“A stock operator has to fight a lot of expensive enemies within himself.” – Edwin Lefevre

The NASI (Nairobi All Share Index) closed at 138.31 points on the first session of November. During the month of October it dipped by 1.7% and touched a monthly low of 135.79 points before recovering around the 138 level.

The chart below is a one year chart of the all share index. Despite valuations going down, prices have recovered modestly from the August 24th Interest rate cap decision which depressed most counters on the equities market.

The Benchmark NSE 20 Index which represents blue chip companies listed in the Nairobi Securities Exchange has been on a breakdown since the peak in 2015. The chart below says it all:

Monthly Gainers

Most of the gainers in October came from small – mid cap stocks.

Kenya Airways

Kenya Airways which has been constantly on the media for negative reasons and poor financial results makes it to the top of the list as the best counter in October. KQ’s share price rallied from Ksh 3.95 on 3rd October to Ksh 6.60 on 28th October representing a 67% upswing. About 14 million shares were traded that month. Currently (1st November) it is trading at Ksh 6.75.

Market commentators have attributed the rally due to two main factors:

- Appointment of former successful CEO of Safaricom Michael Joseph to the airline’s board

- Commendable effort made by the airline in improving their financial position by narrowing down their previous losses

On a year-to-date basis KQ is up by well over 30%. October triggered it all.

East African Portland Cement

EAPC a majority owned cement company by the Government of Kenya moved up by 17.39% in the month from Ksh 23.00 to Ksh 27.00 (28th October). It has since retreated to a current price of Ksh 24.50.

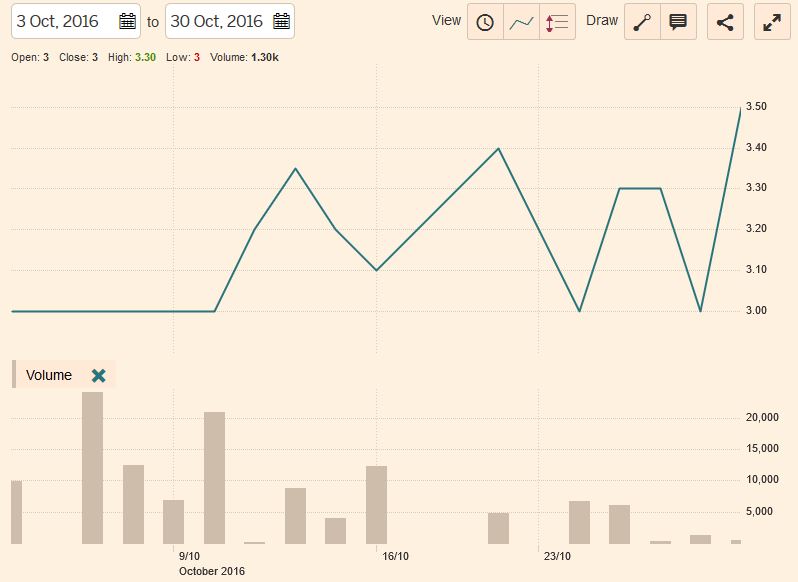

Express Kenya

Express Kenya a company that deals in clearing and forwarding services for both air and sea as well as warehousing and logistics services share price rose by 16.67% from Ksh 3.00 to close the month at Ksh 3.5.

Banking Sector

I&M Holdings

The notable gainer in the banking sector for the month was I&M Bank which moved up by 10.86% from Ksh 87.5 to Ksh 97.00 per share on the back of 365,200 shares traded that month.

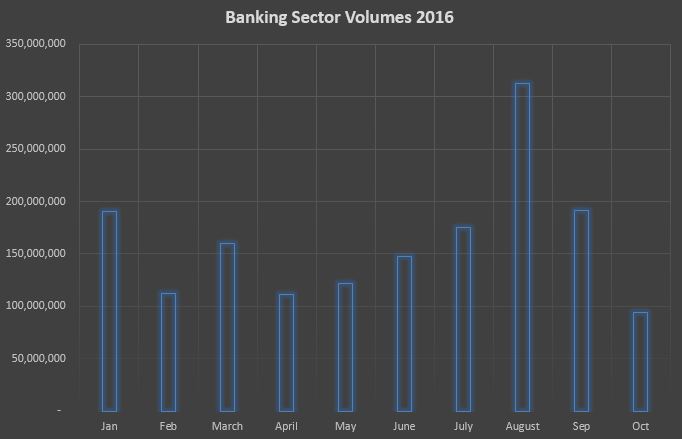

Volumes

October is currently the month with the lowest volumes traded in the Banking sector so far. August was the month with the highest monthly volumes recorded in 2016, the surge in volume came the week after the interest rate cap decision was made (week 35) between August 29th and September 2nd. The counters which experienced activity in August were KCB, Equity, Co-operative Bank and Barclays Bank of Kenya.

Listed banks are yet to release their Q3 2016 numbers.

Monthly Losers

Deacons (East Africa) Plc

Deacons E.A Plc lost 41% in October from Ksh 9.35 (3 October) to Ksh 5.45 per share (28 October). Deacons recently listed on the NSE on August 2nd, in its latest filings it made a loss before tax of Ksh 70 Million.

In an IOC research report by Kestrel Capital they highlighted that:

- They forecast growth in top line numbers as the company embarks on store network expansion plans with a target of having 60 stores by 2020 (currently has 33 stores).

- Availability of retail space in the region as a key driver of expansion.

- Growth in consumer spending to further boost the retail sector.

- Signing of new franchise agreements and new brands will be a positive for the company.

Related: Deacons signs Franchise Agreement with UK’s largest merchandise Store

Have a look at the retailers share price below as since listing to November 1, 2016.

Limuru Tea Company

Limuru Tea Company lost 24.62% in October on the back of a mere 900 shares. It is currently trading at Ksh 490.00 per share.

Investors and market commentators have been arguing that Limuru Tea’s real value is in the massive tracks of land (677 Ha) it holds whose value has not been recognized in their books hence providing an undervaluation case.

East African Cables

E.A Cables share price went down by 17.3% for the month of October (see YTD chart below).

Sanlam Kenya

Sanlam Kenya (formerly Pan Africa Insurance) tanked by 14.86% from Ksh 37.00 to Ksh 31.50 per share

Nation Media Group

The largest Media Group in East Africa lost 13.45% in share price value in October from Ksh 119 to Ksh 103 (28 October). Looking at the 10 year chart below, the last time we this price levels was in 2010. Interesting!

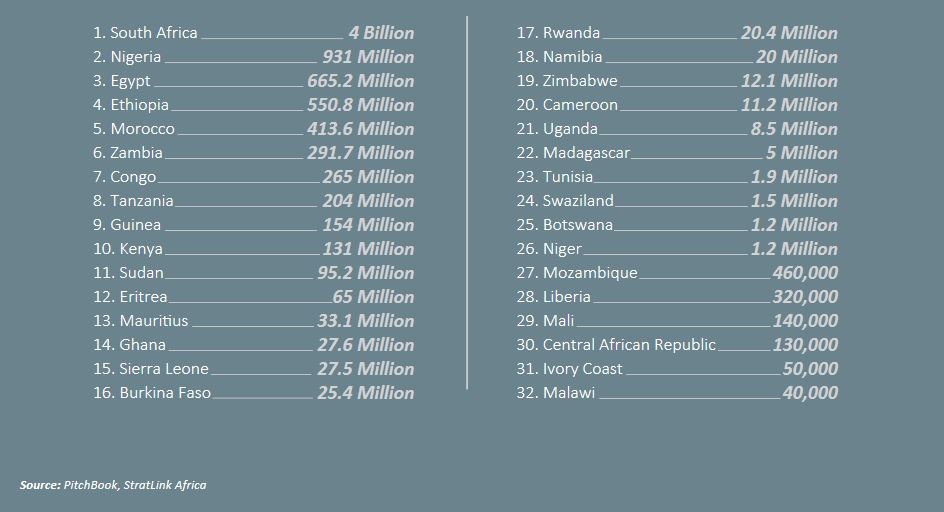

African Deals

In the deal space Kenya has made deals roughly worth USD 131 Million according to Stratlink Africa. It is ranked 10th in Africa in terms of deal size. (see chart below)

Key Upcoming Date

The largest telecom company in Kenya, Safaricom, will announce it’s half year results on November 4 2016. Safaricom’s share price is up by roughly 30% year to date.

The Team here wishes our readers great outperformance in their portfolios as we approach the end of a really tough year in the markets.

Sources: (Bloomberg, Financial Times, Stratlink Africa, Abacus, Nairobi Securities Exchange, Kestrel Capital, Kenyan Wall Street)

Disclaimer: The contents of this website have been prepared to provide you with general information only. In preparing the information, we have not taken into account your objectives, financial situation or needs. The information contained herein has been obtained from sources that we believe to be reliable, but its accuracy and completeness are not guaranteed. Any liability whatsoever is disclaimed