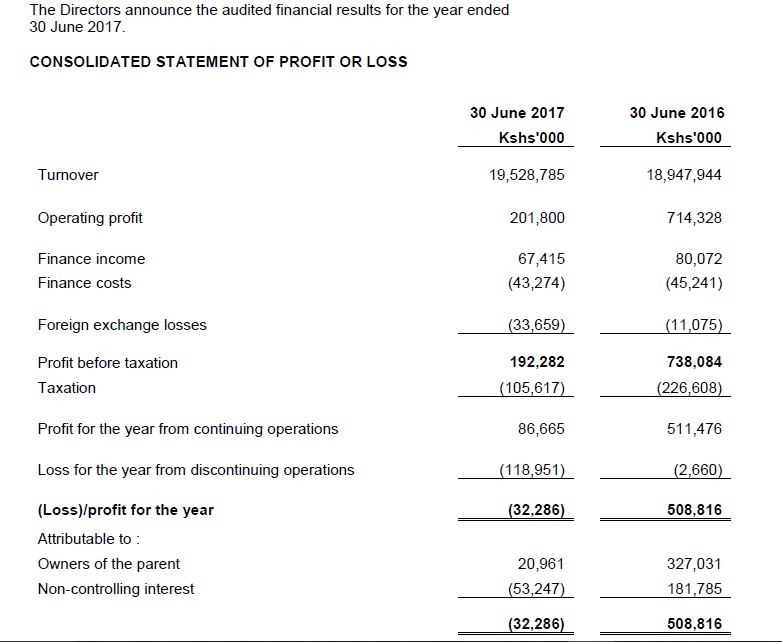

Unga Group released its results for the financial period ending 30 June 2017 that saw unpleasant numbers. The company’s revenues increased slightly by 3% to KES 19.5 Billion compared to KES 18.9 Billion in the previous period. Sales volume was up by 1.8%.

In a statement the company characterized the Kenyan business environment with maize supply challenges caused by drought and crop disease that led to government intervention through duty free importation and a subsidy program towards the end of the year.

The Ugandan subsidiary made a consecutive loss for a third year in a row that has led the board to cease milling operations as it evaluates alternative options.

The bakery business was negatively impacted by credit challenges facing the retail sector resulting in an exit from most Nakumatt stores where it had bakery implants and counters. As a consequence, the business embarked on a strategy to grow volumes and revenue through a direct distribution channel. In spite of this, the significantly reduced operations resulted in a goodwill impairment of Shs 151 million.

The company’s operating profit was down by 71.75% to KES 201.8 million compared to KES 714.3 million in the previous financial year.

Profit before tax came in at KES 192.28 million compared in 2017 compared to KES 738.08 million in 2016 representing a 73.95% drop.

The company made an after tax loss of KES 32.3 million compared to a profit of KES 508.8 million in the previous year. The loss was attributed to a loss of KES 118.9 million from discontinued activities.

Unga Group has reached an agreement with minority shareholders in Ennsvalley Bakery Limited to acquires the entire 48% non-controlling interest.

Despite the results the board recommended a first and final dividend of KES 1.00 per share due to availability of accumulated cash reserves.

On Friday Unga Group’s share price closed at KES 29.50. The counter is down by 14.5% on a year-to-date basis.