First Published on February 6th, 2023 by Bob Ciura for SureDividend

Income investors are always on the hunt for high-quality dividend stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of all 151 Dividend Champions.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

While their length of dividend increases is the same, leading to some overlap, there are also some important differences between the Dividend Aristocrats and Dividend Champions. As a result, the Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

This article will discuss large cap stocks, and an analysis of our top 7 Dividend Champions, ranked according to expected total returns in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

- •Overview of Dividend Champions

- •Top Dividend Champion #7: Carlisle Companies (CSL)

- •Top Dividend Champion #6: 3M Company (MMM)

- •Top Dividend Champion #5: Albemarle Corporation (ALB)

- •Top Dividend Champion #4: Westamerica Bancorp (WABC)

- •Top Dividend Champion #3: Sanofi SA (SNY)

- •Top Dividend Champion #2: Sonoco Products (SON)

- •Top Dividend Champion #1: V.F. Corp. (VFC)

Overview of Dividend Champions

The requirement to become a Dividend Champion is simple: 25+ years of consecutive annual dividend increases. The Dividend Aristocrats have the same requirement when it comes to number of years, but with a few additional requirements.

To be a Dividend Aristocrat, a company must also be included in the S&P 500 Index, must have a float-adjusted market cap of at least $3 billion, and must have an average daily value traded of at least $5 million. These added requirements preclude many companies that possess a sufficient track record of annual dividend increases, but do not qualify based on market cap or liquidity reasons.

As a result, while there is some overlap between the Dividend Aristocrats and the Dividend Champions, there are also many Dividend Champions that are not Dividend Aristocrats. Income investors might want to consider these stocks due to their impressive histories of annual dividend increases, so we have compiled them in the downloadable spreadsheet above.

In addition, we have ranked the top 7 Dividend Champions according to total expected annual returns over the next five years. Our top 7 Dividend Champions right now are ranked below.

The Top 7 Dividend Champions To Buy Right Now

The following 7 stocks represent Dividend Champions with at least 25 consecutive years of dividend increases, but they also have durable competitive advantages, long-term growth potential, and high expected total returns.

Stocks have been ranked by expected total annual return over the next five years, from lowest to highest.

Top Dividend Champion #7: Carlisle Companies (CSL)

- •5-year expected returns: 13.4%

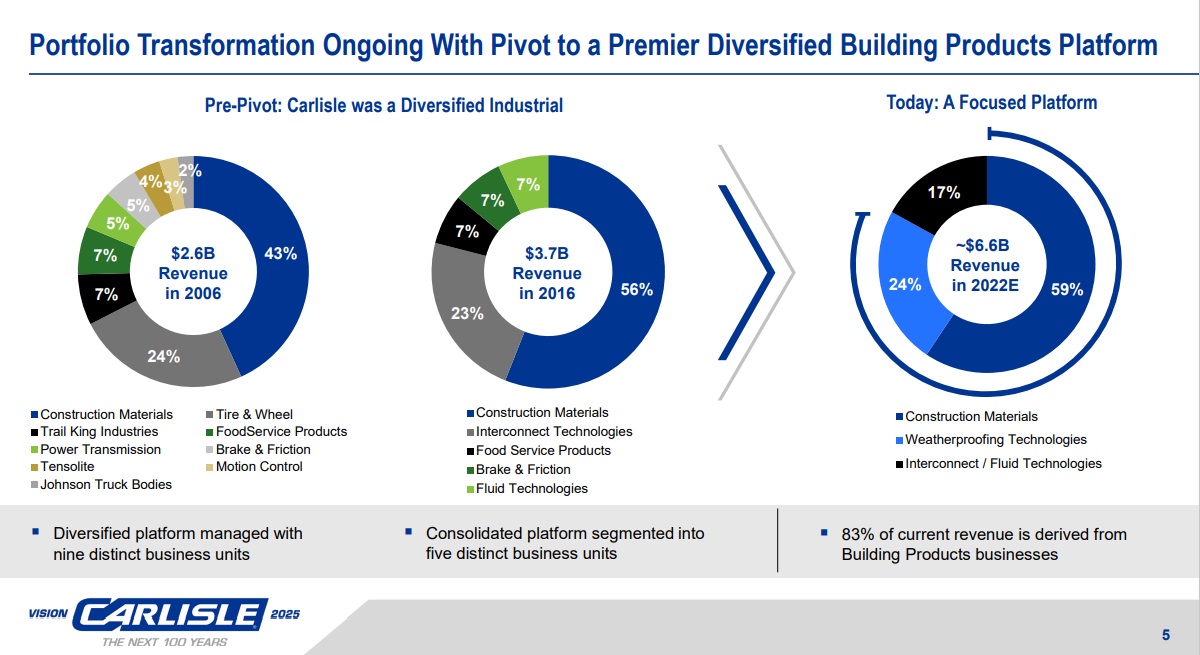

Carlisle Companies is a diversified company that is active in a wide array of niche markets. The segments in which the company produces and sells products include construction materials (roofing, waterproofing, etc.), interconnecting technologies (wires, cables, etc.), fluid technologies, and brake & friction.

Source: Investor Presentation

Carlisle Companies reported its third quarter earnings results on October 27. Revenues of $1.79 billion grew 37% year-over-year, and were in line with analyst estimates. Earnings-per-share of $5.66 beat the consensus analyst estimate by $0.23. Carlisle Companies’ earnings-per-share were up 89% from the previous year, thanks to higher margins and the higher revenues the company generated during the quarter.

Cost-saving measures that were started during 2020 were responsible for some of the margin improvement, and share repurchases also had a positive impact on the company’s earnings-per-share growth rate during the period.

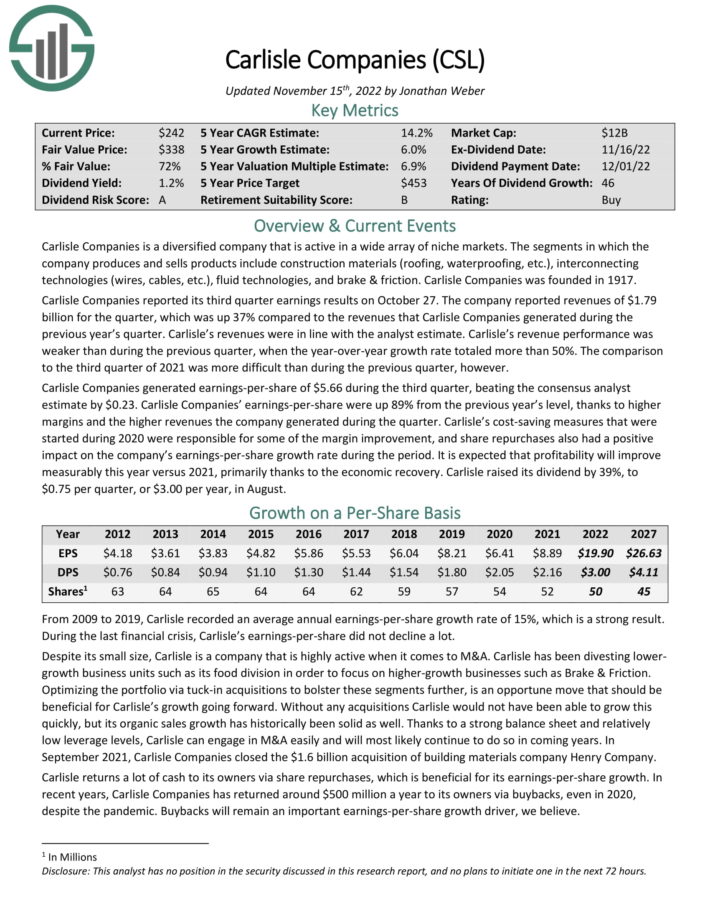

Click here to download our most recent Sure Analysis report on CSL (preview of page 1 of 3 shown below):

Top Dividend Champion #6: 3M Company (MMM)

- •5-year expected returns: 13.6%

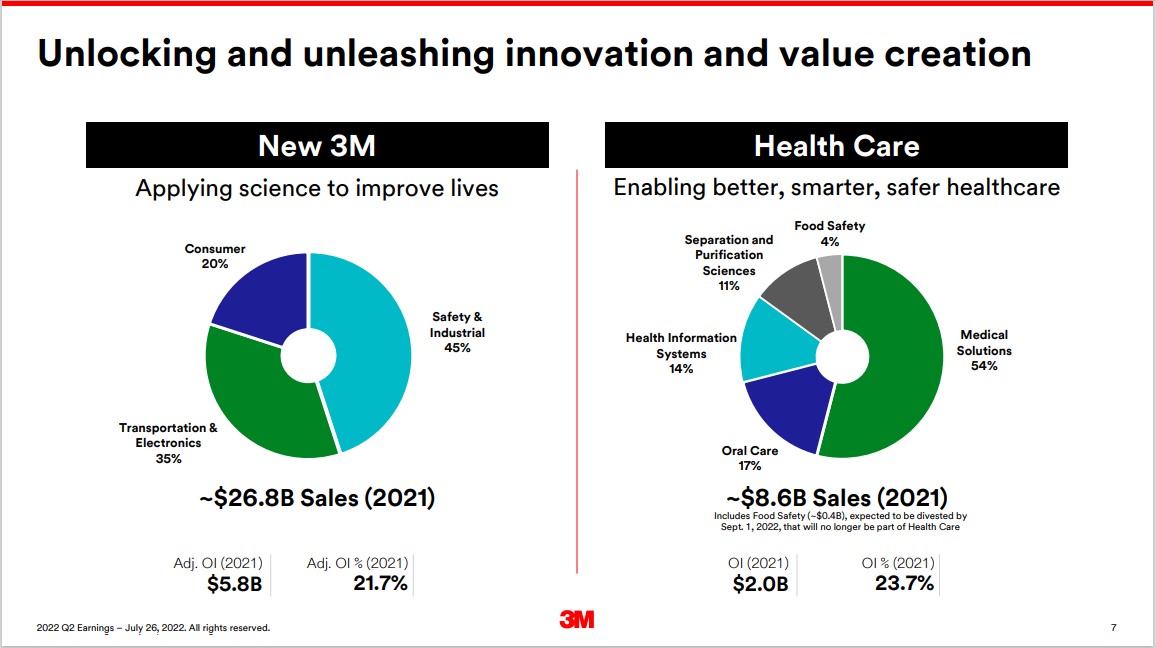

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000employees and serves customers in more than 200 countries.

3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs.

The Consumer division sells office supplies, home improvement products, protective materials and stationary supplies.

Source: Investor Presentation

The company also announced that it would be spinning off its Health Care segment, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

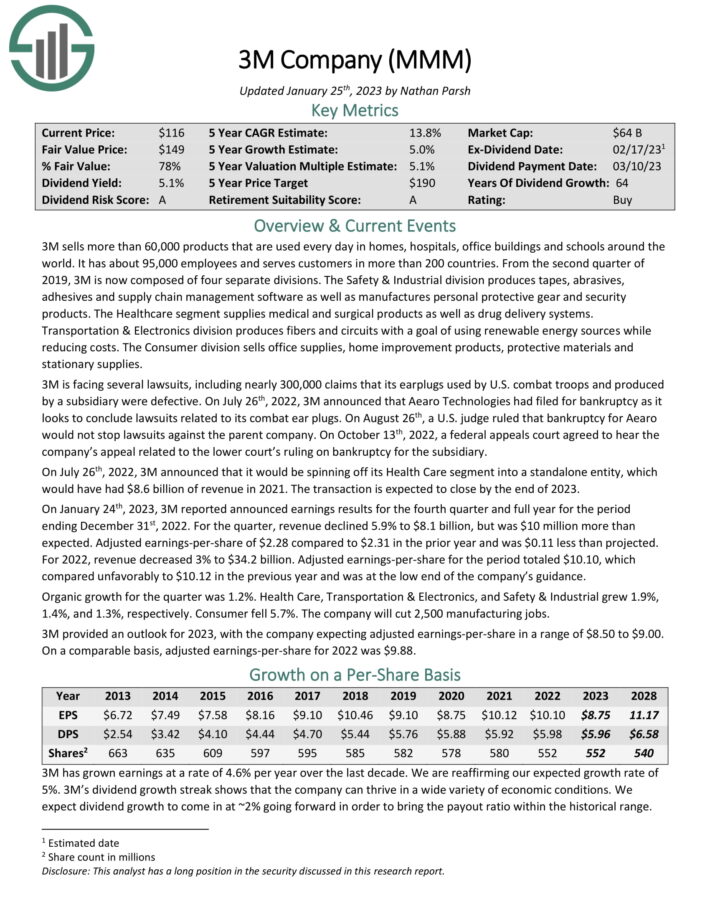

On January 24th, 2023, 3M reported announced earnings results for the fourth quarter and full year for the period ending December 31st, 2022. For the quarter, revenue declined 5.9% to $8.1 billion, but was $10 million more than expected. Adjusted earnings-per-share of $2.28 compared to $2.31 in the prior year and was $0.11 less than projected.

For 2022, revenue decreased 3% to $34.2 billion. Adjusted earnings-per-share for the period totaled $10.10, which compared unfavorably to $10.12 in the previous year and was at the low end of the company’s guidance.

Organic growth for the quarter was 1.2%. Health Care, Transportation & Electronics, and Safety & Industrial grew 1.9%, 1.4%, and 1.3%, respectively. Consumer fell 5.7%. The company will cut 2,500 manufacturing jobs. 3M provided an outlook for 2023, with the company expecting adjusted earnings-per-share in a range of $8.50 to $9.00.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

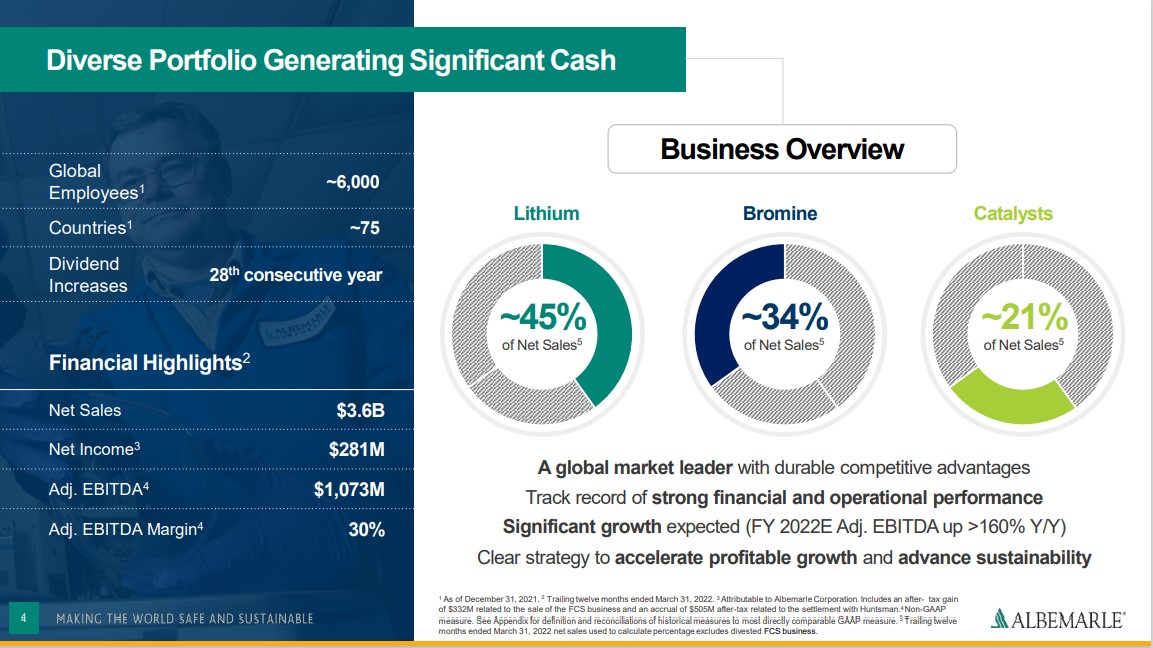

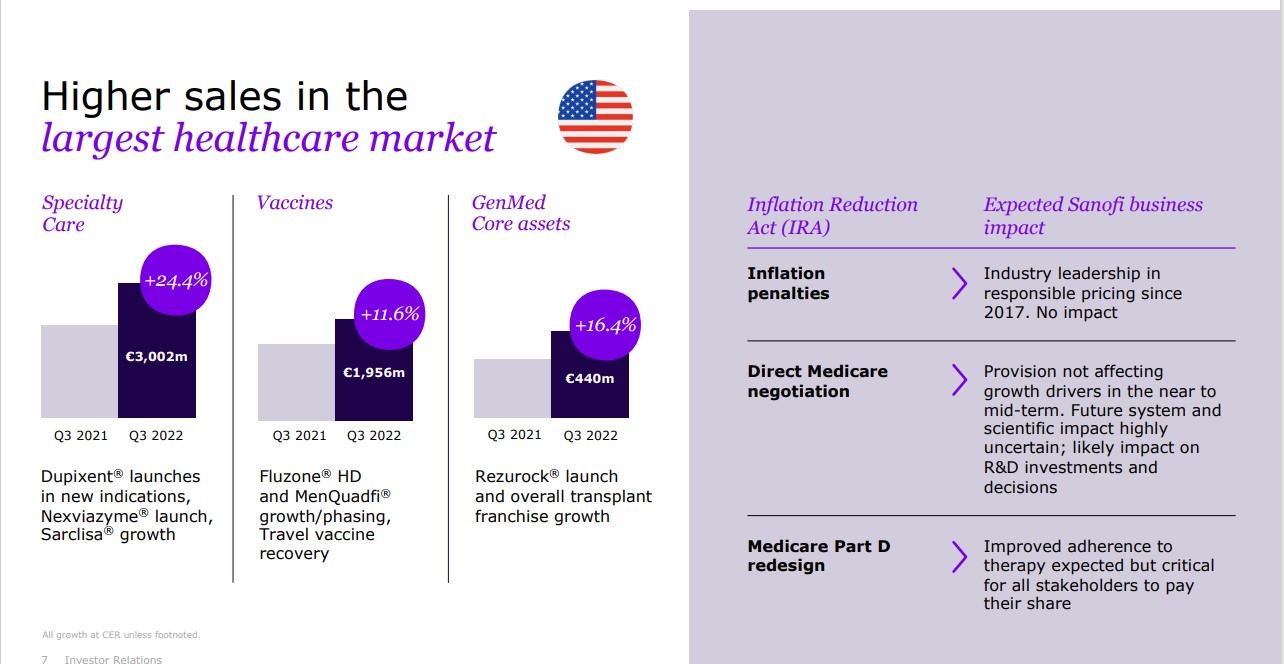

Top Dividend Champion #5: Albemarle Corporation (ALB)

- •5-year expected returns: 13.7%

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile. The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium.

Related: 2022 Lithium Stocks List

The company operates in nearly 100 countries and is composed of four segments: Lithium & Advanced Materials (49% of sales), Bromine Specialties (21% of sales), Catalysts (21% of sales) and Other (9% of sales). Albemarle produces annual sales of more than $7.5 billion.

Source: Investor Presentation

Albemarle produces annual sales of $7.3 billion. It is one of the top lithium stocks.

On November 2nd, 2022, Albemarle announced third quarter results. Revenue grew 151.6% to $2.09 billion, but was $120 million less than expected. Adjusted earnings-per-share of $7.50 compared very favorably to $1.05 in the prior year and was $0.51 above estimates.

Revenue for Lithium was higher by 318% to $1.5 billion, due to a 298% improvement in pricing and a 20% increase in volume due to the completion of an expansion in the company’s operations in Chile and higher customer demand. The company expects volume growth to be in a range of 20% to 30% for the year.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

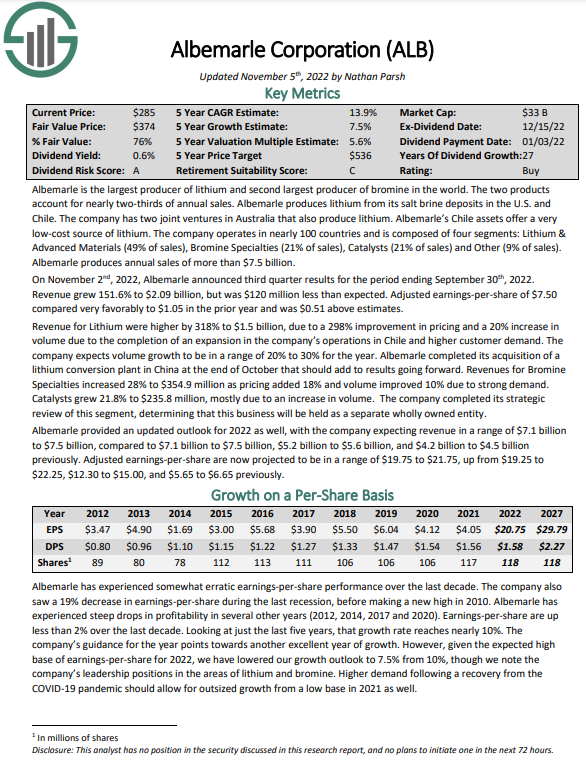

Top Dividend Champion #4: Westamerica Bancorp (WABC)

- •5-year expected returns: 15.2%

Westamerica Bancorporation is the holding company for Westamerica Bank. Westamerica is a regional community bank with 79 branches in Northern and Central California. The company can trace its origins back to 1884. Westamerica offers clients access to savings, checking and money market accounts.

The company’s loan portfolio consists of both commercial and residential real estate loans, as well as construction loans. Westamerica is the seventh largest bank headquartered in California. It has annual revenues of nearly $270 million.

On January 19th, 2023 Westamerica reported fourth quarter and full year earnings results. Revenue grew 47.6% to $79.6 million while GAAP earnings-per-share of $1.46 compared to $0.81 in the prior year. For 2022, revenue improved 23% to $267 million while earnings-per-share of $4.54 compared favorably to $3.22 in the previous year.

As of the end of the quarter, nonperforming loans totaled $774 million, down 25% year-over-year and lower by 20% from the third quarter of the year. Provisions for credit losses totaled $20.3 million, a decrease of 13.7% from the prior year and down 4.2% sequentially. Total loans fell 12.2% to $964 million, mostly due to a steep decline in Paycheck Protection Program (PPP) loans.

Net interest income was $69.2 million, which compares to $60.8 million for the third quarter of 2022 and $43.1 million in the fourth quarter of 2021. Average total deposits were unchanged at $6.3 billion. Analysts expect that the company will earn $5.98 in 2023.

The company has a long history of paying dividends and has increased its payout for 29 consecutive years. Shares currently yield 3%. We expect 2% annual EPS growth, while the stock also appears to be significantly undervalued. Total returns are estimated at 15.2% per year.

Click here to download our most recent Sure Analysis report on WABC (preview of page 1 of 3 shown below):

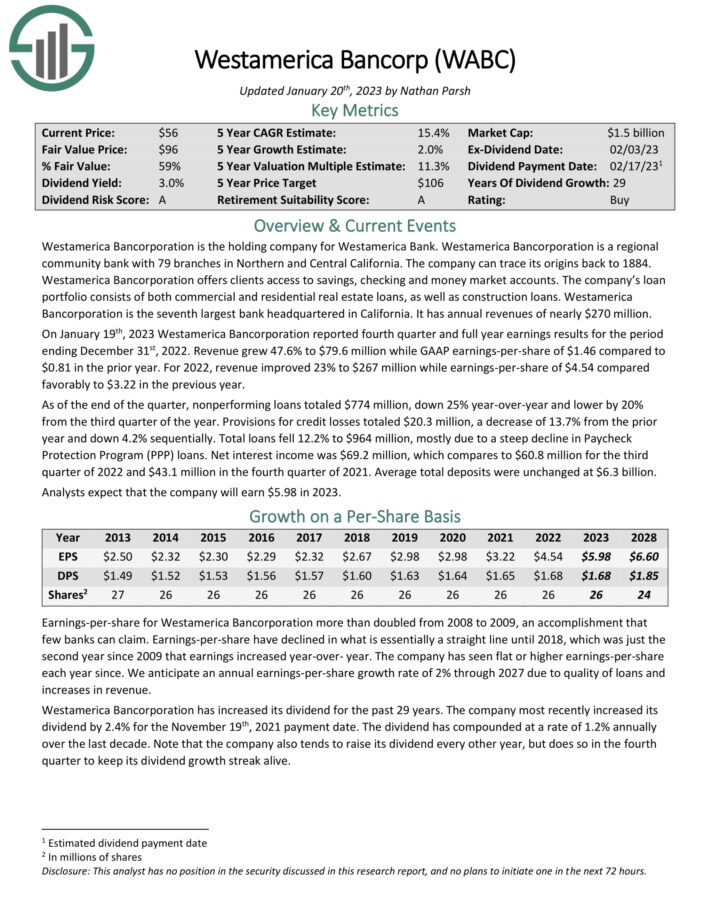

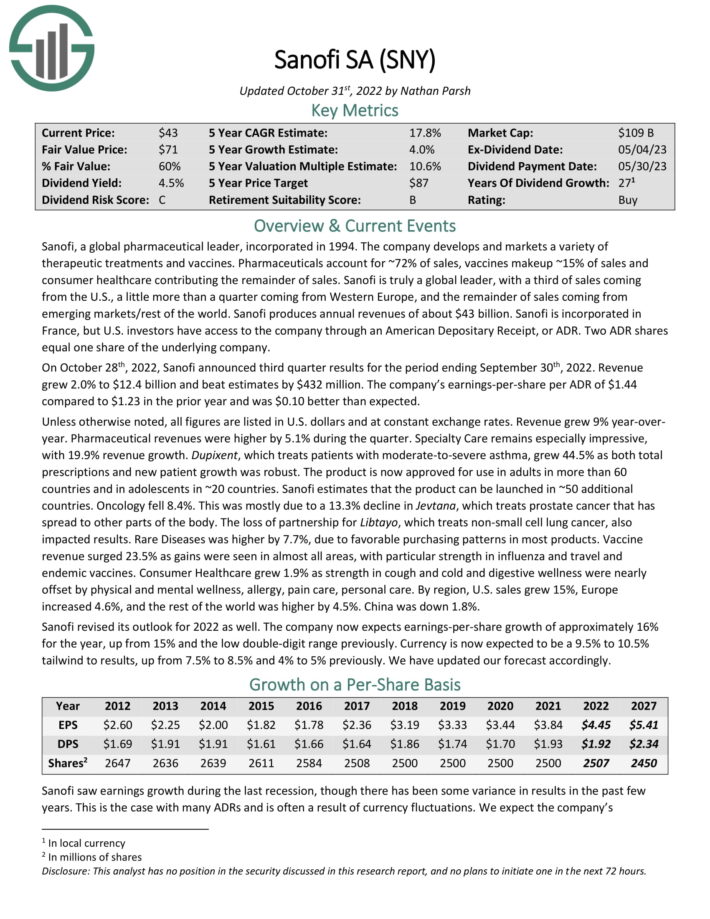

Top Dividend Champion #3: Sanofi SA (SNY)

- •5-year expected returns: 16.1%

Sanofi develops and markets a variety of therapeutic treatments and vaccines. Pharmaceuticals account for ~72% of sales, vaccines makeup ~15% of sales and consumer healthcare contributing the remainder of sales. Sanofi produces annual revenues of about $43 billion. Sanofi is incorporated in France, but U.S. investors have access to the company through an American Depositary Receipt, or ADR. Two ADR shares equal one share of the underlying company.

On October 28th, 2022, Sanofi announced third quarter results for the period ending September 30th, 2022. Revenue grew 2.0% to $12.4 billion and beat estimates by $432 million. The company’s earnings-per-share per ADR of $1.44 compared to $1.23 in the prior year and was $0.10 better than expected.

The U.S. was a particularly strong market for the company:

Source: Investor Presentation

Revenue grew 9% year-over-year. Pharmaceutical revenues were higher by 5.1% during the quarter. Specialty Care remains especially impressive, with 19.9% revenue growth.

Rare Diseases was higher by 7.7%, due to favorable purchasing patterns in most products. Vaccine revenue surged 23.5% as gains were seen in almost all areas, with particular strength in influenza and travel and endemic vaccines. Consumer Healthcare grew 1.9% as strength in cough and cold and digestive wellness were nearly offset by physical and mental wellness, allergy, pain care, personal care.

By region, U.S. sales grew 15%, Europe increased 4.6%, and the rest of the world was higher by 4.5%. China was down 1.8%. Sanofi revised its outlook for 2022 as well. The company now expects earnings-per-share growth of approximately 16% for the year, up from 15% and the low double-digit range previously.

Click here to download our most recent Sure Analysis report on Sanofi (preview of page 1 of 3 shown below):

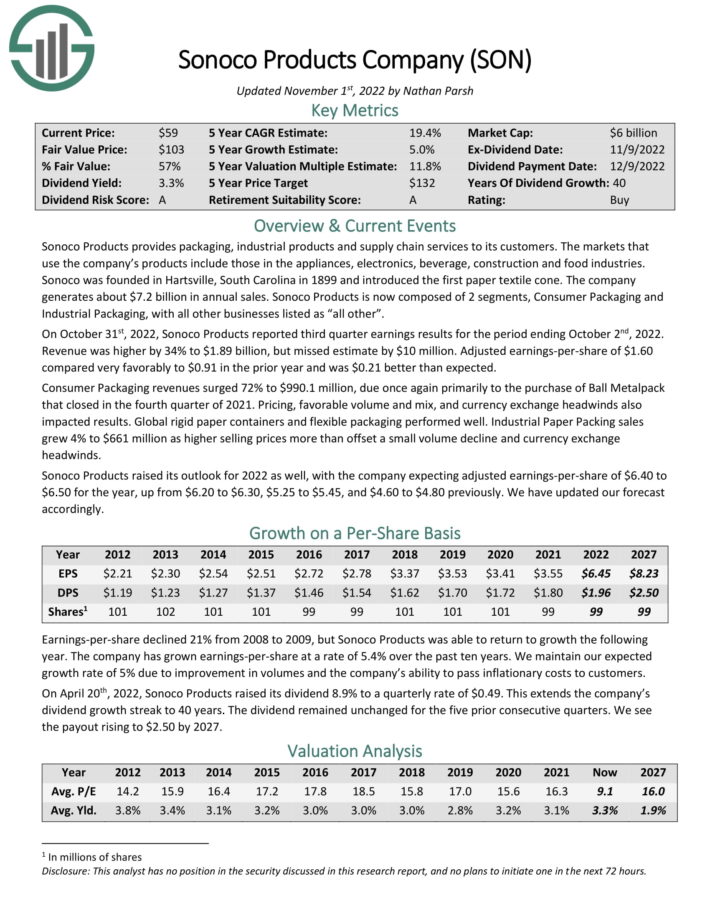

Top Dividend Champion #2: Sonoco Products Company (SON)

- •5-year expected returns: 18.2%

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries. The company generates about $7.2 billion in annual sales.

Sonoco Products is now composed of 2 core segments, Consumer Packaging and Industrial Packaging, with all other businesses listed as “all other”.

Source: Investor Presentation

On October 31st, 2022, Sonoco Products reported third quarter earnings results for the period ending October 2nd, 2022. Revenue was higher by 34% to $1.89 billion, but missed estimate by $10 million. Adjusted earnings-per-share of $1.60 compared very favorably to $0.91 in the prior year and was $0.21 better than expected.

Consumer Packaging revenues surged 72% to $990.1 million, due once again primarily to the purchase of Ball Metalpack that closed in the fourth quarter of 2021. Pricing, favorable volume and mix, and currency exchange headwinds also impacted results. Global rigid paper containers and flexible packaging performed well. Industrial Paper Packing sales grew 4% to $661 million as higher selling prices more than offset a small volume decline and currency exchange headwinds.

Sonoco Products raised its outlook for 2022 as well, with the company expecting adjusted earnings-per-share of $6.40 to $6.50 for the year, up from $6.20 to $6.30.

Click here to download our most recent Sure Analysis report on SON (preview of page 1 of 3 shown below):

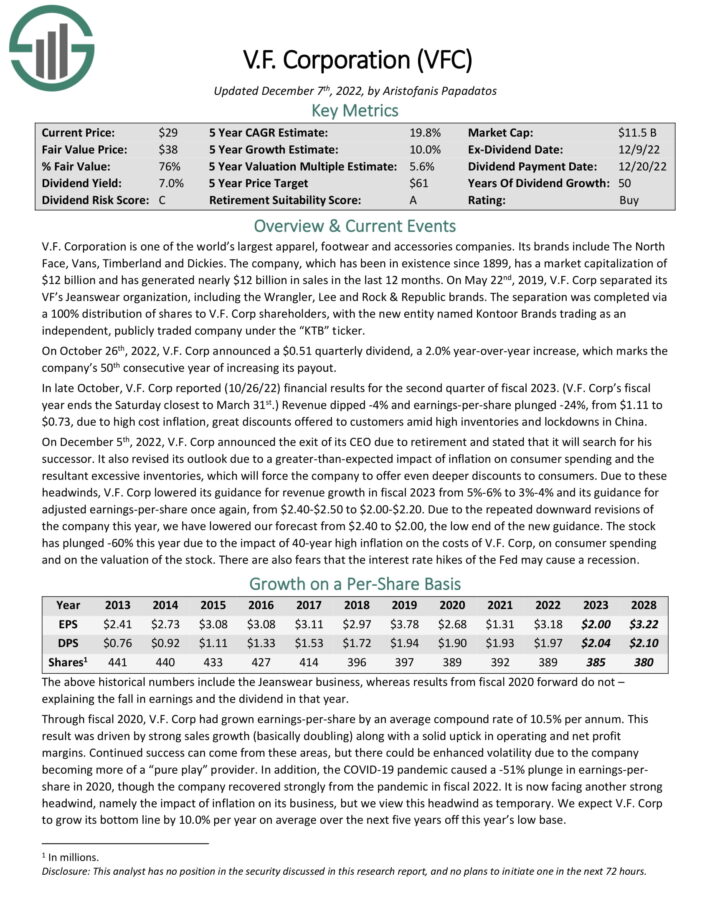

Top Dividend Champion #1: V.F. Corp. (VFC)

- •5-year expected returns: 18.5%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last 12 months.

On October 26th, 2022, V.F. Corp announced a $0.51 quarterly dividend, a 2.0% year-over-year increase, which marks the company’s 50th consecutive year of increasing its payout.

In late October, V.F. Corp reported (10/26/22) financial results for the second quarter of fiscal 2023. (V.F. Corp’s fiscal year ends the Saturday closest to March 31st.) Revenue dipped -4% and adjusted earnings-per-share plunged -24%, from $1.11 to $0.73, due to high cost inflation, great discounts offered to customers amid high inventories and lockdowns in China.

We expect 7% annual EPS growth over the next five years. VFC stock also has a dividend yield of 7.0%. Annual returns from an expanding P/E multiple are estimated at ~5.4%, equaling total expected annual returns of 19.4% through 2027.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks.

In order for a company to raise its dividend for at least 25 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries.

They also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 7 Dividend Champions presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Top 10 Highest Yielding Dividend Champions | Yields Up To 8.4%

What Are The Dividend Achievers, Contenders, Aristocrats, Champions and Kings