“In a lot of ways, Facebook is more like a government than a traditional company” – Mark Zuckerburg

The rise of virtual internet platforms such as Facebook, Whatsapp, Telegram, Kakao is challenging established regimes of state and sovereignty, monetary policy and issuance of currency, control, ownership and governance of virtual resources in developing countries in Africa.

Billions of users, including Africans, are spending more time on virtual networked platforms that command the attention of far greater audiences than the populations of individual nation-states. WhatsApp has 1 billion, Telegram 200 million users and Facebook has 2.3 billion users worldwide.

Now, these virtual platforms are all getting into the business of issuing currencies using ‘blockchains’ or shared ledgers to monetize all the possibilities of economic activity within the confines of their platforms.

Out of all of them, Facebook’s Libra coin drew the most attention. No surprise at all considering the sheer size of its 2.3 billion people user base.

What does this mean for Africa’s fintech industry and policies, that tech giants from overseas can monetize the digital economy of Africa through non-sovereign means including issuance of digital currencies?

What follows is a transcript of conversations between Michael Kimani and Andile Masuku, about the current shift to internet virtual platforms, and currencies, and what lies ahead for Africa’s Fintech policy.

Michael Kimani is Head of Business Development East Africa at Zippie, a mobile blockchain platform, a Fintech Innovation Advisor for Visa and Secretary-General of the Blockchain Association of Kenya. He is one of East Africa’s renowned digital money analysts.

Andile Masaku is a Co-founder and Executive Producer at Africa Tech RoundUp.

Some parts of this Q&A were pulled from a podcast with Andile, while some of it are from phone discussions with Malak Gharib of NPR and Ronit Ghose of Citi Bank.

The structure is presented in the format of a Question and Answer. Enjoy!

Michael, you and I have had discussions about the unprecedented opportunity for anyone who wields power and influence over a network – any type of network whether it is a network of mobile phone users, mobile phone network, users eg Uber, Spotify or Google, Wechat, Alibaba, Amazon whoever.

What is a healthy way to think about this

When Safaricom and Vodafone Mobile Network Operators (MNOs) got started in Kenya and East Africa in the early 2000s, the foundation of the business was an expansive cellular network that could host subscribers for services like phone calls and SMS.

You can think of this network as the earliest form of a digital platform, based on GSM rather than the internet.

Over the next 10 years, Safaricom expanded this network to 20 million subscribers. The story is true for MNOs in Tanzania, Uganda, Rwanda, Zambia, Nigeria and Congo. MNOs are Africa’s success story of the decade.

Soon after, in 2009, Safaricom figured out that if they added a prepaid currency wallet on every phone, for sending, receiving and storing money, they could turn into virtual banks overnight without the burden of building branches and onerous banking regulations. They called it Mpesa mobile money, and it too, is another one of Africa’s success story.

Not only could you communicate, but you could also send money for business (payments) or social (remittances). If someone was interested in buying, you could call, negotiate and then bill for goods and services.

So the ability to communicate and then to transact turned out to be powerful because it flipped the mobile network into somewhat of a virtual economy.

I share this piece of history because right now, we are witnessing it again, only this time it is the internet platforms like Facebook, WhatsApp and Opera looking at their expansive user bases and asking themselves, how can we monetize this?

Have Mobile Network Operators (MNOs) Lost to Virtual Platforms?

Yes they have, and I feel sorry for them.

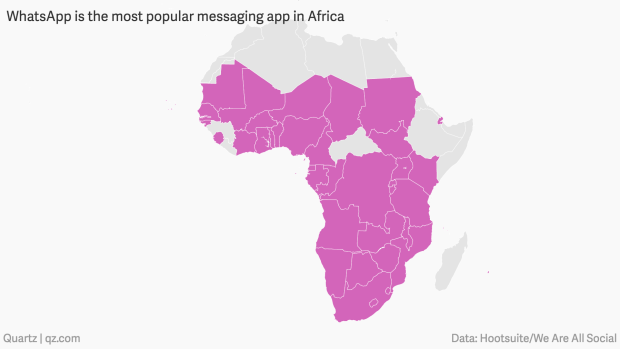

MNOs were the original digital platforms in Africa, where people connected with friends, family or business contacts through calls and SMSs. But, with increasing smartphone and internet penetration, they have ceded this crucial business to internet companies.

Facebook, WhatsApp, Telegram and Skype now have the upper hand because they facilitate better communication experiences at an ultra low cost with enhanced features like photo sharing, group chats, games, content streaming . . . the list is endless.

WhatsApp for example, is the most popular messaging app in Africa. Young people in Kenya and Zambia now prefer to make calls and send voice and text messages via whatsapp. They are spending at least 5 hours per day on these platforms.

Due to their massive appeal to the new generation of emerging African consumers, MNOs like Safaricom and MTN have been obliged to zero rate internet data bundles for subscribers to access Whatsapp, Facebook and Youtube, just so that they can retain users on their cellular network!

So when you see Kenya’s Safaricom struggling to build out an online messenger app named Bonga, or MTN announce a new social messaging app name “Ayoba” with “Instagram-like features” to “compete with WhatsApp”, consider it an act of desperation by MNOs.

Michael, it seems like we are at an interesting moment in history where frankly you don’t need to call yourself a bank or even be regulated to launch a financial service. You can just wake up one morning and leverage your network to deliver financial inclusion for all, or cash in big time. What do you have to say on this?

Whoever controls the network, calls the shots.

MNOs in Kenya were the first to pull this off successfully in Africa. They took the bold decision to add a prepaid mobile money ‘currency’ wallet to their networks and completely altered the banking competition landscape in East Africa. If you could send, receive and store money on your mobile phone, then you technically had bank account.

History is repeating itself today only, instead of MNOs, it is the largest social networking platforms incorporating virtual currencies and wallets within their platforms to monetize their virtual economies.

Facebook’s Libra coin is one such example, a platform with 2.3 billion people, 400 million in India, 130 million in Africa – these are user bases that are bigger than the populations of individual countries, and definitely bigger than that of MNO networks.

Africa’s favorite browser Opera, is another example of an internet platform with 100 million users using their browsers everyday. Opay, a subsidiary of Opera just raised $50 million dollars for their inbuilt money wallet that includes an in built cryptocurrency wallet.

South Korea’s favorite social network messenger Kakao announced a blockchain powered in-app cryptocurrency for its blockchain wallet.

Telegram raised $ 1 billion through a token sale for its in-app platform cryptocurrency gram for its messaging network.

Kin Kik, a social messaging app that is popular in North America, launched an in platform cryptocurrency named Kik for its Kik ecosystem of app developers, content creators and users.

These developments are not a coincidence. I am convinced we are in a meta trend of platforms, networks, network coins and network currencies.

Having seen the success of WeChat, Tencent and AliPay in China, tech companies are hoping to replicate the same in Africa, especially on the backdrop of the Africa Rising narrative.

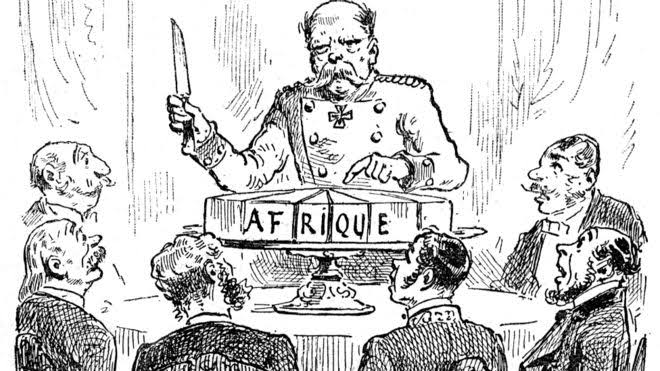

In your article, 5 Reasons Why Facebook’s New Cryptocurrency is Bad News for Africa, you use a provocative term, digital colonization by proxy. Why do you feel that Facebook’s Libra coin is bad news for Africa? Is that what Libra coin represents if it becomes a mainstream reality?

I am not sure people in much of Africa appreciate how much we are already kinda colonized in regards to the global financial system. African economies are overly dependent on the United States Dollar (USD) currency and the USD settlement banking system. African cross border business is settled outside of Africa, by US and European banks.

So we are already, in my view, living under somewhat of a monetary colonization regime. Now that we are transitioning to digital currencies, we face the same risk of dependency.

We are at a crucial juncture in history to address this imbalance. We need to take a step back, look at what is happening right now and ask ourselves, how can we re-imagine our future?

My worry is may end up making the wrong choices and end up dependent on other people’s technologies, other people’s currency.

Speak to policymakers then, give them a sober sense of what is at stake here and what the risks might be if they were to back the Libra association’s plan

The biggest risk is letting Libra coin and the Libra network become disproportionately dominant in Africa or East Africa’s digital economy.

The challenge for policy is how to catalyze a rich ecosystem of competitive alternatives.

We need quality alternatives, as many as possible because we are not part of the governance structure of Facebook or the Libra association and both could change their policy or management overnight.

So what is the risk? Is this a risk to our sovereignty?

It still does seem to me, that Facebook is a soft sell because it is pragmatic. I think about myself and the daylight robbery that ensues every time I send money for cattle vaccine to Zimbabwe, and I’m like, what if I could just send a WhatsApp message to my people back home, and they could walk to an agri-market and buy vaccines. That sounds great to me.

Make a case for what is my blind spot?

You’re right. Practically, and on paper Libra coin solves a real problem – remittances which is something a lot of African countries are dependent on.

Kenya, for example, receives over $2 billion annually from formally recorded sources with over 50% from the UK and North America alone. In Nigeria, remittances stand at $20 billion.

I expect we are going to see a favourable policy environment for Libra coin, for use cases such as remittances because it solves a real problem for people and Central Banks.

But policymakers also have a responsibility to think about issues more broadly, over a longer period of time, sometimes even for national and domestic interests.

If you think about the recent case between Google and Huawei, whereby because of trade wars and national interests, Google (an American company), cut off support for a whole ecosystem of Android applications for Huawei (a Chinese company) devices because US President Trump’s orders barred American firms from selling components and software to Chinese companies.

This is an example of a risk I would be worried about as a policymaker; where one player wields a disproportionate power over the market. It’s a systemic risk, considering the backbone of Africa’s digital economy runs on over smartphones that run on Android and over 50% are manufactured by Chinese companies.

Policymakers need to think about frameworks that allow competing types of digital currencies and digital platforms to thrive so that people have a sufficient choice of alternatives.

For example, maybe Opera could do an Opera coin cryptocurrency for cross border remittances through its browser for it network of 100 million Africans.

Is this risk validating the need the utility for decentralized cryptocurrencies like Bitcoin relative to Libra

Absolutely!

I am always saying to my friends and networks that Libra coin was the best validation for decentralized cryptocurrencies like Bitcoin and Ethereum.

From my experience, everything I see happening in the decentralized blockchain industry is a mirror image of the current internet economy; the only difference is the ideology and philosophy.

Decentralized platforms and cryptocurrencies are trying to remedy the problems that users of platforms such as Facebook, Google, android, Patreon, Paypal etc have encountered for example censorship of payments online, discrimination of speech, the privacy of data, control of technology and such.

Bitcoin and cryptocurrencies redress the imbalance caused by current models of platform ownership, control, privacy and power to censor by building networks where there is no single person or company or Central Bank in control. Where the network exists purely online, not tethered to any single geographic jurisdiction where they could come under attack from state actors like Google taking orders from the US government to pull down Android support services for Huawei, or PayPal taking orders from the UK government to censor payments to African freelancers, or the Kenyan government pulling down the .ke domain names of sports betting firms.

- So if Google is a corporation, Ethereum is a Decentralized Autonomous Corporation (DAC) that lets developers build applications without the fear of Google changing rules overnight.

- If the US Federal Reserve Bank is a corporation, then Bitcoin is a Decentralized Autonamous Corporation (DAC) whose sole purpose is to secure an alternative virtual currency.

We are living at a time where we are experiencing different philosophies at building virtual networks because platforms and companies like Google, the US Federal Reserve Bank and Facebook and PayPal have shown us time and again that they cannot be trusted and are inclined to abuse their powers.

Decentralized virtual networks and currencies like Bitcoin and Ethereum and EOS are built as an alternative to centralized forms of platforms like Google, Facebook and Libra coin as a counter measure to balance out the enormous powers wielded by tech giants, central banks and even governments.

Companies and people can be more confident about building on decentralized platforms, or using decentralized applications and services, that no one will change the rules overnight.

But, just like all successful businesses, decentralized virtual platforms have to attract users to their network ecosystems by building useful dapplications and services.

I believe this will come to fruition but might take a while.

Is it any surprise that Bitcoin fever has hit in countries such as Zimbabwe and Nigeria?

What do you reckon the state of monetary policy or even fiscal policy within sovereign African geographies is going to contribute to adoption levels whether we are talking Libra or truly decentralized currencies

I think truly decentralized currencies are a real threat to countries with questionable monetary policies – like you mentioned, Zimbabwe and Nigeria which have a long history of currency crisis.

People are no different from animals when challenged by external threats to their survival. So if people feel threatened by wealth erosion or confiscation such as by war, or inflation or poor monetary policies, they will seek out alternatives. The mere existence of cryptocurrencies like Bitcoin and Libra presents a real alternative to avert crisis.

Of course, this will not happen overnight, but I would say to monetary policy makers they are only one crisis away from nudging people into alternatives. Whether it is for trade, or store of value or as a hedge.

If you are a policy maker in an African country with shaky monetary policies and high levels of internet penetration and digital money, you should be looking at how the emergence of non-sovereign currencies like Libra and Bitcoin could affect your economy.

Central Banks are mostly interested in checking the flows of money in and out of an economy. Until recently, they only had to worry about foreign currencies, that is, sovereign currencies of other nation states which are clearly articulated as part of the law.

But non-sovereign currencies are fairly recent and there is no regulation or law in African countries that come close to adequately cover the scope of virtual currencies.

So Central banks will always be interested in gateways, at the points where people are converting from Libra coin to mobile money like Mpesa, or people are converting from Mpesa or Bank to Libra or Bitcoin.

In this regard, Libra is a good bet for regulators because the partners of Libra association are companies like Visa and MasterCard who work with Banks and payment institutions as part of their business. The central bank can negotiate to have an eye on all flows in and out of Libra coins.

Bitcoin on the other hand, poses a completely different risk because its peer-to-peer by design. So people can acquire and dispose bitcoin via friends or networks; they are not limited to regulated gateways like Mastercard.

Peer to peer markets like localbitcoins, where volumes are up to $5 million per week and $1 million per week in Nigeria and Kenya are able to operate specifically due to this key design.

I believe informality is highly correlated with decentralization, and much of Africa’s economies are highly informal.

What about Central Bank Digital Currencies by African governments?

I laugh when I see the Kenyan Blockchain Taskforce recommend a national central bank digital currency. I am reminded of Ecuador, a country that decided to take on the ambitious project to launch a digital currency.

“In 2014 the government of Ecuador, under then-President Rafael Correa, announced with great fanfare that the Ecuadorian Central Bank (BCE) would soon begin issuing an electronic money (dinero electrónico, or DE). Users would keep account balances on the central bank’s own balance sheet and transfer them using a mobile phone app.” – Cato Institute, The World’s First Central Bank Electronic Money Has Come – And Gone: Ecuador, 2014-2018

3 years later, Ecuador shut down this ambitious project.

“Ecuador’s National Assembly passed legislation to decommission the central bank electronic money system. The legislation simultaneously opens the market to mobile payment alternatives from the country’s private commercial banks and savings institutions. The state system had failed to attract a significant number of users or volume of payments.”

So I am generally skeptical of central bank issued digital currencies at retail level. The thing with African bureaucrats is that they are great at conjuring up grand plans without thinking through the details. While it may appear to be a great idea on paper, there is no reason to believe that a national government can run a digital currency system more efficiently than private firms.

In Kenya, we already have what many countries would envy, an economy with various forms of digital currencies –

- airtime currency

- prepaid electricity tokens,

- Mpesa and mobile money,

- loyalty points,

- credit and debit card money

- and most recently cryptocurrencies

In addition, we have a massive retail distribution network for these types of currency

- Mobile phones

- Mobile money agent network

- Bank agency network

- Airtime distribution agents

- Branches

- ATMs

- Paper vouchers

- Virtual cryptocurrency agents

- Forex bureaus

- Prepaid token agent network

Why is it better for a Central bank issued digital currency to replace all of these. What happens to the pre-existing distribution network? How do we brand this new digital currency? How do we grow its adoption?

The best arguments for a Central bank issued currency is for wholesale, at best. Where the Central bank issues a digital currency to commercial banks for settlement between large firms and the central bank; something that the People Bank of China has suggested.

There is no need to replace (by force) what the market has already solved. Best approach IMO is to have an enabling environment that supports different forms of digital/virtual currency by parties other than central bank.

Do you have any parting words?

Yes.

I see African governments, fintech companies and policy makers as trapped between a rock and a hard place thanks to the popularization of virtual platforms, digital money and mobile networks and the emergence of cryptocurrencies like Bitcoin and Libra.

On the one hand, Libra by Facebook and the Libra association portrays itself as an alternative for cheap cross border remittances, and possibly a future where Libra is a mainstay in Africa’s digital economy.

The trouble is Facebook has a shady history of data privacy, censorship and interfering with sovereign elections. Libra is by Western corporations, and Facebook is a tech giant subject to the whims of the US government (and Trump)

Can African policy makers/governments trust Facebook and its associates?

On the other hand, there is Bitcoin and decentralized cryptocurrencies which are not owned owned or controlled by any company and are resistant to control by any single government (including the US & African governments too).

These too are a real alternative for example, when the UK government forced PayPal to shut down payment services to freelancers in Kenya, Bitcoin worked as a great alternative (How PayPal & the UK Government are nudging Kenyan Online Workers to Bitcoin)

Now, there is possibly a 3rd option where, somehow, African governments or regional governments OR Pan African corporations come up with some sort of pan-African digital currency (backed by commodities or what have you) that can be used across the continent with the ability to plug into the internet platforms.

On paper, this is a great story the type to make Africans feel like they can truly own something.

But how realistic is this? Such a digital currency would require collaboration and cooperation across borders to pull it off – overnight! Already the digital currency space is evolving fast. China is apparently planning “to launch a state-backed cryptocurrency and issue it to seven institutions in the coming months, according to a former employee of one of the institutions who is now an independent researcher.”

So somehow, African governments and people and institutions and thinkers and policy makers would have to draw up a plan, design, agree, build and release to the wild in say 2,3,5 years? And over and on top of this, somehow make such a hypothetical African digital currency work with online platforms – not just for cash out – but embedded within the digital economy?!

I think Africans African governments and policy makers are trapped because

- They have no control of digital platforms (bar cellular networks)

- They have little to no technical capacity

- Their currencies are considered shit outside of their national borders

- They can’t event cooperate at cross border level (let’s be honest)

How exactly will option 3 work?

This is the conundrum. And I’m excited to see how it plays out and if I can help it, influence the outcome.