The Capital Markets Authority(CMA) has moved to institute a transitional payment system as it takes over the oversight role at the Nairobi Coffee Exchange(NCE).

The Authority has directed that existing payment mechanisms be utilized in the interim period as the Direct Settlement System(DSS) is being put in place.

“Details of direct coffee sales will be reported to the Nairobi Coffee Exchange and that all disputes that may arise in relation to coffee sales should be forwarded to the Authority to ensure follow up and resolution for the benefit of the coffee growers,” said CMA Acting Chief Executive Officer Wyckliffe Shamiah.

He said an industry committee be constituted to address any gaps that exist and those that may emerge during this transition period.

CMA has put in place measures granting permission to the Nairobi Coffee Exchange to operate as it works towards full compliance with the Regulations.

” All the applicants intending to offer coffee brokerage services are allowed to continue performing the role once they apply and as they work towards full compliance,” said Shamiah

Gazettement of the Coffee Exchange Regulations 2020 brought the Coffee Exchange and its members under the regulatory oversight of CMA.

These regulations were gazetted by the Cabinet Secretary for the National Treasury and Planning on 3 April 2020.

Following the amendment of the CMA Act through the Finance Act 2016, the Spot Commodities Market was brought under the regulatory oversight of CMA. The Authority is mandated to license the Coffee Exchange and the Coffee Brokers.

The Capital Markets (Coffee Exchange) Regulations, 2020 read together with the Crops (Coffee) General Regulations,2019 envisage that the Coffee Exchange and Coffee Brokers will be licensed and supervised by CMA effective 01 July 2020.

The Capital Markets (Coffee Exchange) Regulations 2020 provide for the incorporation of the coffee exchange, licensing of brokers and establishment and operationalization of a direct settlement system for expedited and transparent payment of coffee sales proceeds.

These regulations also lay the grounds for trading in a secure, stable and transparent manner in an environment of fair competition that protects the interests of the grower, buyer and other stakeholders at an exchange.

The Coffee Exchange Regulations have been harmonized with the Capital Markets (Commodity Markets) Regulations, 2020.

ALSO READ:

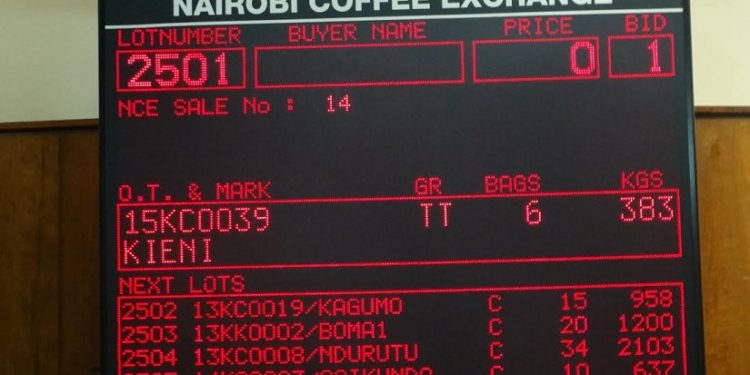

Prices Fall by 15% at Nairobi Coffee Exchange