According to the Barclays Africa Group Financial Markets Index report which evaluates financial market growth in 17 major countries in Africa, development of domestic investor capacity and ability to attract foreign capital are key points of focus for these economies.

The Index highlights economies with clearest growth prospects & ranks them according to six pillars: market depth; access to foreign exchange; tax and regulatory environment and market transparency; capacity of local investors; macroeconomic opportunity; and enforceability of financial contracts, collateral positions and insolvency frameworks. The report further surveys 60 top executives from financial institutions with operations across the 17 countries, including banks, investors, securities exchanges, regulators, audit and accounting firms and international financial and development institutions.

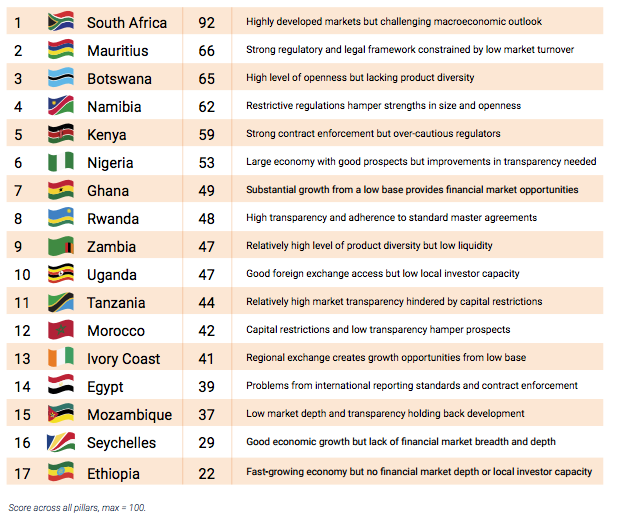

As shown in the table below, South Africa topped the survey with a score of 92 out of a possible 100 followed by Mauritius with an overall score of 66. Ethiopia achieved the lowest score out of all the 17 countries in the index mainly because the country doesn’t have a securities exchange, minimal local investor capacity and low enforceability of contracts.

In terms of liquidity, South Africa, Egypt and Kenya score relatively highly. However, liquidity still remains one of the major issues for most of these countries. The index also notes that market valuation averages 61% of GDP across all countries albeit low turnover.

The Barclays Africa Group Financial Markets Index was produced by The Official Monetary and Financial Institutions Forum (OMFIF) in association with Barclays Africa Group Ltd.The report was written by OMFIF, with Barclays acting in an advisory capacity.

ALSO READ; Barclays bullish on the kenyan Economy, Expects 5.5% Growth