The monthly survey data by Markit Economics indicated the worst deterioration in the health of the Kenyan private sector in the short survey history during August.

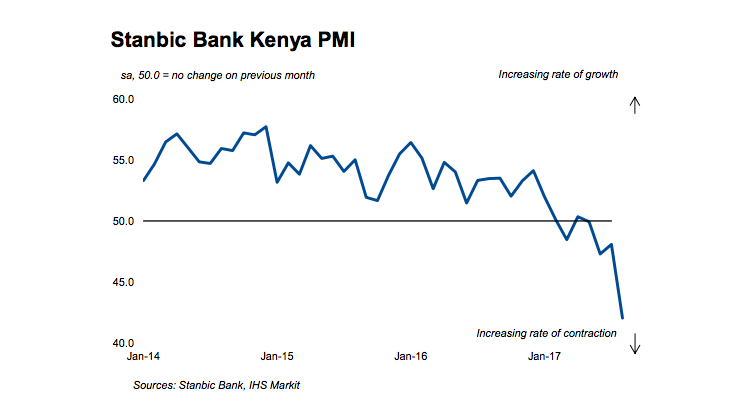

The seasonally adjusted PMI fell to a survey-record low of 42.0 in August from 48.1 in July. This was consistent with a sharp deterioration in business conditions across Kenya’s private sector. (The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI™). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.)

This was driven by sharp falls in output, new orders and stocks of purchases. In response to lower output requirements, firms reduced their payroll numbers. On the price front, divergent trends were observed as overall input costs rose, while firms continued to reduce output charges.

The headline PMI index has now recorded below the 50.0 no-change mark for five of the past six months.

The main findings of the August survey were as follows:

- The overall downturn was driven by a fall in business activity. Output fell for the fourth month in succession.

- Moreover, the rate of contraction was the sharpest recorded since the inception of the survey in January 2014.

- Low money circulation and weak demand conditions were the key reasons cited by panellists behind a fall in output.

- New export orders fell for the first time in the survey’s history. Also, the rate of contraction was sharp overall. Firms attributed a decline in domestic demand to a lower customer turnout due to the political climate and weaker purchasing power among clients.

- Employment in the Kenyan private sector fell during August, the first decline in the survey history. The rate of job shedding was marginal, however. A number of monitored companies commented on weak demand and staff voluntarily leaving for better job opportunities.

Commenting on August survey findings, Jibran Qureishi, Regional Economist E.A at Stanbic Bank said: “The Stanbic Bank PMI fell to another survey record low of 42.0 in August and has now been in contractionary territory, for four consecutive months. Notably, the anxiety around a tense general election in August was one of the major factors that weighed down the private sector; however this angst is likely to extend over the coming months due to the recent decision by the Supreme Court to nullify the presidential election results. The decision by the court is indeed a reflection of Kenya’s strengthening institutions and will certainly appease the foreign investor community.”