Editor’s Note: This is an abridged version of a full analysis of Kenya’s economic and business prospects for 2024. Read the full analysis here (PDF).

In 2023, the Kenyan government implemented radical fiscal policy changes on taxation, public spending, government operations and public debt management.

- •The radical changes were meant to narrow the fiscal deficit that was under pressure due to low tax yields, rising debt service obligations and spending pressures.

- •The economy was also struggling with low productivity, high unemployment, balance of payment pressures and a cost-of-living crisis.

- •The economic situation was caused by a combination of geopolitical shocks, tight financial markets, climate crisis, global inflation, and internal missteps in public finance management.

Between 2013 and 2022, the government had operated an average budget deficit to GDP ratio of -6.8% to fund infrastructure projects. Government financed the deficit primarily using, both domestic and foreign debt. As a result, the public debt to GDP ratio increased from 44% in 2013 to an estimated 73% in 2023.

- •Debt servicing ratio (debt repayments/tax revenue) grew from 36% in 2013/14 fiscal year to an estimated 75% in 2023/2024 fiscal year.

- •According to central bank data, 53% of the current Kshs. 10.5 trillion public debt is foreign currency debt meaning any local currency depreciation adds more pressure to future debt servicing obligations.

- •Tax yields (tax revenue/GDP) on the other hand have been dwindling, declining from 16.2% in 2013 to 14.1% in 2023, meaning revenue collections has not kept pace with economic expansion.

The reality of debt servicing is now catching up with the government. 77% of its ordinary revenue in this fiscal year will go to debt service obligations. With a poor risk profile combined with uncertainties in the financial markets, the government is finding it difficult to refinance the debts that are falling due in a sustainable fashion.

Key Risks to the Transition

- •Public resistance-Transitions are often difficult and painful, especially to citizens who fund them. If policy makers don’t handle public relations well, citizens may act through public protest, litigations, civil unrest and even tax evasion & avoidance.

- •Lack of fiscal discipline- Kenya government officials and politicians have a reputation of being wasteful and unethical when managing public funds. This tends to erode trust and goodwill that citizens have given the government. It also diverts resources from the intended use leading to slow to no progress.

- •External shocks- As we observed during the Covid crisis and during the Russia-Ukraine conflict, external shocks can disrupt economies greatly. This remains a key risk to our economy.

Business Performance in 2023

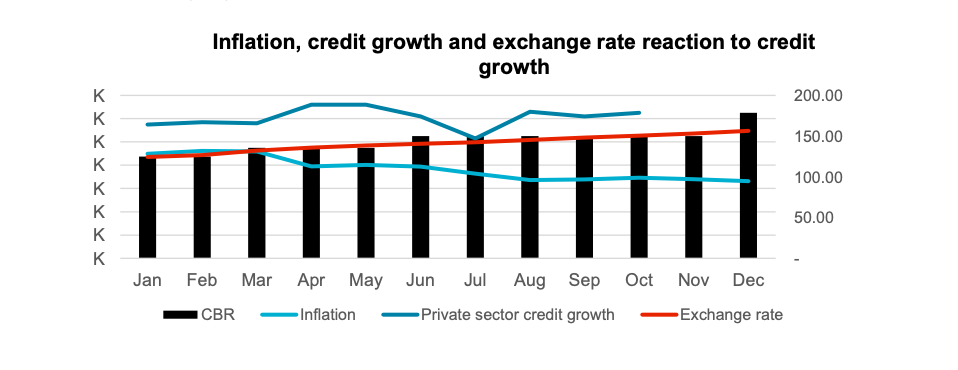

Depending on what economic metric/ indicator you look at, you are likely to make different conclusions on how the business environment faired in 2023. A double-digit growth in 2023 private sector credit for instance may give an indication of improving business conditions. On the other hand, sentiments by respondents through the Purchasers Managers Index (PMI) survey collected throughout 2023 indicate difficult business conditions.

Another case is the Q3 2023 GDP data which reports that the financial services sector grew by 14.7%, a very robust growth given that it was the second fastest growing sector after tourism. On the other hand, the combined market capitalization of the Banking and Insurance sectors indicate that the sector declined by 13.2%. It is therefore difficult to make an informed decision on business performance purely based on Macro indicators.

To understand the health of businesses in the country, it is important to identify, analyse and interpret the right signals. They may not necessarily represent all businesses and industries, but they give an indication of overall business activities. For our case, we look for signals that give us an indication of business productivity, consumer demand and disposable incomes.

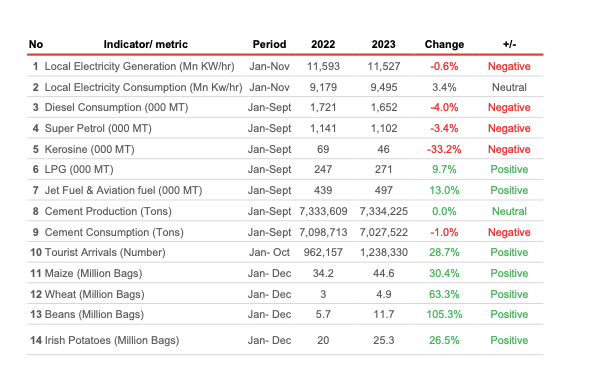

- •Electricity production & consumption- In the first eleven months of 2023, Kenya generated 11.5 billion KW/hr of electricity which was a 0.6% decline from a similar period in 2022. Electricity consumption on the other hand improved slightly by 3.4% over the same period. The two metrics indicate that both producers and consumers did not increase their activities during the year, signalling minimal growth in economic activity.

- •Fuel consumption- Diesel, Super and Kerosine consumption declined in the first 9 months of 2023 by 4%, 3.4% and 33.2% respectively. This signals reduced movements, low production and low consumption all indicating low to muted economic activity during the year. Consumption of LPG and Jet fuel increased during the year. The increase in LPG consumption signals a shift by users to cleaner energy solutions while the increase in Jet fuel consumption signals increased activity in the tourism sector.

- •Cement Production & Consumption- The first nine months of 2023 indicate stagnation in the production and consumption of cement, indicating muted investment activities (capital formation). This may signal a decline in future production.

- •Tourist arrivals- The first ten months of 2023 saw a 29% increase in the number of tourist arrivals through our main airports, signalling a vibrant tourism sector in 2023.

- •Food Production- Following good rainfall during both the 2023 long and short rain season, the ministry of agriculture estimates that food production will grow by strong double-digit figures. Maize is expected to grow by 30%, Wheat 63%, beans 105% and Irish potatoes by 27%. Increased food production signals an improvement in future disposable incomes since producers get higher incomes and consumers get lower prices. It is also an indicator of lower inflation in the near future.

- •Overall, 2023 was a year characterised by high input and output prices for most businesses which may have led to low to muted output levels. The high prices were driven mainly by increased food prices, high energy costs, depreciating shilling and higher taxes. The same factors also dampened demand from consumers, leading to lower orders. Things improved as the year progressed as food prices started trending downwards, which was a positive for consumption.

- •Fuel prices also stabilised towards the end of the year, giving further reprieve to both consumers and producers. Currency depreciation, high electricity costs and high taxes remained a bother to businesses and households as they both increased production costs, while reducing disposable incomes of consumers. As our indicators show, sectors like hospitality and agriculture enjoyed a good year while others like manufacturing and construction struggled to maintain prior levels of production.

2024 OUTLOOK

We expect the improvement in food production towards the end of 2023 to have positive ripple effects going into 2024. High production leads to lower food prices which translate to improved disposable incomes for households. This may spark a rebound in consumer demand.

Increased food production also means more and cheaper inputs for manufacturers which will in turn boost production. On that front we expect to see improved production across industries in the first quarter of 2024. We expect manufacturing and construction sectors to enjoy the improved consumer demand even as other sectors like agriculture and hospitality continue to thrive.

Opportunities

The country is undergoing an economic transition that will change the way government, households & businesses interact with each other. Current economic realities are opening new opportunities while closing old ones. It is important that businesses adapt early to increase their chances of surviving. Below are a few of the areas we see new opportunities going into 2024.

- •First, we expect to start to see government expenditure slowly having less impact on local markets. Businesses with high reliance on government related business should start diversifying their markets to private entities and individuals.

- •Secondly, with rising input costs, local businesses will start investing in new production models aimed at improving the competitiveness of their products. Households will also start to demand cheaper and efficient energy solutions in response to the high cost of energy.

- •Third, new markets for Kenyan products & services have started to emerge outside our borders as the depreciating shilling has made locally made products cheaper to oversees clients. Businesses should start marketing their products overseas. With improvements in cross border logistical solutions, exporting local products is now possible through ecommerce platforms. Service providers can take advantage of internet powered communication to offer services anywhere in the world.

- •Fourth, financial markets are poised to get a government driven ‘market cap injection’ following introduction of the new privatisation policy. Financial market participants can take advantage of the expected wave of IPOs to attract new clients while expanding options for existing clients.

- •Fifth, businesses should start negotiating with oversees suppliers for alternative trading currencies to the dollar. They should also explore possibilities of changing their country sources of inventory/ raw materials to minimise exposure to dollar fluctuations.

- •Lastly on taxes, businesses should engage the services of tax professionals to explore the best ways of ensuring they are tax compliant without exposing their businesses to unnecessary tax bills.

Ruriga Kimani is a seasoned Business Analyst and Consultant specializing in economics and finance. His expertise lies in financial analysis, strategic planning, and effective risk assessment.