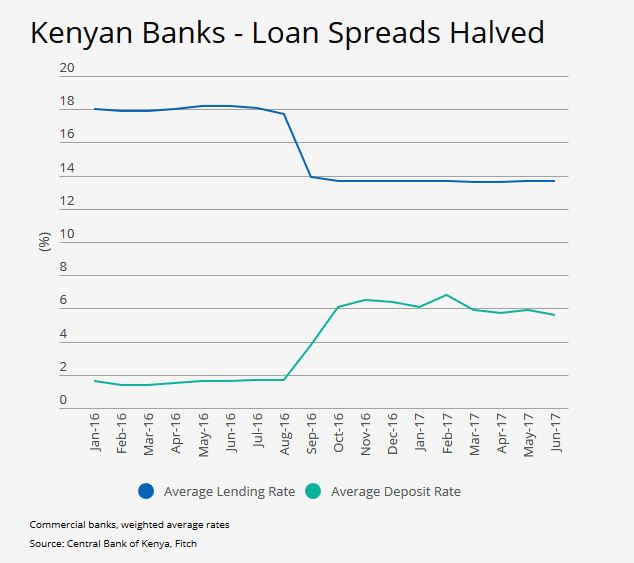

(Fitch Ratings) Kenya’s cap on loan rates and its floor on deposit rates have had a dramatic impact on the spread between banks’ lending and deposit rates, which have halved on average since implementation just over a year ago, Fitch Ratings says. The loan cap is also causing banks to reduce their lending to the private sector as they can no longer price fully for higher risks.

All banks saw a sharp reduction in loan spreads after the government capped rates at 4 percentage points above the central bank’s benchmark rate (CBR – currently 10%) for all loans, and placed a floor of 70% of the CBR on deposit rates, leading to falling interest income from loans and rising funding costs. The latest data from the Central Bank of Kenya to end-June 2017 shows a sustained impact since the cap and floor were implemented in September 2016.

Small banks are most affected by the cap as they are more reliant on higher-risk/higher-return loans and on those sectors where the loan cap hits hardest; some are finding that their niche business models are no longer viable – a factor behind some recent mergers and acquisitions. A depositor flight to quality away from smaller banks could increase sector risks. Banks are addressing margin pressure by shifting to high-yielding treasury bills and some have moved customer deposits into transactional accounts not subject to the deposit rate floor.

The intended benefit to customers of lower interest rates on loans is offset by a slowdown in lending, as banks shy away from lending to higher-risk sectors such as SMEs and from granting long-term loans. Private sector credit growth fell to 1.2% year-on-year (yoy) by July 2017, from 7.5% in July 2016. We expect new lending to remain subdued as long as the rate cap remains in place. Credit growth had already been slowing significantly since 2015 (private sector credit growth was 20% yoy in July 2015) due to weaker operating conditions, rising non-performing loans (NPLs) and three banks going into receivership.

The reduction in lending has contributed to a rise in credit losses, as some customers are no longer able to get refinancing. The sector’s NPL ratio continued to rise in 2017, ending 1H17 at 11%. Profitability is down across the sector, even for the larger banks, despite their stronger franchises.

We expect the lending cap and the deposit floor to be revised (but not rescinded), although a decision is unlikely before the re-run of the country’s election later this month.

Rate caps are not uncommon in emerging markets. The Kenyan rate cap is unusual, however, in that it is a blanket rate cap on all loans; in other markets, rate caps typically apply only to specific segments, such as retail lending, generally for the purpose of consumer protection.

The article first appeared on www.fitchratings.com