UAP Insurance Kenya recorded a 24% growth in Gross Written Premium to kes 13.18 billion from kes 10.61 billion recorded in 2020 while the net earned premiums increased by 13 per cent.

Consequently, net claims incurred increased by 20 per cent in line with business growth, and the claims ratio worsened from 65 per cent in 2020 to 69 per cent in 2021.

The increase in claims incurred was largely attributed to a spike in motor and medical claims driven by factors such as increased cost of spare parts which are largely imported, an increase in hospital visits driven by three covid waves, and, a notable increase in claim count in both motor and medical. Covid claims contributed four percentage points to our overall medical claims ratio.

The insurance company recorded a 25% decline in profit before tax to kes 543 million in 2021 compared to kes 720 million that was recorded in the previous year. The decline was attributed to the property revaluation loss of kes. 600million in 2021.

The loss was triggered by an expiring lease contract in April 2022 and a downward renegotiation of rent to align with the properties market rate thus reducing the expected cashflows per square foot.

Net investment income in the group was Kes 4.6 billion up from Kes 3.8 billion recorded in 2020. This was primarily driven by the recovery of the Nairobi Stock Exchange and growth in investible assets supported by the increased topline and a disciplined collection of premium receivables.

In addition, interest costs on borrowings were up 9% on account of actions taken by the Group towards the end of 2020 to refinance its debt in local currency to mitigate the forex mismatch risk it was carrying in its books. The Kenyan shilling has been losing ground to the US dollar over the period informing the need to limit our exposure via refinancing in local currency.

Income tax expense also rose 241% compared to the previous year largely driven by increases in non-deductible expenses across the business and derecognition of deferred tax assets relating to tax assessed losses for our loss-making businesses. This treatment is in line with accounting standards.

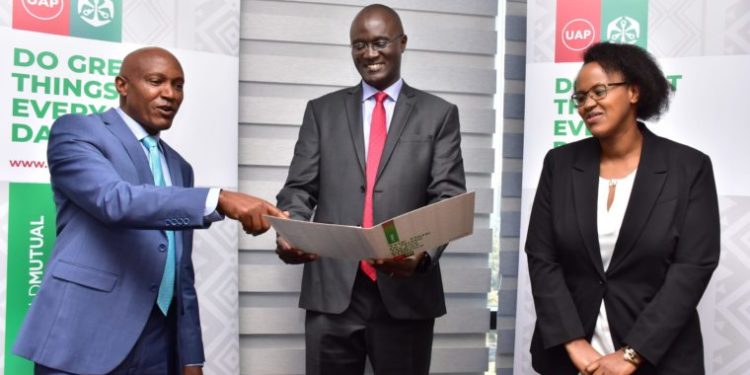

“Our strong performance and growth in market share is attributed to the implementation of our strategy anchored on Transformational Growth and Superior Customer Experience. In addition, we implemented prudent risk selection, innovation in the claims value chain, and cost control which are key strategic initiatives geared towards enabling us to achieve these great results” David Kuria, Managing Director, UAP Insurance Kenya.

Read also; UAP Old Mutual expects Christmas season to spark Interest in Home and Travel Insurance.