Kenya is expected to raise its debt ceiling to accommodate growing expenditure needs amid underperforming tax collections.

The National Treasury said the discussion was in the background as the public debt stock was fast approaching Kes 9 trillion’s statutory ceiling set out in the Public Finance Management Act, 2012.

“… the implementation of this strategy may require the revision of the debt ceiling through the amendment of the PFM Act based on future borrowing requirements.” said the Treasury.

However, the National Treasury has not disclosed the new loan limit.

Kenya’s Accumulating Debt

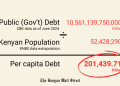

According to a report issued by the Treasury, public debt stood at Kes 7.28 trillion by the end of December equivalent to 65.6% of the country’s gross domestic product in nominal terms.

Earlier on, the Treasury projected the total public debt would hit Kes 7.66 trillion by the end of the current financial year in June and rise to Kes 8.59 trillion in June 2022.

This comes after the Treasury announced the country’s entry in its fourth Eurobond in six years to raise Kes 123.8 billion from sovereign bonds sold to foreigners in the next four months and an additional Kes 124.3 billion during the fiscal year starting in July to help finance the budget.

Earlier on Monday, the International Monetary Fund (IMF) and Kenya agreed on a three-year, Kes 262.5 billion ($2.4 billion) loan to assist Kenya in its response to the covid19 pandemic and to put strong effort to reduce the country’s debt levels relative to GDP which was severely affected by the Coronavirus pandemic.