Amid global uncertainties, CEOs in Sub-Saharan Africa have increased optimism about the future of their businesses and the global economy, the PWC’s 28th Annual Global CEO Survey reveals.

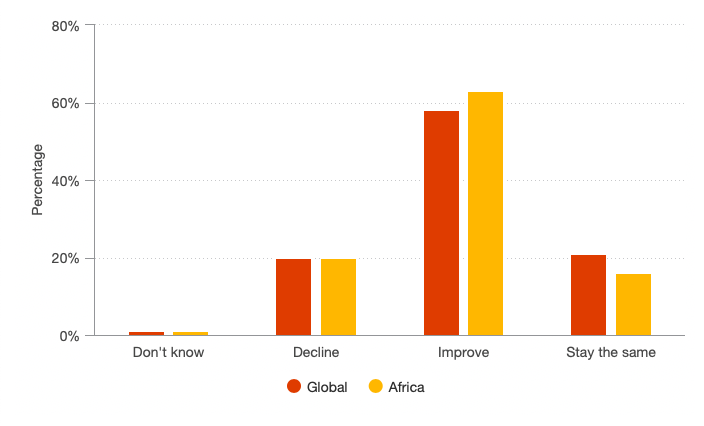

- About 63% of regional business leaders expect improved global economic growth over the next 12 months, higher than the 51% recorded in 2024 and the global average of 58%.

- The optimism comes in the wake of declining interest rates in most world economies and higher global demand which is likely to boost African exports.

- Confidence regarding long-term viability of businesses went up, with 61% of CEOs projecting sustainability beyond the next decade, surpassing the global average of 55% and the previous year’s 40%.

“Additionally, an improvement in global demand will likely lead to increased demand for African exports, further boosting economic growth on the continent. This combination of lower interest rates and higher global demand sets a positive foundation for business strategies and growth plans in Africa,” PWC noted in the survey report.

The African continent presents diverse yet interconnected developments across, fuelling a collective optimism about Sub-Saharan Africa’s economic future.

In Kenya, the expected decline in interest rates coupled with a narrower fiscal deficit will likely boost private sector lending and fixed investment spending. Significant investments in mining, tourism, infrastructure and transportation in Tanzania further anchors the East African positive outlook.

Business confidence in South Africa is the highest in almost 4 years with the government keen on tackling energy security and logistics challenges. The ongoing fiscal reforms in Nigeria improved the government’s fiscal space with the anticipated strong monetary policy that is likely to stabilize the Naira. In Ghana, business leaders opine an ease in inflation to enhance purchasing power and drive economic activity through private consumption.

“These reforms are expected to boost investor and business confidence in the economy,” PWC noted.

Bracing for Disruptions

Meanwhile, the new ruling party in Botswana faces a large deficit arising from the slowdown in global demand for natural diamonds while looking at ways to fast-track economic diversification and deliver on an ambitious social agenda.

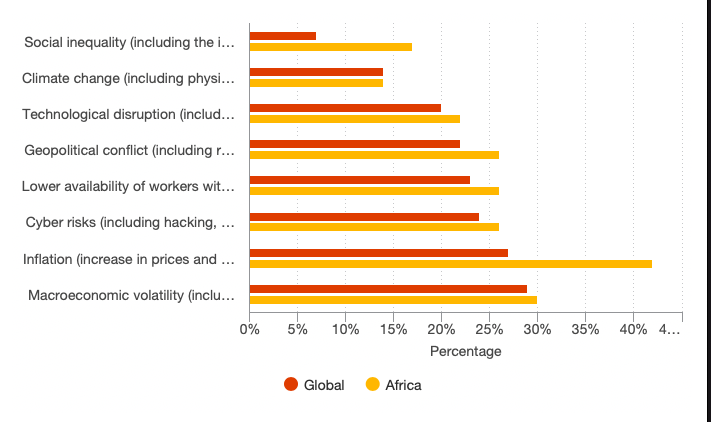

About 57% of the CEOs see potential changes in the regulatory environment, higher than the global average of 42%. The high anxiety points to the region’s dynamic and unpredictable policy landscape likely to impact operational stability and strategic planning.

“Unlike their global counterparts, these private business leaders face unpredictable regulatory developments that can disrupt business operations, impair capital investment, and significantly diminish return on investment,” Duncan Adriaan, Africa Private Company Sector Leader, PwC South Africa said in the report.

While Sub-Saharan Africa lags in AI adoption, 72% of the CEOs are planning to adopt AI in the next 12 months – lower than the global average of 80% – with 45% expecting AI to increase profitability.

About 32% of Sub-Saharan CEOs reported increased revenue from climate-friendly investments initiated over the last five years.