Africa’s financial markets have expanded at the fastest pace since 2017 due to the overall recovery of economies bouncing back from global shocks, according to a survey by Absa Group.

- •The widespread and long-term progress made in developing financial markets, despite the global shocks experienced in recent years, bodes well for Africa’s resilience and investment prospects.

- •Out of the 29 countries on the scope of the Absa Group Africa Financial Markets Index (AFMI), 23 countries saw their overall scores increase.

- •The increase is attributed to increases in the value of pension fund assets, foreign exchange reserve adequacy, improved macroeconomic conditions with inflation softening across the continent in the past year – excluding Angola and Nigeria.

“This is a welcome respite after several difficult years during which the continent faced first the challenges of the global Covid-19 pandemic, then higher domestic inflation and financing costs,” Charles Russon, Absa Group CEO wrote in the report, “Debt restructuring in some African markets and worries about debt sustainability in many more have served to further interrupt Africa’s recovery.”

The increase in domestic market size, improved financial inclusion and upgrades to market infrastructure underpinned the overall performance. Absa group’s AFMI attributes the overall improvement to the structural developments to market infrastructure coupled with improved transparency regarding FX markets.

Advancing legal frameworks and the overall creditworthiness of corporates with solid monetary policy decisions were factors. New ESG issuances emerged in the past year ending June 2024 with the first listed green bonds introduced to the market in Cape Verde, Mauritius and Zambia. The first sustainable bond was issued in Botswana and a sustainability-linked bond in Rwanda.

The report noted that liquidity in interbank FX markets in Africa is limited, as convertibility risks between local and hard currencies deter foreign investors and inconsistent price discovery arises from restricted exchange rate flexibility. The lowest average score was on the prominence of local pension funds, at just 28, on account of the underdeveloped formal pension system.

The rise in external debt is concerning, with the IMF noting that 18 AFMI countries are at risk of debt distress, highlighting key areas for policymakers to support capital market growth.

Kenya’s Ranking Declines

The top five performers included South Africa, Mauritius, Nigeria, Uganda and Namibia. Laggards were Ethiopia, DRC, Lesotho, Madagascar and Angola. South Africa remained a leader with an overall score of 87 owing to the unrivaled deep, liquid and sophisticated and diversified advanced financial markets.

In addition to Angola and Nigeria, Kenya and Zimbabwe also saw a drop in their overall scores. Kenya ranked 8th among the 23 countries under review with a score of 57 – a percentage lower from 2023. This was primarily driven by weaker forex reserves during the review period, however boosted by the issuance of the first domestic Sukuk bond in July.

In terms of access to International capital, Kenya is making steps towards issuing Africa’s first sovereign sustainability – linked bond worth US$500 million in early 2025 in collaboration with the World Bank.

In new financial products, Kenya featured the Linzi Sukuk bond issued in 2023 as the first Islamic financial product in the country. It also launched the Dhow CSD in 2023, boosting market infrastructure to improve registry, custodial and settlement services for both primary and secondary securities market operations.

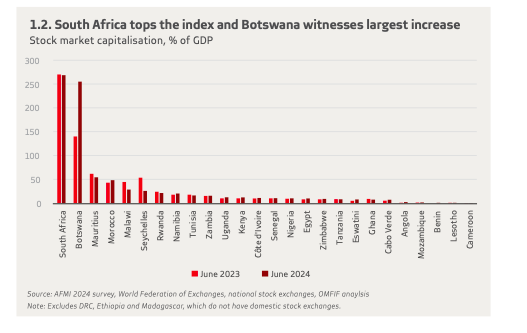

In terms of size, most countries saw their financial markets grow in the year to June 2024. About 17 countries increased their stock market capitalisation as a percentage of gross domestic product, while this share fell in nine countries.

Botswana’s stock market experienced the biggest rise in the year to June 2024 to 255% of GDP mainly driven by dual-listed large cap stocks ‘traded for the first time in decades’ leading to improved price discovery and a convergence with their international share price.