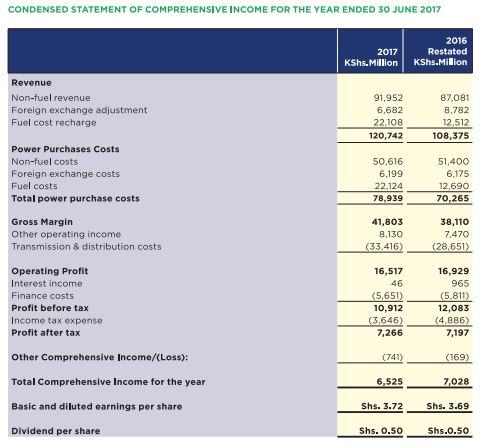

Listed energy company Kenya Power (KPLC) released its FY 2017 results for the period ending 30 June 2017 that has seen is profit before tax go down by 9.7% to KES 10.9 billion versus KES 12 billion in the previous period. Profit after tax came in up by nearly a percentage point (+0.96%) to KES 7.3 billion compared to KES 7.2 billion in 2016.

The company displayed an 11.4% increase in revenue to KES 120.7 billion compared to KES 108.4 billion in the previous financial year.

The company’s power purchase costs increased by 12.3% attributed to KES 78.9billion compared to KES 70.3 billion in the previous period. This was largely attributed due to a 74% increase in Fuel costs that came to KES 22.1 billion compared to KES 12.7 billion in 2016.

The company’s power purchase costs increased by 12.3% attributed to KES 78.9billion compared to KES 70.3 billion in the previous period. This was largely attributed due to a 74% increase in Fuel costs that came to KES 22.1 billion compared to KES 12.7 billion in 2016.

Transmission and distribution costs also increased by 16.6% to KES 33.4 billion compared to KES 28.7 billion in 2016.

The company declared a KES 0.50 dividend per share subject to approval by shareholders on 1 December 2017.

Kenya Power was last spotted (October 18, 2017) trading at KES 9.55 per share. Its current 52 week trading range is KES 6.00 – 12.00. On a year-to-date basis the counter is up 17%.