The Nairobi Securities Exchange says it is upgrading to a new electronic trading system that will be able to accommodate new financial products including short selling in addition to allowing faster processing of trades.

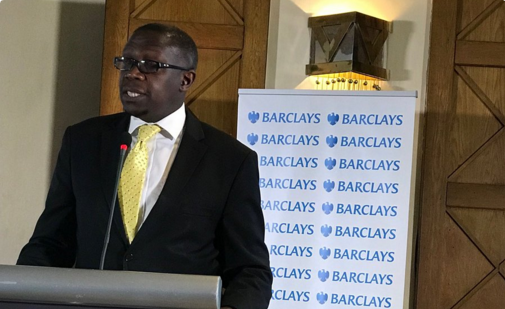

The CEO of the exchange Geoffrey Odundo said the new system would also make it easier for market members to seamlessly provide services to investors. The new system will also increase market efficiency and reduce the risk of clearing and settlement.

The new system is expected to be in place by the second half of 2018.

The announcement comes few days after the Govt gave NSE ago ahead to introduce short selling aimed at boosting liquidity and diversify the exchange’s services in a bid to attract more investors.

NSE CEO Geff Odundo said the upcoming short selling will be open to both retail & institutional investors. However, retail investors must have a significant position to participate.

He was speaking at the launch of Barclays Africa Group Financial Markets Index 2018.

MAJOR UPDATE…

NSE CEO Geff Odundo says they are upgrading their systems to allow Short selling, to be completed by Q2#AFMIndex

— Kenyanwallstreet (@kenyanwalstreet) January 17, 2018

NSE CEO Geff Odundo says upcoming short selling will be open to both retail & institutional investors. However, retail investors must have a significant position to participate #AFMIndex pic.twitter.com/XpzoJ7Nhz7

— Kenyanwallstreet (@kenyanwalstreet) January 17, 2018