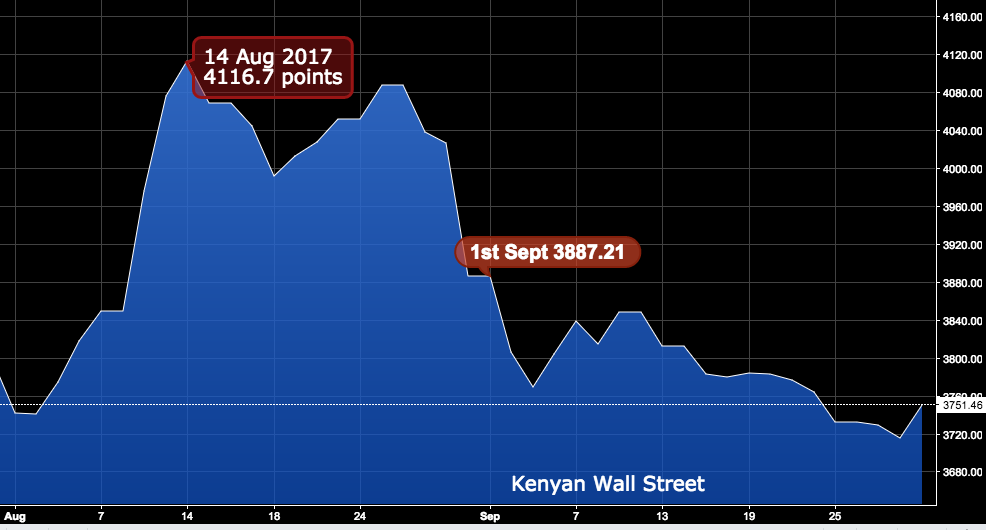

Kenya’s Nairobi Securities Exchange (NSE) was Africa’s worst performing major stock exchange in the month of September 2017, according to data compiled by London based economic research consultancy Capital Economics.

During the month under review, the country’s benchmark NSE 20 Share index, which is one of Africa’s most widely-traded, dropped by 8.7% in local currency terms.

The poor performance was mainly attributed to political risk after the Supreme Court annulled President Uhuru Kenyatta’s August re-election and ordered that a new vote be held in October. Disputes over the management of this re-run election have raised fears that the authorities could miss the court-imposed deadline, which would prompt a constitutional crisis.

According to Capital Economics research note, losses were not limited to Kenya over the past month: equity markets across the region lost ground. Indeed, the Mauritian SEMDEX was the only major index to strengthen over the course of the month. Beyond Kenya, the worst performing equity index was Uganda’s all share index, which dropped by 5.4% on the month.

The Kenya Shilling

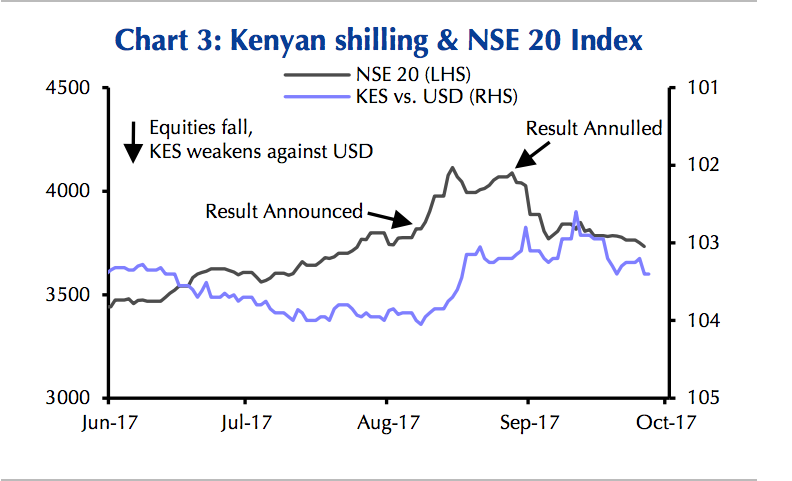

The Kenyan shilling shrugged off an increase in political risk, remaining stable over the past month.

The shilling strengthened against the USD after the result was announced, but only weakened a touch following the court’s decision.

“We think that the Central Bank of Kenya intervened in order to prevent any significant swings. The country’s equity market was much more volatile over the course of the month.” read a research note to investors.

READ; Capital Economics raises concerns over accuracy of Kenya’s official GDP figures