bids for the FXD3-2008-10 bond came in at 281 and the FXD1-2009-10 received 300 bids.

The Bank received a total of Ksh 32.8 billion from the Ksh 49.4 billion bids offered by investors. The amount accepted on the FXD3-2008-10 Bond was Ksh 14.6 billion and Ksh 18.1 Billion on the FXD1-2009-10 Bond. The bonds have a coupon of 10.75%

The total funds raised will be used as new borrowings.

Source: Central Bank of Kenya