It is that time of the year where we sit down and quickly jot down our new years resolutions in the hopes to actually realize them during the year 2016.

It is also the time when we have literally exhausted our monies on a life of ‘excess’ during the festive period and we are dreading the ‘starvationo’ in the month of January. This comes to show why the January effect would be god sent to you.

The January effect is a trend in stock prices, especially small cap stocks (price times total number of shares issued), in which stock prices tend to increase in the last trading days of December (pssst!, this means you only have 3 more days to enjoy this phenomena in December) and the first week of January.

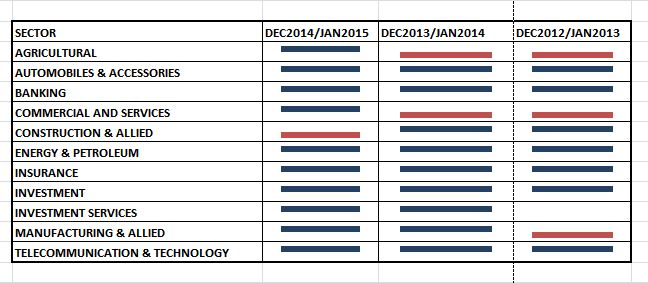

I conducted a simple analysis of this and found that, on average, in the past 3 years share prices have shot up between the last week of December and the first week of January. This can be seen below:

Also Read; Top Ten 2016 Resolutions for an ambitious Value Investor

The blue represents gains while the red represents losses.

It is a well known fact (and if you did not know, now you know) that Kenya abolished taxes on profit made from the sale of shares and bonds through the Nairobi Securities Exchange (Capital Gains Tax) with effect from January 1, 2016 (if you are not pressed for cash, hold off selling the shares that have realized a positive return and read on to know when to sell).This is meant to boost trading and restore investor confidence in the market.

I believe that this will further stimulate the January effect as many investors choose to not sell their shares as they will experience a capital gains tax between now and January 1st 2016 on gains made.

What does this mean for you getting into the market?

About the Author;

Stephanie Kimani,Investment analyst and market enthuthiast

@KimaniStephanie