Credit Suisse, the Swiss financial services company in its latest frontier research note has picked Kenya among the ten countries that are expected to deliver superior investment growth compared to emerging markets over the next five years.

The Bank compiled a research which includes 30 countries across four continents, but focused much of its attention on what it described as the CS FM10, a group of nations including Pakistan, Vietnam, Nigeria, Kenya, Egypt and Morocco that are the largest by population, GDP and equity market capitalization.

“Currently, frontier markets represent 16% of the global population, occupying 12% of the planet’s landmass, generating 5% of world economic activity, while offering just 0.5% of the global equity market opportunities. Some of these economies already demonstrate superior growth, strong demographics and discounted valuations, whereas others show promising prospects.” read the report.

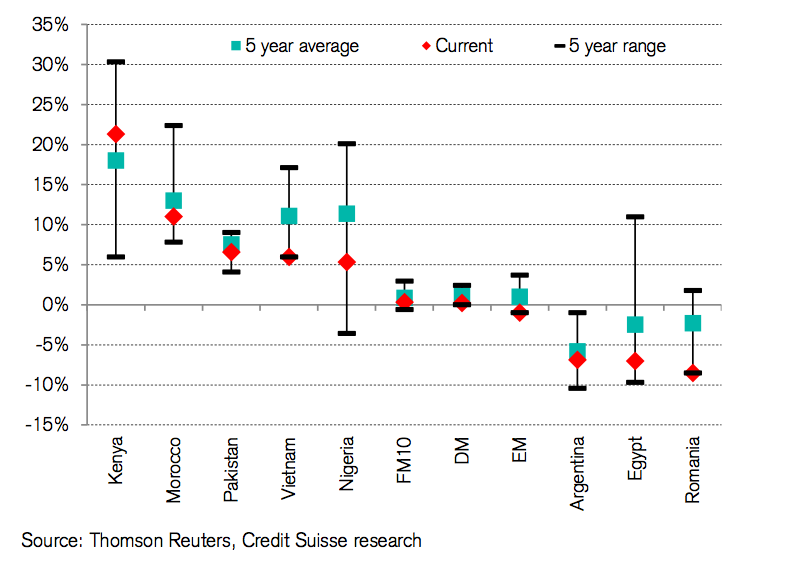

Compared to other markets, the Swiss Bank noted that corporates in Kenya, Morocco, Pakistan, Vietnam and Nigeria are highly profitable, and currently have attractive earnings based on valuations and offer superior yields compared to their peers in developed and emerging markets which are maturing while investment opportunities in the less-developed markets continue to receive growing attention.

Indeed, Kenya was the only country among the CS FM10 countries which continues to deliver in excess of its already high five-year average value creation hence outperforming the remainder of the CS FM10 group of countries by a significant margin over the past five years.

Credit Suisse On M-PESA “East Africa now accounts for 80% of the global mobile- money transactions”

Credit Suisse also highlighted that the success of mobile banking in Kenya is a prime example of an innovative application of simple technology helping circumvent the impediments to growth due to the lack of traditional infrastructure. M-PESA, a mobile-phone-based platform for money transfer and basic financial services, boasts of more than 25 million active users in Kenya. Money transacted through the platform in 2016 was about Sh 5.29 trillion ($5.2 billion), representing a 20% growth from 2015 and 200% growth from 2013 with over 4.5 billion transactions carried out.

“The success of M- PESA has spurred the growth of other mobile money service providers in other frontier economies, especially in East Africa, which is a region that now accounts for 80% of the global mobile- money transactions.” read the report.

READ; Emerging Financial Technologies in Business Development

However, the bank raised concerns that Kenya, Panama, Ukraine, Ecuador and Kazakhstan recorded the greatest deterioration in the view of economic management over the past three years.

These markets have also struggled to meaningfully increase their global export market share over the course of three decades. Moreover, most CS FM10 exports comprise raw materials and consumables, rather than products higher up the value chain. Nigeria, Iran, Kenya and Argentina fare especially poorly in exporting value-added products, with their exports being dominated by energy in the the case of Kenya and Argentina.

Follow us on twitter @kenyanwalstreet for live Updates…