Payments Giant Ant Group is planning to set the world record in its upcoming IPO, which will raise over $34.5 billion. The online payments company priced its shares in the Hong Kong Stock exchanges at 80 Hong Kong Dollars ($10.32) and its Shanghai stock at 68.8 yuan ($10.27).

According to filings, the company will have a market value of $315 billion, surpassing banking giants like Goldman Sachs and Wells Fargo. The valuation could reach $320 billion if the company exercises its $5.17 billion over-allotment ‘greenshoe’ options in shanghai and HongKong.

The listing will break the current IPO record set by Saudi Oil Giant Aramco, which raised $29.4 billion in its record IPO in January. Aramco was expected to raise $26 billion in listing in the Riyadh stock exchange. Bloomberg reports that investors subscribed for over 76 billion shares during the preliminary price consultation of the Shanghai listing.

READ ALSO: Saudi Aramco to Raise $25.6 Billion in Biggest IPO Ever

Ant Group will offer 1.67 billion shares on the Shanghai stock exchange and a similar amount on the Hong Kong exchange. China International Capital Corp (CICC) and CS Financial Co will lead the Shanghai listing while Morgan Stanley, Citi Group, JP Morgan and CICC will head the Hong Kong listing.

Ant Group will start trading in the Hong Kong Stock Exchange on November 5, awaiting to confirm the initial trading date in the Shanghai bourse.

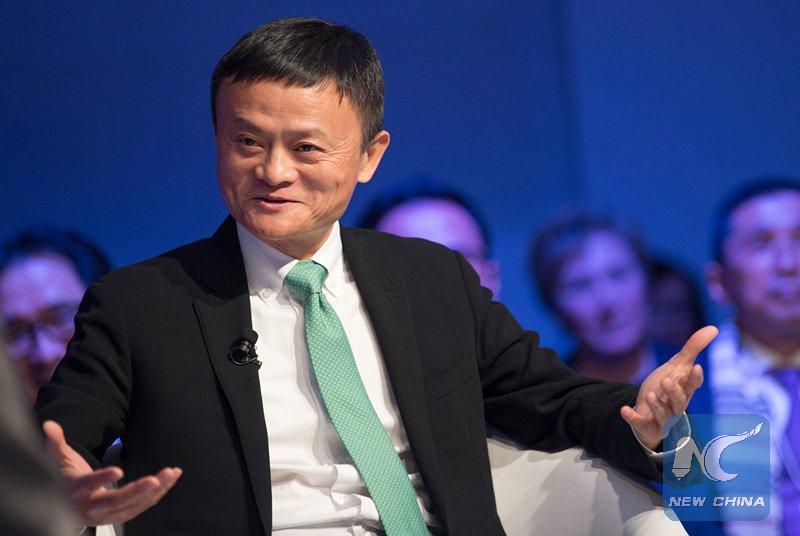

Ant Group’s IPO is another win for Jack ma, who set a record listing in Alibaba’s $25 billion listing on the New York Stock Exchange. Ma’s e-commerce giant owns 32% of Ant Group. Alibaba will own 730 million shares of the Shanghai shares.

A record listing outside the US will mean will also boost confidence in Chinese stock markets, as well as provide for a refuge for Chinese companies to avoid uncertainties of the Sino-American conflict.