Kenya’s stock market on Monday rose to record highs as investors remained optimistic following the recent news that the country’s key political figures had agreed to dialogue after a year of bitterest rhetoric.

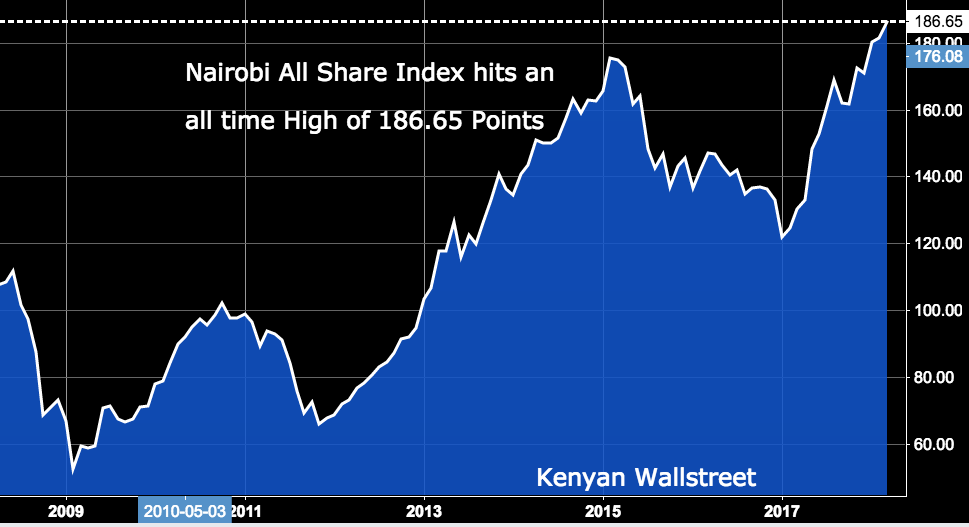

The Nairobi All Share Index (NASI), a market cap weighted index consisting of all the securities listed on the Nairobi Securities Exchange hit a fresh all-time high, rising 2.56 points to close at 186.65 points. The rally has been mainly driven by banking sector stocks owing to the news that the Govt was working on a plan to review the rate cap law before June.

In a media briefing last week, Kenya’s Finance Minister Henry Rotich said the rate caps were unsustainable and the government is finalizing on a draft to be forwarded to parliament that calls for the abolishment or amendment of the interest rates law.

The rally comes at a time when most of the listed companies companies are releasing their financial results for the period ended December 2017. So far, earnings reports of various companies such as banks have been disapointing owing to the interest rate capping law.

Despite the poor earnings growth, listed banking stocks are currently trading above 52 week highs.

Lets have a look at some of the best performing banking stocks

Equity Group

On Monday, Equity Bank closed at a 3 year high of Sh 53 having gained by 3.92% during the session. The counter is up by more than 33% since the start of 2018 ahead of its full year 2017 results release.

KCB Group

On Monday’s session, KCB Group closed at a 30 month high of Sh 52. The stock is up by more than 22% since the start of this year.

Diamond Trust Bank

The counter closed Monday’s session at Sh 219 and is up by 14% in 2018.

Barclays Bank

On Monday, Barclays Kenya stock closed at Sh 12.20, its highest level since April 2016. The counter has gained by more than 28% in 2018.