Kenya’s tea export earnings plunged 20% in December 2024 while coffee revenues soared, underscoring the divergent paths of two of the nation’s key cash crops amid shifting global market dynamics.

- Despite exporting more tea—49,731 metric tonnes compared to 46,524 metric tonnes in December 2023—revenues fell to KSh 13.8 billion from KSh 17.25 billion the previous year.

- The drop was attributed to declining global prices and softer demand in traditional markets, exacerbated by global economic headwinds.

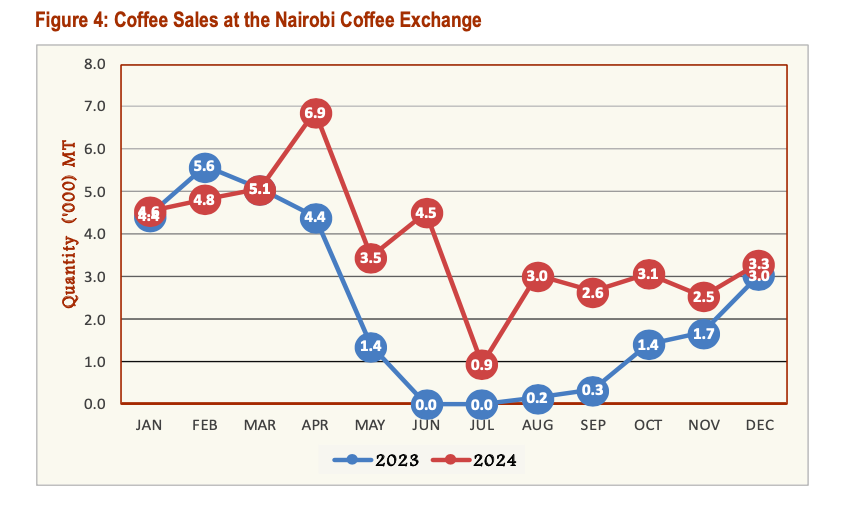

- Coffee exports experienced a robust upswing with volumes nearly doubling to 2,647 metric tonnes from 1,478 metric tonnes a year earlier, while earnings surged 54% to KSh 1.9 billion.

December 2024 also saw the highest coffee prices of the year, averaging KSh 859.40 per kilogram, a sharp rise from KSh 588.57 in December 2023, according to the Agriculture and Food Authority (AFA). The strong prices helped offset lower volumes in previous months, with December marking a peak in farmer deliveries at 3,315 metric tonnes.

Tea producers, on the flip side, grappled with falling auction prices and production slowdowns. November 2024’s tea production dipped to 47,413 metric tonnes, down from 50,905 metric tonnes the previous year. The average auction price also softened to KSh 286.38 per kilogram from KSh 329.82.

Tea farmers – especially in the west Rift – have expressed growing frustration over declining returns, staging protests late last year against factory prices that dipped as low as KSh 20 per kilogram. The discontent has sparked concerns about future production levels as growers weigh the viability of tea farming amid tightening margins.

Kenya’s tea industry, which has long relied on bulk exports to markets like Pakistan, Egypt, and the UK, is increasingly vulnerable to global economic shifts. Meanwhile, coffee’s pivot towards specialty markets has offered some insulation, though volatility remains.

The peak months for both commodities in 2024 highlights their contrasting trajectories. Tea recorded its highest earnings in February with KSh 20.43 billion from 59,043.65 metric tonnes, while coffee hit its zenith in July, earning KSh 4.9 billion from 6,991 metric tonnes.

As the agriculture sector braces for another volatile year, stakeholders are calling for policy reforms and diversification strategies to bolster resilience in Kenya’s key export industries.