Blockchain, a decentralised, distributed ledger for digital information is one of the most innovative technologies today and it is already disrupting various industries.

Blockchain powers cryptocurrencies and NFTs and can radically change multiple sectors, including payments, cybersecurity, healthcare among others.

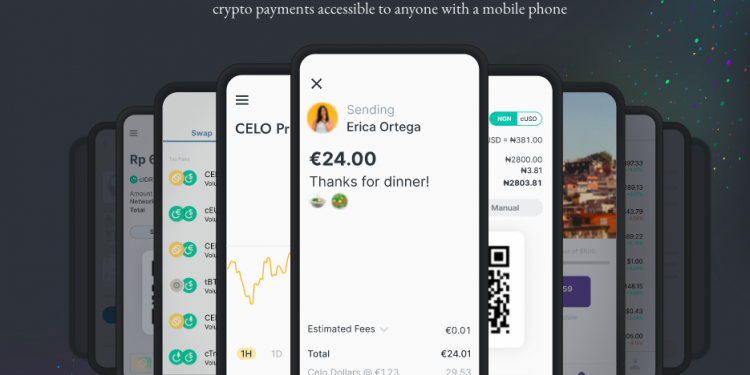

Just this week, a consortium of leading Ethereum decentralized finance (DeFi) projects announced DeFi for the People, a collaboration of global crypto organizations united by a common goal: bringing DeFi to the 6 billion smartphone users around the world.

Built on Celo, the new initiative will offer more than $100 million in educational initiatives, grants, and incentives. The majority of program participants will jointly contribute half the funds for incentive programs..

In this article

Kenya’s Blockchain Projects Built on Celo

The buzz is building up in Kenya with Blockchain and Decentralized Finance (DeFi) projects picking up.

In no particular order, we have put together a list of some interesting startups in Kenya building innovative solutions on Celo, a global payments mobile-first blockchain infrastructure platform that makes financial tools accessible to anyone with a mobile phone.

Kotani Pay

Kotani Pay is a technology stack that enables Blockchain protocols, Decentralized applications (dApps) and Blockchain FinTech companies to integrate seamlessly to local payment channels in Africa with a primary focus on mobile money services.

Kotani Pay makes it easier to integrate through its secure APIs that support lending protocols, payment platforms, saving circles, exchanges, dapps and teams innovating around value transfer.

Africa’s most dominant mobile money payment services such as Mpesa, MTN money with Airtel money also available on the platform. Kotani Pay supports cUSD (Celo dollar) a stable currency that tracks the price of the US Dollar on Celo.

Pezesha

Pezesha is a lending digital marketplace that connects Small and Medium Enterprises (SMEs) with affordable working capital through productive financing. Founded by Hilda Moraa, the platform takes a collaborative approach to utilize capital from lenders (i.e banks and other financial institutions) in the market, seeking purposeful returns by lending to creditworthy quality SMEs as identified by its robust credit scoring technology.

In April this year, Pezesha joined hands with Celo Ecosystem partners to enable Blockchain powered lending to merchants across supply chain verticals in Kenya and Ghana.

Pezesha seeks to leverage Celo’s Blockchain infrastructure to democratise loans and ensure they are competitive to the platform’s borrowers while creating a global network effect.

Since going live in 2017, Pezesha has connected more than 20,000 youth MSMEs with working capital, leading to the creation of more than 1,000 formal sector jobs and 5,000 informal sector jobs.

According to the company’s CEO Hilda Moraa, Pezesha has funded more than 75,000 loans to MSMEs, and educated more than 200,000 MSMEs across Kenya.

READ;

CMA Gives Nod to Pezesha’s Crowdfunding Platform

Kenya’s Pezesha Wins FinTech Award

Kukuza

According to the startup’s founder Steffen Krogmann, the ubiquity of M-Pesa makes Kenya the natural place to start Kukuza. It is already second nature for Kenyans to use their phones for all financial matters.

Kukuza is a mobile-first crypto based micro-investing and loans community for small local groups in emerging and frontier markets. It is structured as a DAO (Decentralized Autonomous Organization) built on the Celo blockchain — and owned by its community members.

With Kukuza, groups of up to 5 people can start a Kukuza circle and invite up to 4 other members to join. These circles are a central element for each financial product on Kukuza.

The investment plan is Kukuza’s first financial product. Kukuza aims to encourage regular investing through a combination of positive financial incentives, social accountability between circle members, and flexibility. Circle members can choose to step in for each other.

Pesabase

Pesabase founder Nhial Majok lived in the midst of war in Sudan, fleeing along with his family from conflict as a refugee. He lived in five countries, finally settling in Australia, where his career in IT was built for over 15 years while working with IBM.

In 2013, he was struck by the promise of bitcoin as an alternative to the financial system of the day. After several experiments with the tech and its potential, he went all in and founded Pesabase in 2017.

Pesabase uses blockchain as a means of moving money quickly and cheaply, avoiding bank settlement times that are measured in days. Through its wallet, Pesabase enables its users to hold tokens, virtual currencies and stablecoins, giving them the opportunity to remit, pay and transact securely.

The app based platform also allows users to send money from South Sudan to Kenya using just your mobile phone or a registered agent.

READ;

DuniaPay Brings Stablecoins to West Africa, With 8% Interest on Savings

Kenya’s Regulator Readies for Crypto Assets

69% of Kenyans More Open to using Cryptocurrency – Mastercard Survey