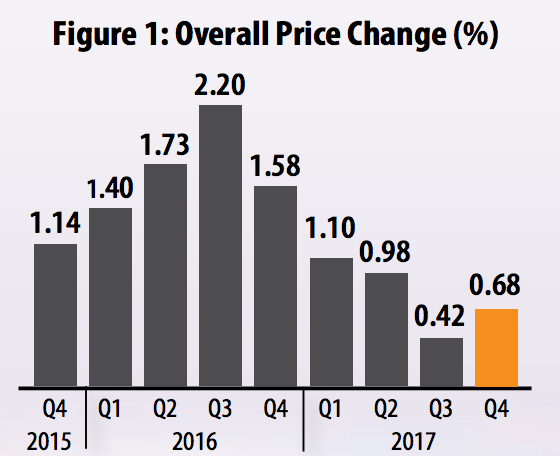

On the back of a generally suppressed private sector credit expansion, the rise in house prices remained subdued as reported by the Kenya Bankers Association House Price Index (KBA-HPI). According to the Index that tracks price movements based on industry data and property valuation, house prices in Kenya rose by approximately 0.68 percent during the fourth quarter of 2017 compared to 0.42 percent in the third quarter.

While the market remains skewed towards apartments relative to other house types, the KBA-HPI reports that some areas witnessed better price improvements. Properties in ‘Region 1’ as defined in the report improved by about 1.35 percent compared to the overall price movements that remained below 1 percent. The region includes such locations as Athi River, Mlolongo, Mavoko, Nakuru, Ngong, Ruaka, Syokimau, Embakasi, Kahawa Wendani, Thika, Mtwapa, Utange, Kitengela, Kiembeni, Nyeri, Likoni, Eldoret, Ruiru, Kilifi, Thika Road (Kasarani, Roysambu, Ruaraka), Meru and Bungoma.

“The search for affordability has tended to steer both buyers and investors to the lower-middle income to middle income property segments,” said KBA Director of Research and Policy Jared Osoro. “Access to capital is evidently integral in influencing the demand and supply dynamics in the housing market.

“The results for quarter four continue to support the evidence that depressed demand is due to the slowdown in credit expansion. Households relying on credit for home acquisition have been adversely effected by the Banking (Amendment) Act of 2016, which introduced interest rate controls that are distorting the credit market,” he said.

Despite credit constraints, the Index report predicts that potential home buyers, who held back on decisions to invest last year, will gradually enter the property market in the coming months. “As the economy is anticipated to perform relatively better in 2018, a response would be expected in terms of house prices starting to take an upward but slow and delayed trend,” added Osoro.