Airtel Money’s market share rose slightly from 6.6% in the final quarter of 2023/2024 to 7.6% in three months to September 2024, according to sector statistics from the Communications Authority (CA).

- •Safaricom’s M-Pesa retained its dominance in the mobile money market but its market share slipped marginally from 93.4% in the June 2024 to 92.3% in September 2024.

- •Safaricom maintains its lead in mobile sim subscriptions with 65.7% in market share while Airtel has 29.6% market share, both networks recording slight decimal growth compared to the preceding quarter.

- •Finserve (Equitel) mobile sim subscriptions overtook Telkom Kenya and Jamii Networks, recording 2.1% of the market share while its rivals took 1.7% and 0.9% in market share respectively.

In the Q4 2023/2024 statistics, CA statistics showed Telkom and Equitel at par with 2.1% market share, while Jamii’s market share has remained unchanged.

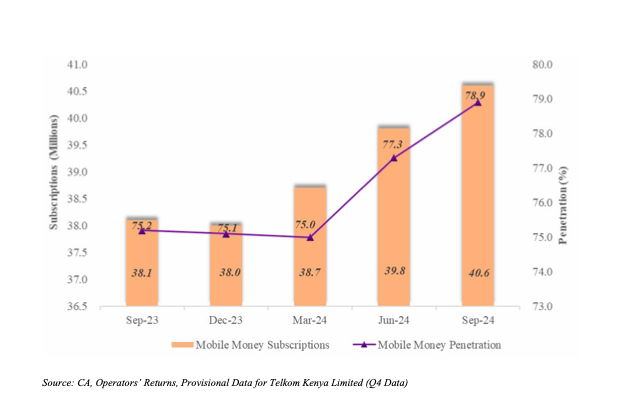

Overall mobile money subscriptions in Kenya crossed the 40 million mark in September 2024, growing by 2% from 39.8 million in June 2024. The number of mobile money agents across the country grew by 5.1% from 347,699 in June 2024 to 365,432 in September last year.

In the latest data, the total number of mobile phone devices connected to mobile networks was 68.1 million, a penetration rate of 132.2%. Smartphones took the lead with a penetration of 72.6%, followed by feature phones which had a penetration rate of 59.6%.

The mobile money services remain central to the revenue growth of telcos in Kenya. In Safaricom’s half-year results, M-Pesa’s revenues rose 16.6% to KSh 77.2 billion in the 6 months to September driven by increased customer usage. M-Pesa agents increased to 266,070 across the country. In the latest Airtel’s financial report, mobile money in its East African units grew by 31.4%, illustrating the immense potential for growth in the sector.

At the close of 2024, Airtel Money agents were estimated to be around 90,000 across Kenya. The service also eyed key partnerships with major retailers like Naivas and Moja Expressway to broaden their reach.