Tanzanian graphite developer Black Rock Mining Limited successfully raised $4.2 million through a heavily oversubscribed placement (“Placement”) of 70 million new fully paid ordinary shares at $0.06 per share predominantly to new institutional and sophisticated investors.

As a result of the strong demand from institutional investors the Board elected to increase the size of the Placement by an additional $1.2 million, placing the Company in a strong financial position to complete a Definitive Feasibility Study (DFS) on the Company’s 100%-owned Mahenge Graphite Project.

In addition to the Placement, the Company’s Directors and advisors will seek shareholder approval to subscribe to the issue of approximately 9 million shares, or approximately $540,000 on the same terms as the Placement. Post completion of the Placement and the 9 million shares, Black Rock will have a strong balance sheet with approximately $5.25 million in working capital available for deployment.

The Chief Executive Officer of Black Rock, John de Vries said the support demonstrated the strength of the Mahenge Graphite Project: “The completion of the Placement is a significant step in our transition from a graphite explorer to developer and ultimately a global producer. The strong support validates our project that combines super low capital costs, high margins and scale which we believe makes our Mahenge Graphite the best undeveloped graphite project globally. Being fully funded to complete the Definitive Feasibility Study allows us to continue to de-risk the project, develop our markets and people and progress to a construction decision.”

About Black Rock Mining

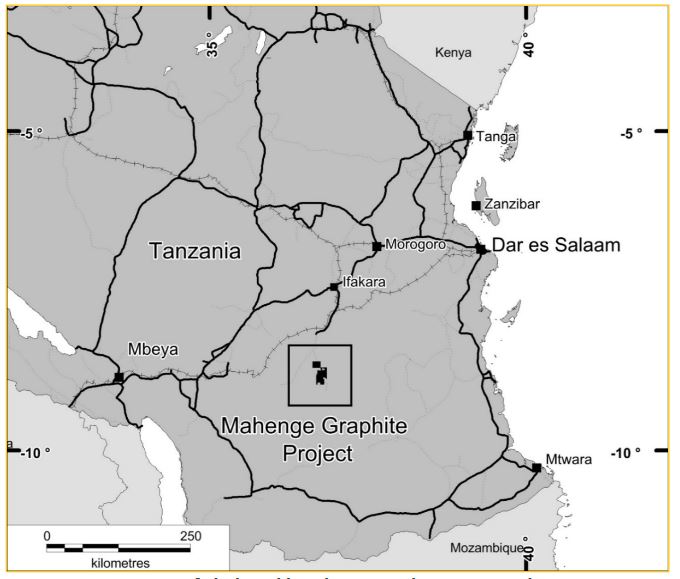

Black Rock Mining Limited is an Australian-based company listed on the Australian Securities Exchange. The Company owns graphite tenure in the Mahenge region of Tanzania.

The Company announced a JORC compliant Mineral Resource Estimate of 211.9m tonnes at 7.8% TGC for 16.6m tonnes of contained Graphite, making the Mahege Graphite Project one of the largest JORC compliant flake graphite Mineral Resource Estimates globally. Over 50% of the Mineral Resource is in the Measured and Indicated categories. In April 2017, Black Rock announced results of a Preliminary Feasibility Study (PFS) for its Mahenge Graphite Project which confirmed its potential as a long-life, low capex, high margin operation.

The PFS estimated a post-tax, unlevered, internal rate of return (“IRR”) for the Project of 48.7%; and a net present value (NPV) using a discount rate of 10% (NPV10) of US$624m. Black Rock confirms, that except for the proposed legislative changes relating to 16% free carry position of the Tanzanian Government and the royalty fee increasing to 4.3%, the key assumptions used in the PFS have not materially changed and that the material assumptions continue to apply per the PFS announcement released to the ASX on 24 April 2017. Subject to clarification on Tanzanian legislative changes, Black Rock is moving towards commencing a Definitive Feasibility Study (DFS). With a successful DFS and associated financing, construction could commence in 2018 with first production in 2019.