Atlas Industries has announced the disposal of its flagship Ethiopian glass making subsidiary to two existing shareholders, effectively leaving the company without any assets.

The disposal comes after failed attempts to recover Sh 247 Million that was summarily removed from Atlas and its Ethiopian subsidiary, TEAP Glass PLC bank account with the Development Bank of Ethiopia over claims of Tax Evasion.

The troubled firm was recently suspended from trading at the Nairobi Securities Exchange and the London Stock Exchange.

At the same time, I&M Burbidge Capital Limited, the Company’s Kenyan nominated adviser, has given notice of termination of its engagement with the Company, such notice to expire on 29 May 2017. However, Burbidge Capital will continue to provide un‐remunerated co‐ordination during this managed and controlled wind‐down process of the group.

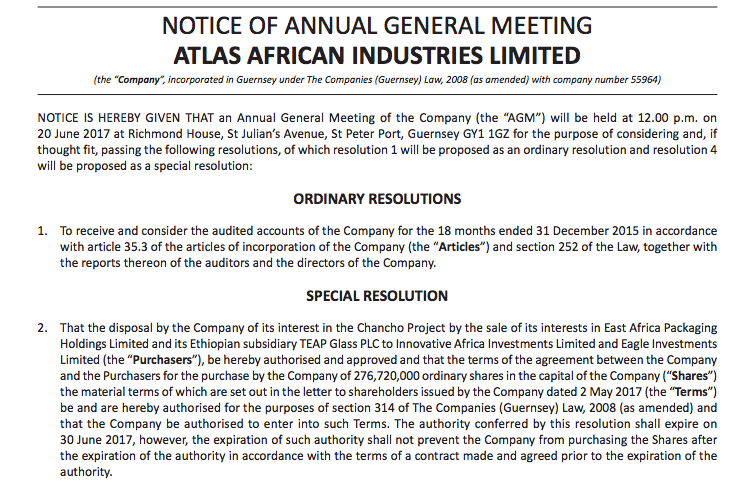

The company’s Annual General Meeting will be held at 12.00 p.m. on 20 June 2017 at Richmond House, St Julian’s Avenue, St Peter Port, Guernsey GY1 1GZ.

Related;

Nairobi Securities Exchange Suspends Trading Of Atlas Shares After CMA Order

Atlas To Sell Its Flagship Ethiopian Glass bottle Project

Atlas Acquires stake in Nigerian based Online Sports Betting company

Ethiopian Revenue Authority Withdraws Ksh 240M from ATLAS Bank Accounts Over Tax Evasion Claims